Pivot Lines

- Utilitaires

- Igor Semyonov

- Version: 1.31

- Mise à jour: 1 avril 2020

- Activations: 5

Description

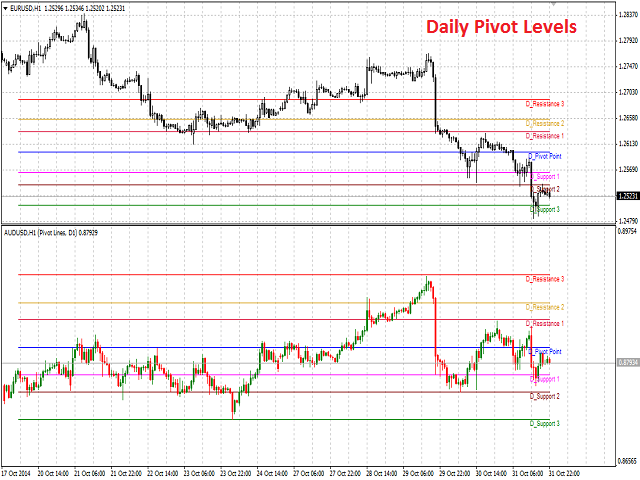

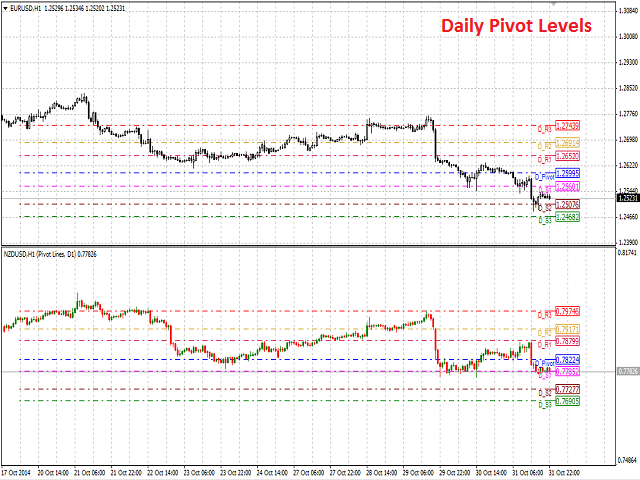

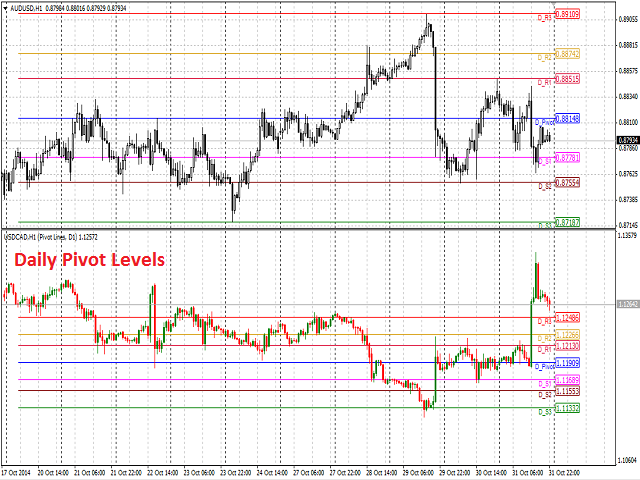

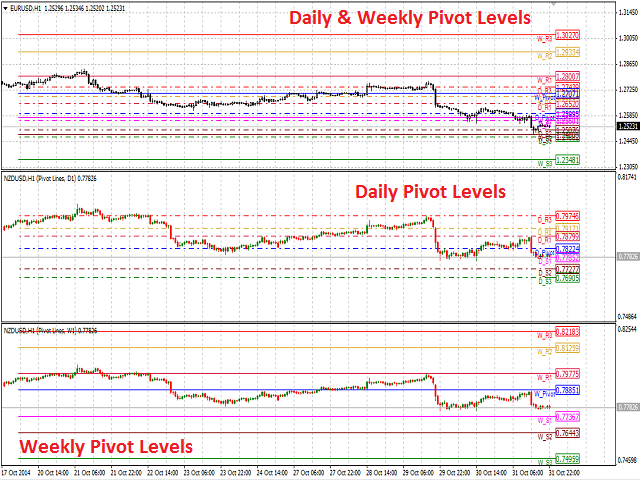

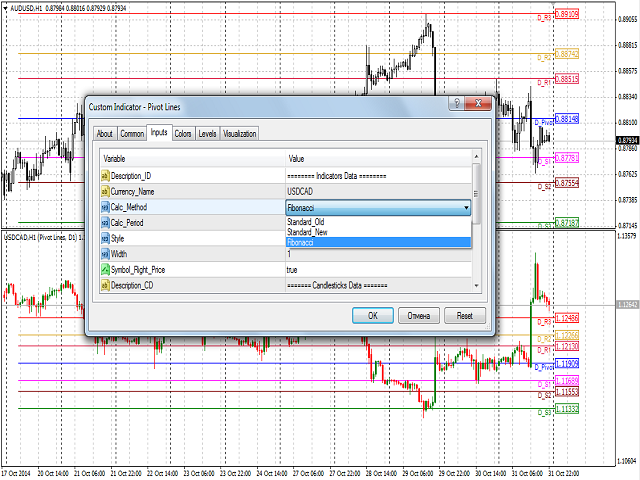

Pivot Lines is a universal color multicurrency/multisymbol indicator of the Pivot Points levels systems. You can select one of its three versions: Standard Old, Standard New and Fibo. It plots pivot levels for financial instruments in both windows simultaneously.

The system will automatically calculate the Pivot Point on the basis of market data for the previous day (PERIOD_D1) or week (PERIOD_W1) and the system of support and resistance levels, three in each. It can also display price tags for each level.

You can color the indicator lines.

The only difference between Standard New and Standard Old version is the method of calculation of the third level of support (S3) and resistance (R3).

Inputs

- Currency_Name - the name of the financial instrument.

- Calc_Method - the Pivot Points calculation method:

- Standard Old.

- Standard New.

- Fibonacci.

- Calc_Period - the Pivot Points calculation method:

- Daily.

- Weekly.

- Style - style of the line:

- solid line (by default).

- dashed line.

- dotted line.

- dashed and dotted line.

- dashed and double dotted line.

- Width - width of the line (allowable values - 1, 2, 3, 4 and 5).

- Symbol_Right_Price - permission to display price tags.

- Bars_Number - the number of bars to be displayed in a separate window.

- Bars_Flag - a flag to allow display of the number of bars specified in the Bars_Number parameter:

- true - according to Bars_Number.

- false - maximum available bars in the history.

- Bulls_Color - the color of the bullish candlestick.

- Bears_Color - the color of the bearish candlestick.

- Bid_Line_Color - color of the Bid line.

Purpose

The indicator can be used for manual or automated trading in an Expert Advisor. Values of indicator buffers of the double type can be used for automated trading:

- Main Window:

- Pivot Point - buffer 0.

- Support level 1 - buffer 1.

- Support level 2 - buffer 2.

- Support level 3 - buffer 3.

- Resistance level 1 - buffer 4.

- Resistance level 2 - buffer 5.

- Resistance level 3 - buffer 6.

- Separate Window:

- Pivot Point - buffer 8.

- Support level 1 - buffer 9.

- Support level 2 - buffer 10.

- Support level 3 - buffer 11.

- Resistance level 1 - buffer 12.

- Resistance level 2 - buffer 13.

- Resistance level 3 - buffer 14.

Depending on the timeframe of the chart, on which the indicator is used, values of the indicator buffers towards the depth of the history should be requested with a shift relative to the zero bar and the same step on the following principle:

- Calc_Period - Daily:

- PERIOD_M1: the shift and the step = 1 440.

- PERIOD_M5: the shift and the step = 288.

- PERIOD_M15: the shift and the step = 96.

- PERIOD_M30: the shift and the step = 48.

- PERIOD_H1: the shift and the step = 24.

- PERIOD_H4: the shift and the step = 6.

- PERIOD_D1: the shift and the step = 1.

- Calc_Period - Weekly:

- PERIOD_M1: the shift and the step = 7 200.

- PERIOD_M5: the shift and the step = 1 440.

- PERIOD_M15: the shift and the step = 480.

- PERIOD_M30: the shift and the step = 240.

- PERIOD_H1: the shift and the step = 120.

- PERIOD_H4: the shift and the step = 30.

- PERIOD_D1: the shift and the step = 5.

- PERIOD_W1: the shift and the step = 1.

Limitations

Chart for each financial instrument cannot be displayed in a separate window more than twice. Otherwise, you receive an error message related to its re-use and will be offered to select another financial instrument.

Recommendations

It is recommended to use the indicator with Bars_Number parameter not exceeding the number of bars that can be shown in one window (about 250 bars).

Notes

In case of loss of connection with the trading server, when connection is restored and data is downloaded, the chart will be redrawn from the beginning to the number of bars specified by Bars_Number and Bars_Flag.

Great service everyone shoud be using pivots