Impulse Classic Global

- Utilitaires

- Igor Semyonov

- Version: 1.21

- Mise à jour: 11 avril 2020

- Activations: 8

Description

Impulse Grand Global is an indicator impulse trading system based on Moving Average and MACD Classic Global.

The idea of the impulse system based on Moving Average and MACD Histogram was first offered by Dr. Alexander Elder in his book "Come Into My Trading Room".

You can color bullish and bearish moods.

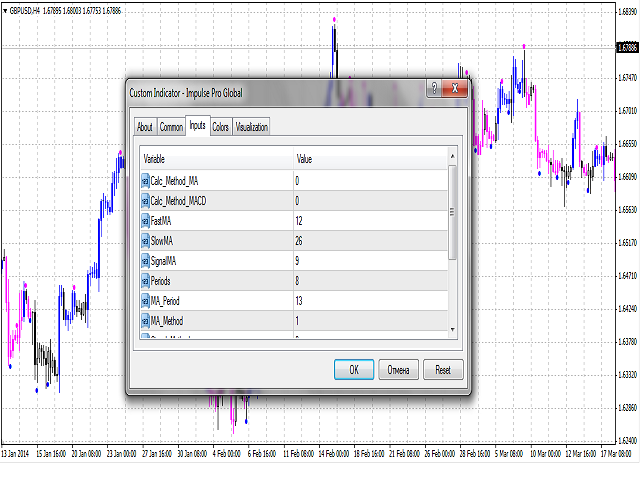

Inputs

- Calc_Method_MA - Moving Average calculation type:

- Single Moving Average - 0 (by default).

- Double Moving Avarage - 1.

- Triple Moving Average - 2.

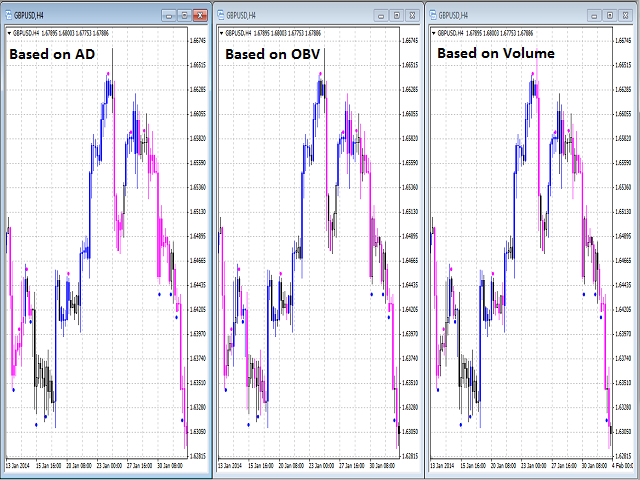

- Calc_Method_MACD - MACD Classic Global calculation type on the basis of one of the standard indicators:

- AD - an indicator of accumulation and distribution of volume (by default).

- OBV - On Balance Volume.

- Volume - tick volume indicator.

- Force - Force Index indicator.

- MFI - Money Flow Index.

- ATR - Average True Range.

- Momentum.

- RSI - Relative Strength Index.

- Moving Average.

- CCI - Commodity Channel Index.

- ADX - Average Directional Movement indicator.

- DeMarker.

- Standard Deviation.

- FastMA - fast moving average period (FastMA = 12 by default).

- SlowMA - slow moving average period (SlowMA = 26 by default).

- SignalMA - signal line period (SignalMA = 9 by default).

- Periods - the period for calculating the basic indicator, based on which MACD Classic Global will be calculated.

- MA_Period - MA period (MA_Period = 13 by default).

- MA_Method - MA averaging method:

- MODE_SMA - 0.

- MODE_EMA - 1 (by default).

- MODE_SMMA - 2.

- MODE_LWMA - 3.

- Signal_Method - The averaging method of the signal line:

- MODE_SMA - 0 (by default).

- MODE_EMA - 1.

- MODE_SMMA - 2.

- MODE_LWMA - 3.

- Applied_Price - used price:

- PRICE_CLOSE - 0 (by default).

- PRICE_OPEN - 1.

- PRICE_HIGH - 2.

- PRICE_LOW - 3.

- PRICE_MEDIAN - 4.

- PRICE_TYPICAL - 5.

- PRICE_WEIGHTED - 6.

- Mode - the index of the line (MAIN - 0 (by default) or SIGNAL - 1) of the basic indicator, based on which the MACD Classic Global will be calculated.

- Shift - shift relative to the price chart.

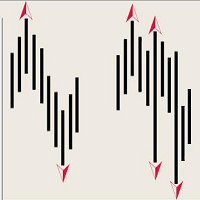

- Arrows - flag for display of signal of probable reverse of the previous tendency:

- true - to display a signal.

- false - don't show a signal.

Purpose

The indicator can be used for manual or automated trading in an Expert Advisor.

The trading rules state that you should not sell when bars are blue, and you should not buy when they are red. Unpainted bars allow traders to consider their further actions: buy or sell.

Rules of action: In the beginning it is necessary to wait for a signal of a possible reverse of a tendency, and then the beginning of coloring of bar in the same direction.

For automated trading, the values of any double type indicator buffer are used:

- for coloring of bars - 0, 1, 2 or 3. The values must not be equal to EMPTY_VALUE!

- for signal of reverse of bulls tendency - 4. The values must not be equal to EMPTY_VALUE!

- for signal of reverse of bears tendency - 5. The values must not be equal to EMPTY_VALUE!

Recommendations

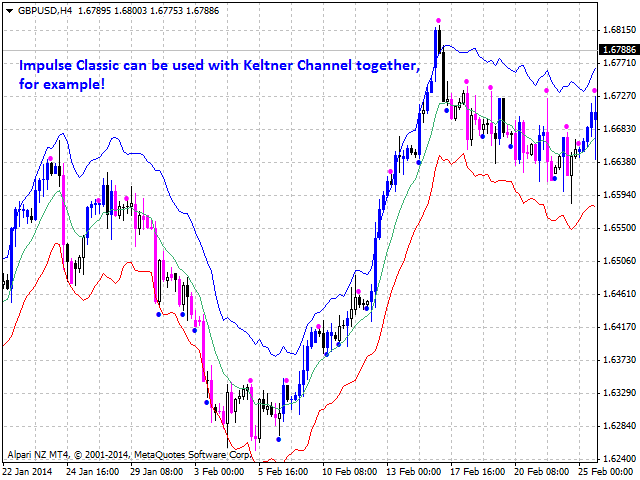

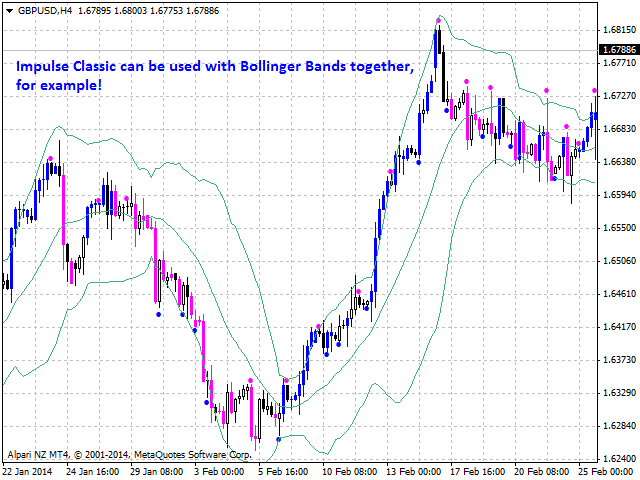

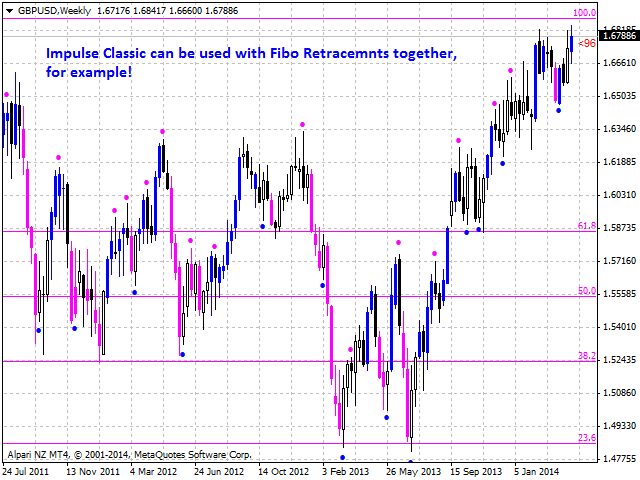

It is recommended to use the indicator together with Keltner Channel, Color Price Channel, Pivot Points, Fibonacci Retracements or Bollinger Bands.