Currency Index Project Definitive Forex Project

- Indicateurs

- Simone Guidarini

- Version: 1.0

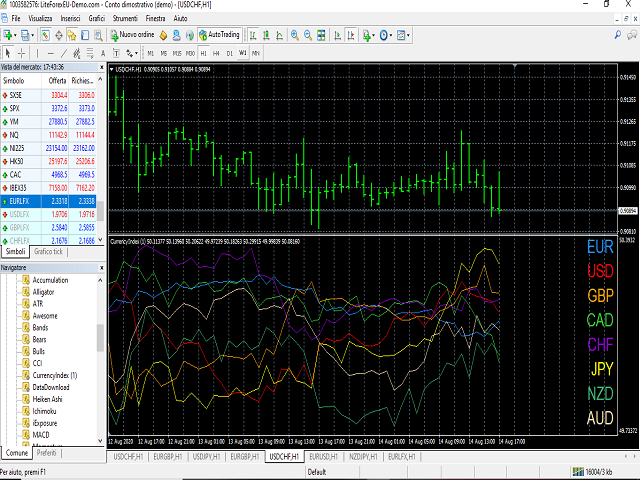

In the indicator there are EUR, USD, CAD, AUD, NZD,JPY, GBP ,CHF.

The Currency Index Project is Forex study. Many people do not know the theoretical basis that drives currency exchange rates to move on the market. With this set of tools you will be able to have a more complete view of the entire market by analyzing not only the single currency of an exchange, but all the exchange rates that make up that currency by looking at a single window!

The study assumes that all forex currencies are linked to each other and that for each change on a single currency cross, there will be changes on all the exchange rates containing the single currency that will appreciate/depreciate more strongly.

This tool will allow you to understand which currency within a currency cross is moving the price chart, so you will be able to understand the direction to enter the market.

The indicator faithfully represents the individual indices evaluate with a mathematical calculation method based on the structure of the USD Index with weighting criteria chosen to best represent each currency.

Each index is normalized on a time basis.

Formulas derived from indicators such as RSI, ADX, MOMENTUM etc. have not been used, because they would have modified the representation of the various indices making the indicator similar to a normal Currency strength index.

The indicator can be used on any TF.

I personally use this indicator for my discretionary trading, using the time of the currency crossing as a first signal and waiting for the standard deviation to explode to make sure that the crossing is not a false signal.

Not being an oscillator it is difficult to find areas of overbought / oversold, however you can also use the gap strategies by choosing the most distant currencies that have already started (at least from a bar) a convergent movement.

IMPORTANT - when all currencies are represented simultaneously on the chart, the calculation method used is to represent the EUR index in a less volatile way than the others.

INSTRUCTION

To facilitate the index value comparision, two methods of normalization are imlpemented, resulting in evaluating indexes to a common value domain.

Modes of operation:

- Evaluate the original indexes - true/false

When enabled, the indicator evaluate the original indexes.

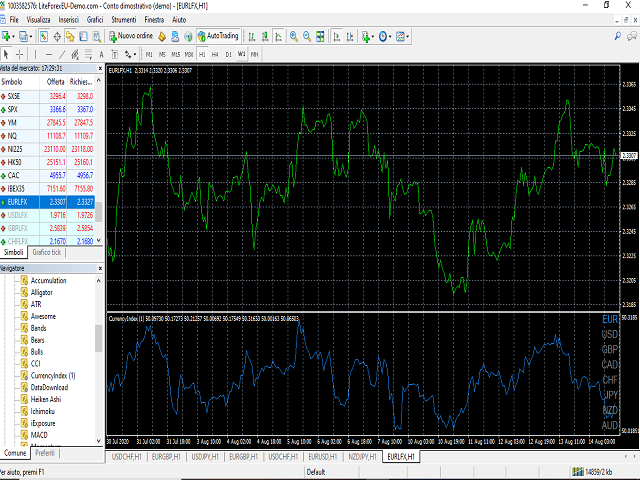

- Normalize by common currency - true/false

When enabled, the indicator reevaluates each used target currency to a custom selected common currency. The common reevaluation currency is defined by the input parameter "Common currency".

This reevaluation brings all the consequent indices evaluation in the common domain of the common currency monetary units of measure.

The resulting normalized currency indices, show remarkable stability, giving significant variation on the very high end of timeframes - Daily timeframe and above.

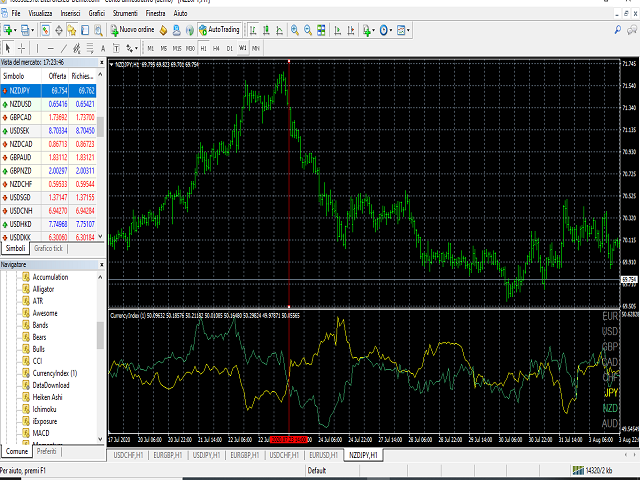

- Normalize by change per bars - true false

When enabled, the indicator uses the rate of change of the selected instrument for a custom defined time period. The time period is defined by the input parameter "Normalization shift".

This reevaluation brings all further evaluation in the common domain of the dimensionless price rate of change domain.

The resulting normalized indices show dynamics to the very low end of timeframe scales - M15 and below. The behavior is controlled by the input parameter "Normalization shift".

Important note:

Parameters "Evaluate the original indexes", "Normalize by common currency" and "Normalize by change per bars" are mutually exclusive. Exactly one of these must be true.

For correct use, the broker used must have the following coins: "EURUSD" "USDJPY" "GBPUSD" "AUDUSD" "USDSEK" "USDCHF".

If even one of them is missing it will be impossible to perform the calculation and the indicator will not work.

This is a true market edge that allows you to evaluate which currency of a foreign exchange is moving the chart.

Happy Trading!

Translated with www.DeepL.com/Translator (free version)

very good