Velocity of price change

- Indicateurs

- Aleksey Ivanov

- Version: 1.0

- Activations: 5

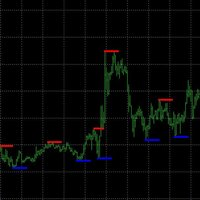

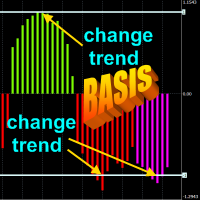

The Velocity of price change ( VP) indicator shows the average rate of price change at those characteristic time intervals where this rate was approximately constant. The robust algorithm used in VP to smooth out the price from its random jumps, ensures the reliability of the indicator reading, which does not react to simple price volatility and its insignificant movements.

The indicator allows you to track trends and the moments of their reversals, during which the indicator readings sharply change their sign. In addition, the rate of price change in VP is specially normalized; and the achievement of the indicator readings of values large in absolute value of one, as a rule, is associated with a trend change. If this normalized speed is much less modulo one, then just rollbacks occur.

Work algorithm.

The VP indicator first builds (without displaying) a polyline from segments of regression lines of different lengths, the beginning of each of which comes from the end of the previous segment. Each regression segment is built until the variance or spread of price around it begins to exceed a certain critical value, after which the construction of this segment ends and the construction of the next segment begins. This approach is due to the fact that the price variance around the regression segment begins to increase strongly with its large jumps and with an increase in its volatility, which take place when the trend movement changes, which allows the VP indicator to identify the moments of the trend change.

The number of points for plotting each segment of the regression line is variable and depends on the market situation described by the indicator, but it can vary from Backstep to Depth, which are set in the indicator settings. At the same time, the smaller the Backstep, the smaller the delay with which the beginning of the trend movement is determined. Decreasing Depth allows a trader to identify areas with a different average rate of price change on long trends.

Then the total price increment at each regression segment is divided by its length and the threshold price variance. This attitude is the indication of the indicator, i.e. the indicator shows the normalized rate of price change.

Indicator settings.

- Price type - applied price. Values: Close price, Open price, High price, Low price, Median price ((high + low)/2 default), Typical price ((high + low + close)/3), Weighted price ((high + low + 2*close)/4).

- Backstep - Minimum distance between speed jumps (>=3Bars) Values: any positive integer greater than 3 but less than Depth. (3 default)

- Depth - Maximum distance between speed jumps (<=60Bars). Values: any positive integer less than 60 but greater than Backstep. (20 default).

- Maximum price variance relative to the regression line. Values: any positive real number (1.0 default).

.