Tiger Lite

- Utilitaires

- Dang Cong Duong

- Version: 1.2

- Mise à jour: 4 septembre 2021

Tiger Lite recreate the history of entry and exit orders.

The goal is that you can grasp their strategy how to play.

CSV format support for WEB, MT4 and MT5 platforms.

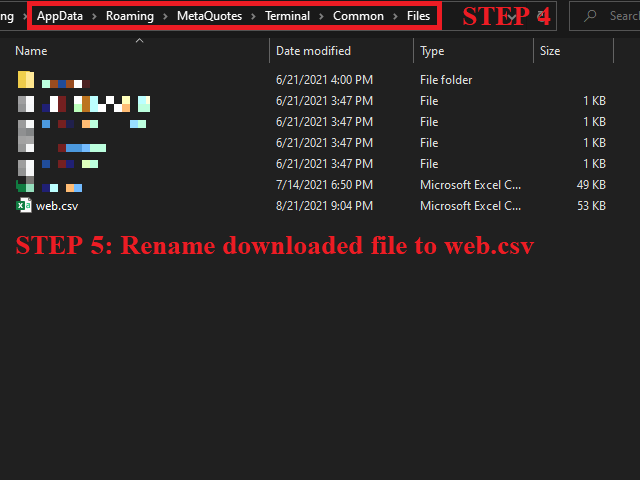

The sequence of steps is described in the photo.

Note:

Please choose the existing date and symbol on the CSV file.

For MT4/5, export historical data and copy the records to excel, save it with the extension CSV.

For MT4/MT5/WEB, save the name with format mt4.csv/mt5.csv/web.csv

If you get the history from another source and your file format is different, please copy the correct column as the sample file.

Please leave a message if this Tiger Lite is valuable to you.

The Most Dangerous Time to Trade

Have you ever noticed that after a solid winning trade you often lose money on the next one? Well, it may be something you

can prevent, at least sometimes. After winners, we may literally invent or see patterns on the charts that are not even there;

we convince ourselves into jumping back in the market, subconsciously. Before we proceed, let me be clear, you cannot avoid

all losing trades, sometimes they are just normal statistical occurrences of your trading edge. What we are talking about here

are the losers that you can prevent; the ones born of emotion.

Why we tend to lose after winning

Right after a winning trade is indeed the most dangerous time to trade. Whilst that may seem surprising to some of you,

it has a scientific basis that we need to understand… After a winning trade, we feel good, there is no denying that and you

cannot stop it, and why would you want to, right? However, this euphoric feeling can lead to disaster of you are not aware of it

and how to deal with how it makes you feel. Dopamine is the feel-good chemical released in your brain when something happens

that makes you happy, like a winning trade. The danger comes in the form of addiction. For a trader, this means after a winner

we are more likely to over-trade and do something stupid with our trading platform because our brains are subconsciously looking

to keep the dopamine high going. When riding a dopamine high after a winning trade, our brains naturally perceive less risk in the

market and that can cause us to deviate from our trading strategy.

The very act of entering a trade, an event that previously made you money and made you happy, will release more dopamine in

your brain, thus keeping the ‘high’ going. So, the brain will get what it wants, whether you win or lose, and as traders, we need

to be aware of this genetic ‘flaw’. Dopamine is truly a double-edged sword that can either reinforce good habits or reinforce bad habits.

Solutions

So, now that you know why it’s so easy to lose money shortly after winning, it’s time to figure out how you will avoid this major

pitfall in the future. The trick is to have some type of filter in place to catch yourself from making an emotion-fueled / dopamine-fueled

trade. Whilst it may sound cliché to once again talk about trading plans, their importance in this matter cannot be over-stated.

The solution to this mistake is to ensure you’re only subjecting yourself to your edge, which needs to be a well-defined trading edge.

You need to build and follow a trading plan so that you are not simply entering on random whims of confidence or because you think

a chart is about to do something.

Summary of solutions to battle the tendency to over-trade after winners:

- You have an actual trading strategy / trading edge that you fully understand and can define.

- You have a trading plan built around the above strategy.

- Make sure you only subject yourself to your edge, which should be well-defined and in your plan.

- Your trading plan should act as a ‘filter’ of sorts

Conclusion

The best way to avoid giving back trading profits is by making sure you have no doubt about what you’re looking for as you scan the charts each day.

When you reach a point of having mastered your trading strategy, you only need to build a trading plan around it and stick to it, to filter out the

emotion-based trades that traders often make. You can get started learning my trading edge and how I trade the market, as well as how to build a

trading plan around that edge. As they say, a journey of 1,000 miles starts with a single step, and if you want to stop losing money unnecessarily

in the market, it’s time to take the first step on the right path.

L'utilisateur n'a laissé aucun commentaire sur la note