AIS Channel Price MT5

- Indicateurs

- Aleksej Poljakov

- Version: 1.0

- Activations: 5

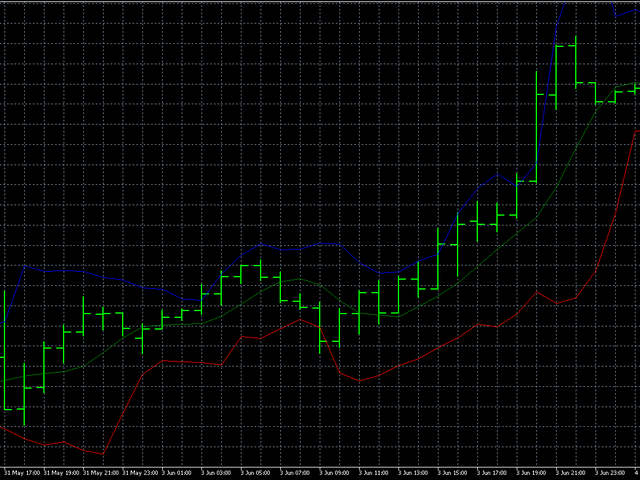

Very often, the trader is faced with the task of determining the extent to which the price may change in the near future. For this purpose, you

can use the Johnson distribution type SB. The main advantage of this distribution is that it can be used even with a small amount of

accumulated data. The empirical approach used in determining the parameters of this distribution, allows you to accurately

determine the maximum and minimum levels of the price channel.

These values can be used in different situations. For example, they can be used to set stop-loss and take-profit levels for market orders, or

entry points for pending orders. Also, these levels can be oriented when using a trailing stop. In addition, with a sufficiently large

history, the indicator may signal the beginning of an uptrend or downtrend. Well, or about its end, if such a trend was.

The main disadvantages of this indicator are its extremely high sensitivity to price emissions, as well as a somewhat late response to

changes in the market situation.

The blue and red lines show the maximum and minimum values of the price channel, respectively. The green line shows the equilibrium value

of the price in a given market situation.

The indicator is configured using the LB parameter. This parameter determines the number of bars that will be used in

calculations, and its allowable value lies within 2 - 64.