Custom Bollinger Bands

- Indicateurs

- Yu Zhang

- Version: 1.3

- Mise à jour: 27 octobre 2021

- Activations: 20

1. What is it

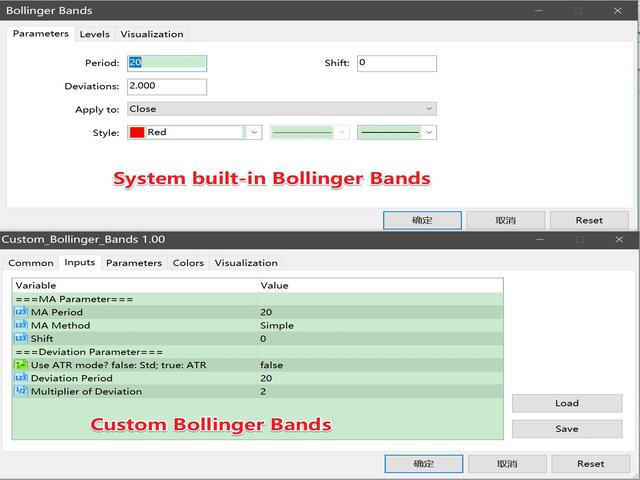

The classic Bollinger Bands and the Bollinger Bands indicator built into the system, they have the same mean period and deviation period. And the method of average is just the simple moving average method. The deviation method used is just the standard deviation method. All this limits our research because:

- Sometimes we would like to have longer period averages + shorter period deviations.

- Sometimes we want moving averages that are not limited to simple moving averages but also include other moving average patterns.

- The standard deviation is used to portray price fluctuations influenced by price position, while the ATR is used to portray price fluctuations that reflect a different market situation.

Therefore, we developed the Bollinger Bands indicator which has more functions.

2. Calculation method

- Mean (mean value under a method) +/- Multiplier * Deviation (Standard Deviation or ATR)

3. How to use

The following is an introduction to the indicator parameters, which are simple and easy to understand.

===MA Parameter===

- InpMAPeriod = 20; // MA Period

- InpMAShift = 0; // MA Shift, Only MA Value Shift.

- InpMAMethod = MODE_SMA; // MA Method: MODE_SMA, MODE_EMA, MODE_SMMA, MODE_LWMA

- InpApplied_Price = PRICE_CLOSE; // MA applied_price

- InpAllShift= 0; // All Shift(Plot Shfit)

===Deviation Parameter===

- IsUsedATR = false; // Use ATR mode? false: deviation is standard deviation; true: deviation is ATR

- InpDeviationPeriod = 20; // Deviation Period

- InpMulDeviations = 2.0; // Multiplier of Deviation

L'utilisateur n'a laissé aucun commentaire sur la note