KT Average Daily Range MT4

- Indicateurs

- KEENBASE SOFTWARE SOLUTIONS

- Version: 1.1

- Activations: 5

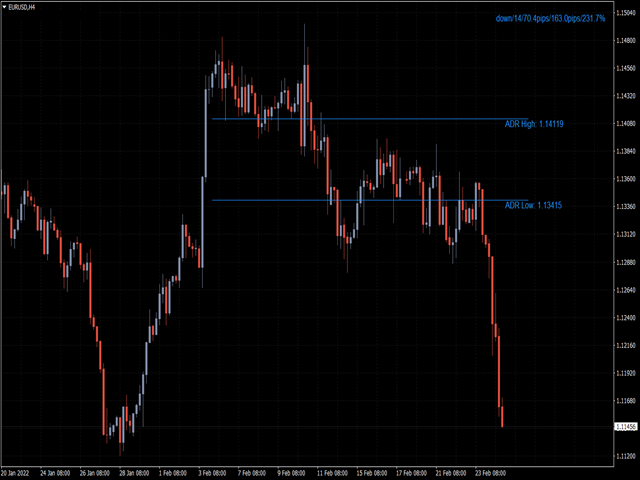

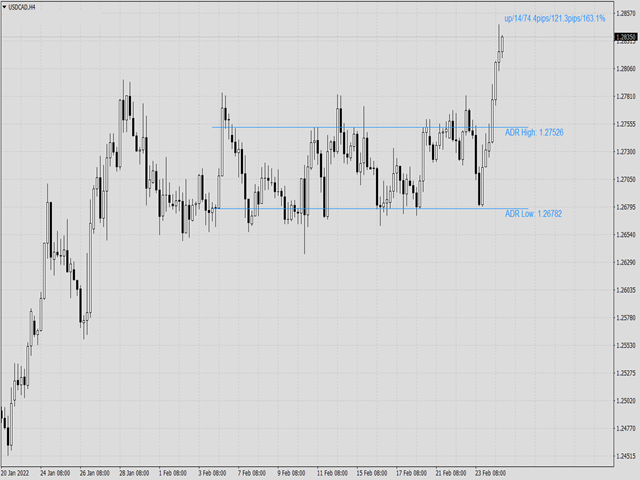

KT Average Daily Range(ADR) shows the upper and lower levels using the average daily range covered by the currency pair or the instrument. The average daily range is calculated using the chosen period in the input settings.

ADR High: ADR upper level is found by adding the average daily range value to the current day's low.

ADR Low: ADR lower level is found by subtracting the ADR value from the current day's high.

Features

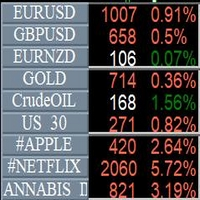

- It shows the ADR levels with several other helpful information beneficial for the traders (at the top right corner of the chart).

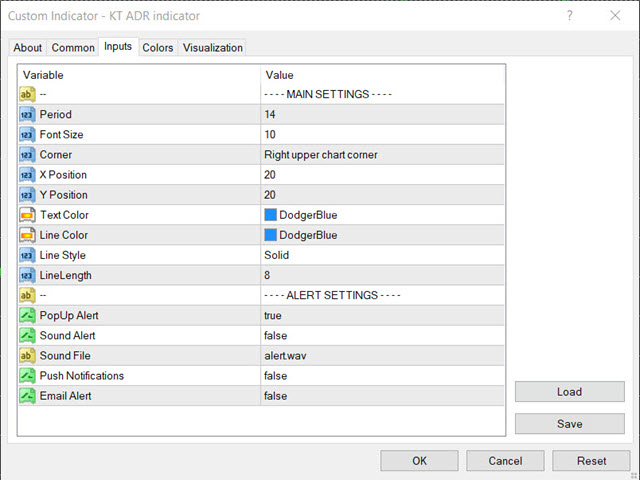

- Fully customizable.

- All Metatrader alerts included.

ADR Formula

- - - - - ADR = (D1+D2+D3+D4+ .....+ Dn) / P - - - - -

Where,

D is the range covered by the corresponding days.

P is the chosen period.

Applications

- The ADR levels can be used as the stop-loss and profit target.

- Traders can use it to design the reversal strategies using the mean reversion principles around the ADR levels.

- Sometimes ADR levels also work to identify the possible support/resistance zones.