ATR Trailing Stoploss

- Utilitaires

- David Muriithi

- Version: 3.1

- Mise à jour: 16 juin 2020

- Activations: 5

For Meta Trader 4.

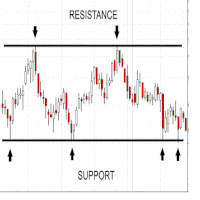

We have all experienced a situation where the market wipes out our stoploss before it turning in the direction we had anticipated.

This is experience becomes more frequent when we use a trailing stoploss. If only there was a way to place and trail the stoploss just the perfect amount of pips away. Well, there is...

The Average True Range (ATR) is a one of the most popular technical analysis indicator, introduced by J.Welles Wilder, that measures Market Volatility for a given number of candles back.

Simply put, a currency experiencing high Volatility has a higher ATR value, and a currency experiencing low volatility has lower ATR value.

The concept behind having An ATR Trailing Stoploss is to trailing your order (locking in profits), giving your trade just enough room so that your Stoploss is not wiped out. Therefore a currency experiencing higher volatility will have its stoploss more pips away than a currency experiencing lower volatility.

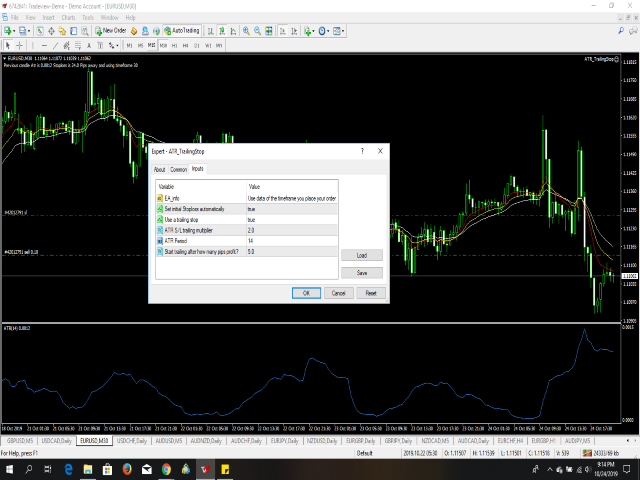

List of Parameters

- Setting of Initial Stoploss - You can choose to set your on stoploss and afterwards have it trail using the ATR value

- Using a trailing Stoploss - You can use to use a Trailing Stoploss or not.

- ATR Stoploss trailing Multiplier - the recommended multiplier is 2 or 3 but you can adjust accordingly

- ATR Period - The number of candles back the ATR calculates its value from. The general period used is 14.

- When to Activate Trailing Stoploss - After our trade has profited by how many pips would you like it to start trailing.