KeltnerChannelIndicatorMT5

- Indicateurs

- Todd Terence Bates

- Version: 1.0

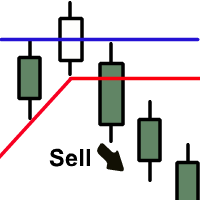

Since most price action will be encompassed within the upper and lower bands (the channel), moves outside the channel can signal trend changes or an acceleration of the trend. The direction of the channel, such as up, down, or sideways, can also aid in identifying the trend direction of the asset.

A longer EMA will mean more lag in the indicator, so the channels won't respond as quickly to price changes. A shorter EMA will mean the bands react quickly to price changes but will make it harder to identify the true trend direction.

A bigger multiplier of the ATR to create the bands will mean a larger channel. The price will hit the bands less often. A smaller multiplier means the bands will be closer together and the price will reach or exceed the bands more often.

- Keltner Channels are volatility-based bands that are placed on either side of an asset's price and can aid in determining the direction of a trend.

- The exponential moving average (EMA) of a Keltner Channel is typically 20 periods, although this can be adjusted if desired.

- The upper and lower bands are typically set two times the average true range (ATR) above and below the EMA, although the multiplier can also be adjusted based on personal preference.

- Price reaching the upper Keltner Channel band is bullish, while reaching the lower band is bearish.

- The angle of the Keltner Channel also aids in identifying the trend direction.

- The price may also oscillate between the upper and lower Keltner Channel bands, which can be interpreted as resistance and support levels.

Just what he has to do!! Thanks