Time Adjusted ATR

- Indicateurs

- Andrey Konovalov

- Version: 1.0

- Activations: 5

Time Adjusted ATR

The Time Adjusted ATR indicator is used to determine the anomalous volatility for exactly specified time of day. The indicator is useful for early identification of reversals, breakthroughs and considering volatility corrections.

Options

• ATR period: the number of bars of the standard ATR indicator for which the averaging is taken (recommended value = 1).

• Normalized Base: how many days (bars) are used to calculate normalization (recommended value = 10 ~ 50).

How is "Time Adjusted ATR" calculated?

• Let's say a 9-hour bar has formed on the H1 chart. If the parameters ATR period = 1 and Normalized Base = 10 are set, the average value of the standard ATR is taken at the same time (at 9 o'clock) yesterday, the day before yesterday, etc. ... in 10 days.

** (if ATR period = 3, the average for 3 bars is taken - 9 hours, 8 hours, 7 hours).

• The current standard ATR value is divided by the average and displayed on the indicator chart (green and red bars on each bar).

Similarly, the indicator value is calculated at a specified time on other timeframes. Time Adjusted ATR is suitable for M1 ~ H4 timeframes. Obviously, using this indicator on D1 and higher timeframes is meaningless.

Difference from standard ATR

A typical normal ATP, for example, with a period of 20, looks like a smoothed sine wave and always contains a lot of noise. Using normal ATR, it is difficult to determine the anomalous volatility for a given moment of the day, especially consolidation or at night, when the volatility is low.

Time Adjusted ATR will take into account the volatility correction for the specified time of day and show a clear surge.

Examples of use in the strategies

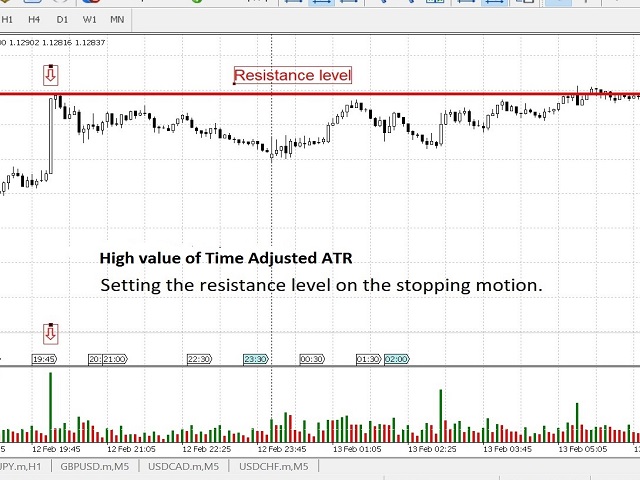

The Time Adjusted ATR indicator helps to suggest an extreme or a local reversal and to find a more accurate early point of opening or leaving a position. Before a reversal, the indicator will show a pre-emptive peak, as well as help confirm the approach to important price level.

When forming a pattern or approach to the price level (for example, on M30, H1, H4 timeframes), we switch to a small timeframe (M1, M5, M15), determine the high atypical volatility and, considering the bar direction, set the necessary order.

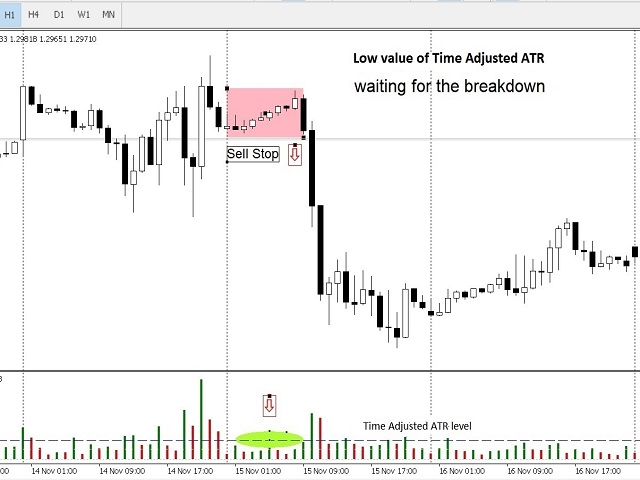

Time Adjusted ATR with a low value is also useful - for example, with narrow consolidation while waiting for a breakdown and opening a session.

Time Adjusted ATR is not recalculated or delayed, since normalization occurs at a specific time of day (the “physiological” market cycle is taken into account).

Time Adjusted ATR significantly simplifies market perception. We wish you successful trading.