KT Inside Bar Hunter MT5

- Experts

- KEENBASE SOFTWARE SOLUTIONS

- Version: 1.0

- Activations: 5

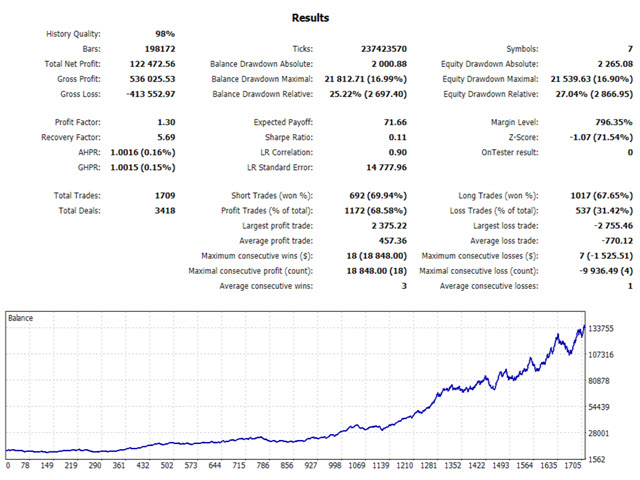

Despite the popularity of inside bar pattern among traders, using it as a standalone entry signal doesn't provide any evidentiary advantage. KT Inside Bar Hunter trades only selected inside bar patterns using some preassessment and ECE price action cycle.

Trading Strategy

On successful detection of the required pattern, EA places a pending order in the direction of the forecasted price expansion phase. Pending orders are canceled if they are not triggered within the next bar.

Once triggered, active positions are only closed at stop-loss or take-profit. KT Inside Bar Hunter doesn't use any other exit techniques

for the active running positions.

Points to remember

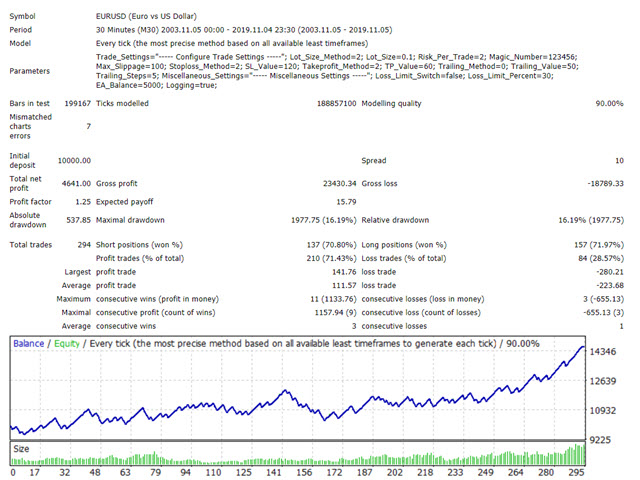

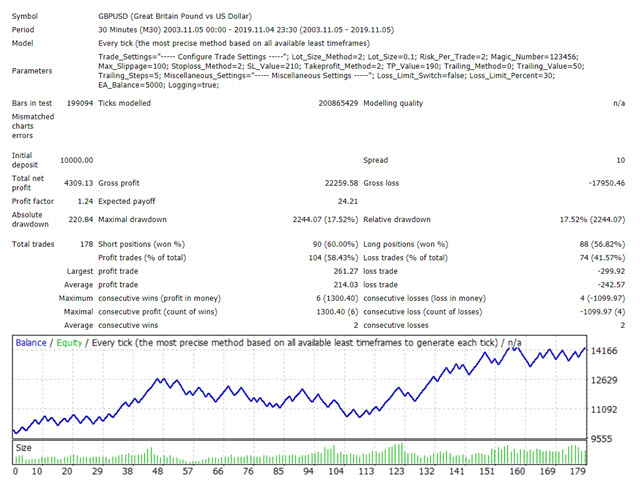

- Recommended Pairs: EURUSD, AUDUSD, EURCAD, EURJPY, GBPUSD, USDCAD and USDJPY.

- Recommended Time Frame: M30

- MT5 version can trade all recommended pairs from a single chart. For the MT4 version, you have to load the ea on each pair separately.

- The EA doesn't trade frequently. You can expect to have around 6-8 trades per month.

- The active positions are closed only at the stop-loss or take-profit. No other exit techniques are used.

What is the ECE cycle?

In financial markets, the price never moves in a straight line but up and down cycles of several durations. It generally moves through a phase of expansion-contraction-expansion periods of different intensity.

When an inside bar pattern occurs during the contraction phase aligned in the direction of the trend, it provides an edge which can be

exploited by a pending order entry.

Features

- Throws out the useless and trade only selected inside bar patterns that actually have some quantified edge in the market.

- Multi-Currency Trading - It can trade up to 7 currency pairs from a single chart (MT5 version only).

- Incorporated a complex trading strategy with minimal and straightforward input parameters for the user.

Input Parameters

- Lot Size Method: Fixed Lot Sizing/Auto Lot Sizing

- Risk per trade: Risk percentage on each trade.

- Stop-loss Method: None / Volatility / Pips

- Take-profit Method: None / Volatility / Pips