KT Volatility Oscillator

- Indicateurs

- KEENBASE SOFTWARE SOLUTIONS

- Version: 1.2

- Mise à jour: 26 mars 2022

- Activations: 5

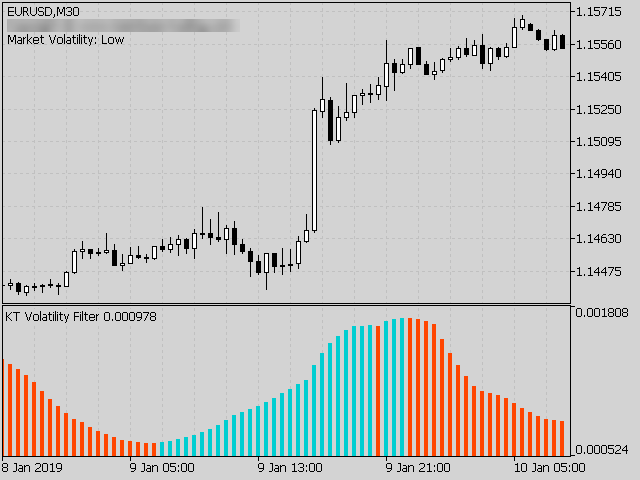

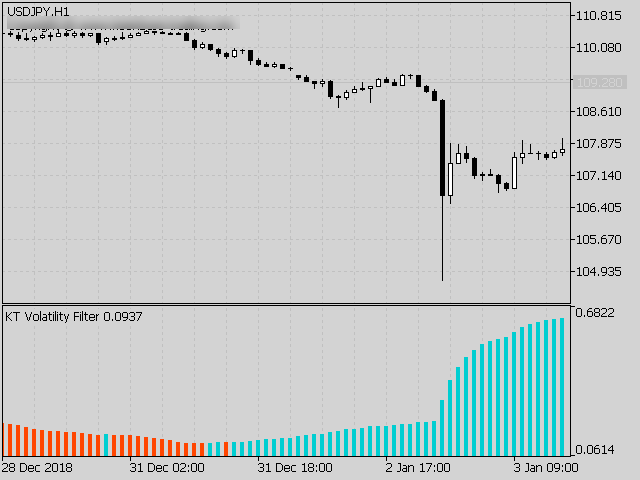

KT Volatility oscillator analyze the past and current market data with a mathematical formula to display the result in a form of an oscillator. The growing and deteriorating waves are equivalent to high and low volatility in the asset.

In a nutshell, volatility is simply a measurement of the price fluctuation of an asset over a certain period of time. Without volatility, there would not much movement in the market and traders would not be able to profit from the price movements.

Use of Volatility in Forex Market

Use of volatility in the Forex market can help you to trade more effectively and keep the expectation in check with the reality.

High Volatility

- Trend based systems work great in volatile markets due to bigger swings and longer positions until there is a change in the trend.

- Breakout systems can fetch more pips from the market if the breakout happens during the high volatility.

Low Volatility

- Mean reversion systems work great in low volatility because of the mean reverting nature of markets.

- Channel based systems perform more effectively during the consolidation in the period of low volatility.

Non-Directional Indicator

KT Volatility Oscillator is a non-directional indicator which doesn't correlate with the bullish or bearish nature of the market. A rising volatility can be related to both state of market i.e. bullish and bearish sentiment.

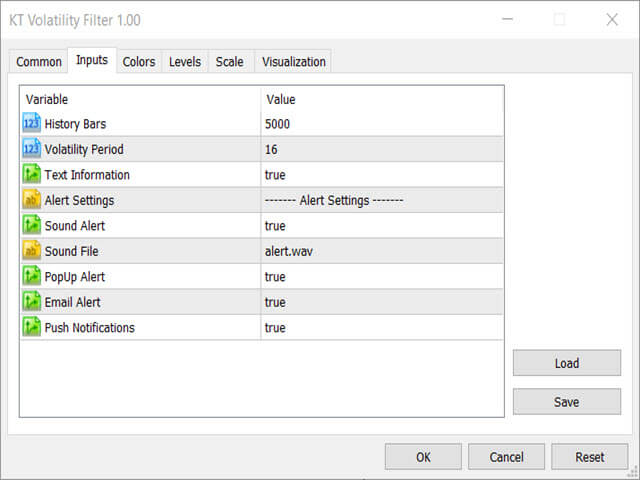

Input Parameters

- Volatility Period: An integer value to decide the calculating period.

- Text Information: Show/hide the information text on chart.

- ----- Alert Settings -----

- Sound Alert: true/false

- Display Box Alert: true/false

- Email Alert: true/false

- Push Notifications: true/false