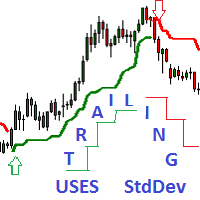

Trailing Uses StdDev

- Indicateurs

- Vladimir Komov

- Version: 1.0

- Activations: 5

Trailing Uses Standard Deviation.

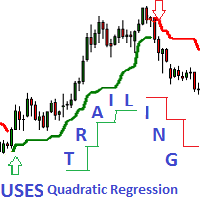

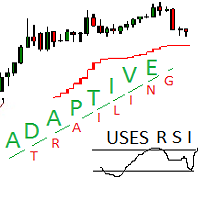

Adaptive_Trailing_uses_StdDev_Indicator is an indicator of directional movement that allows you to identify a trend at the

time of its inception and set the levels of a protective stop.

Unlike trailing with a constant distance, the indicator uses the distance to the price proportional to the current standard deviation of

StdDev. The distance is equal to the product of the standard deviation and the constant coefficient set by the user.

Thus, the trailing method adapts to price volatility.

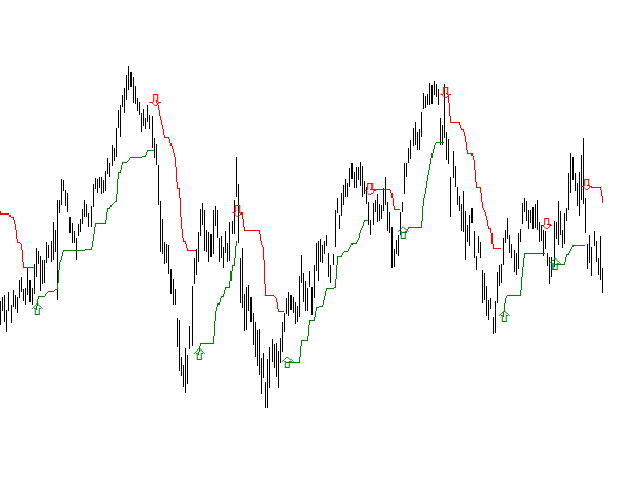

Moments of trend change are indicated by arrows.

Benefits

- Stable trend recognition from its inception to the end.

- It is easily perceived and interpreted.

- It works on any instrument.

- Works on all timeframes.

- Not redrawn, not recounted.

Options

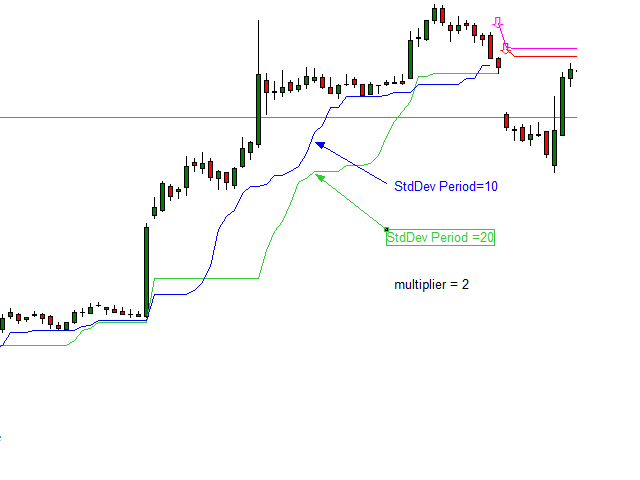

- StdDev period - period for calculating the standard deviation.

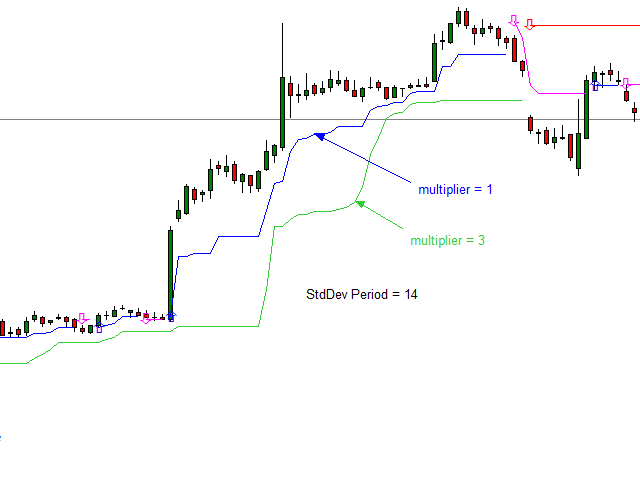

- multiplier - positive coefficient for calculating the distance.

- Shift - indicator shift, number of bars.

Using

The Adaptive_Trailing_uses_StdDev indicator can be used in several ways.

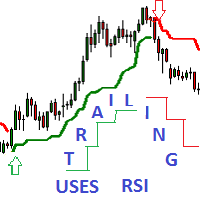

- As a sign of a trend.

- To assess the strength of the trend: when the price significantly exceeds the indicator line, a growing trend is gaining strength. If the price approaches the indicator line, then the growing trend is weakening. A falling trend is likewise recognized.

- To generate buy / sell signals when the price crosses the indicator line.

Features

- The longer the period for calculating the standard deviation, the less often the indicator signals about a trend change.

- The higher the multiply coeff coefficient, the less often signals occur.