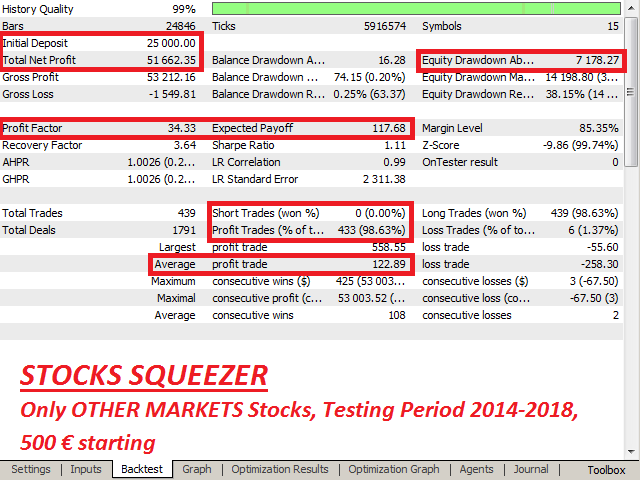

Stocks Squeezer

- Experts

- Federico Sbordoni

- Version: 3.8

- Mise à jour: 20 novembre 2018

- Activations: 9

Follow the STOCKS SQUEEER Signal: https://www.mql5.com/en/signals/503024

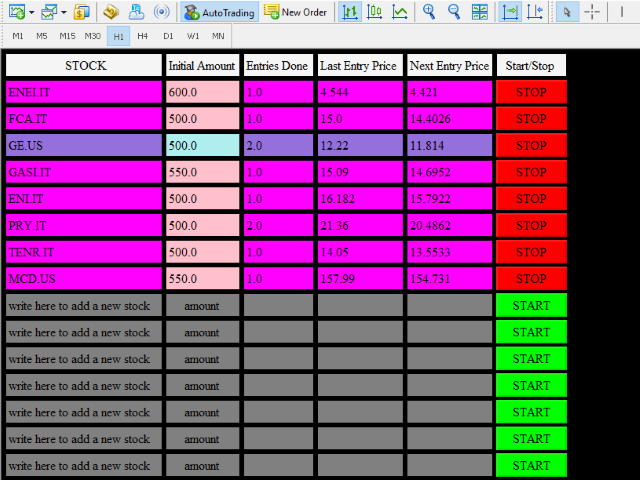

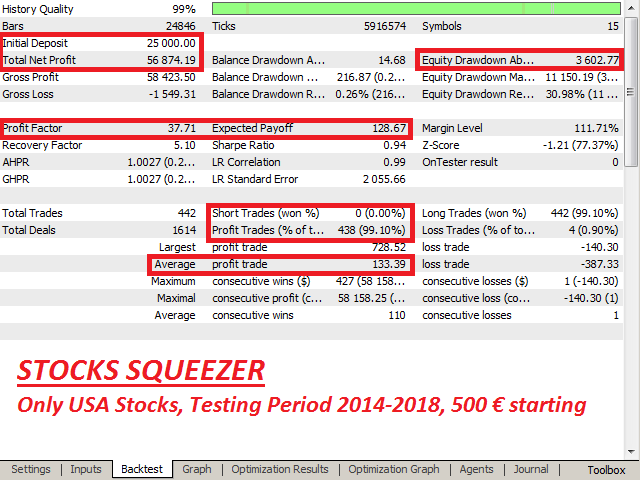

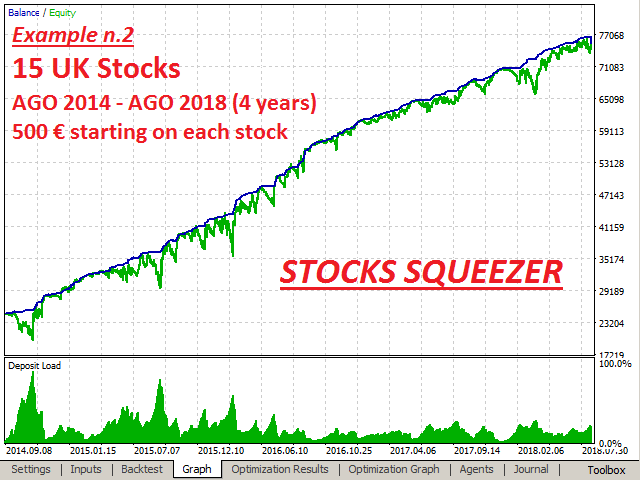

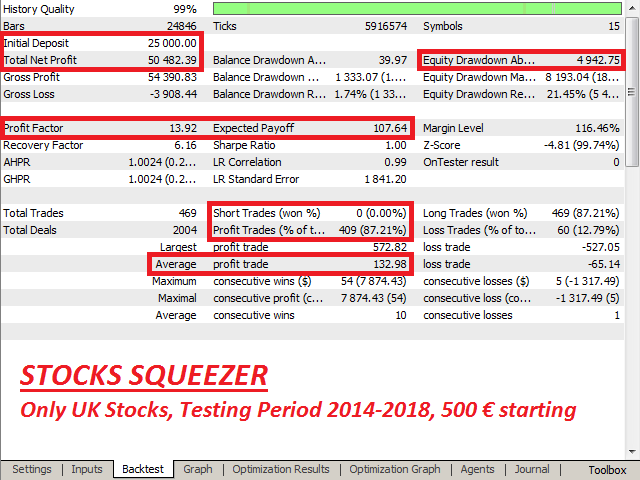

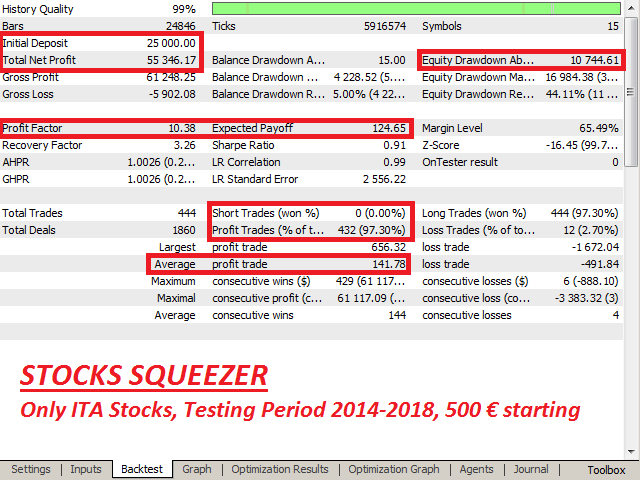

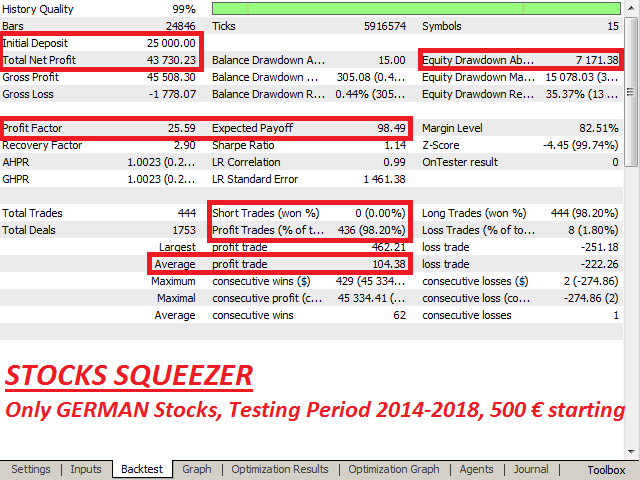

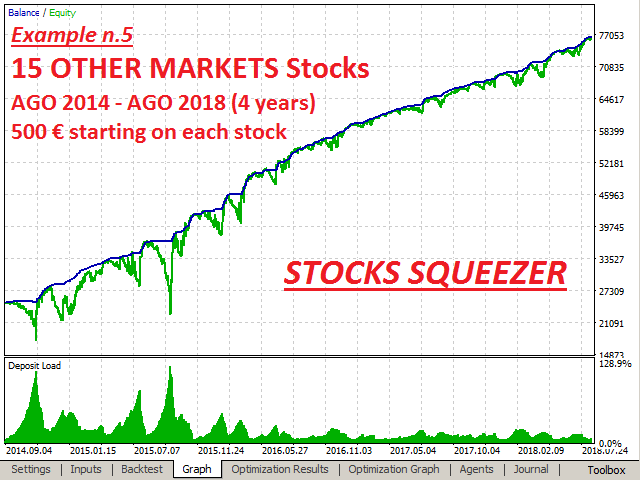

STOCKS SQUEEZER is trading system that simultaneously operates on several stocks trying to take advantage of their volatility. The EA opens a position on each stocks specified investing the initial amount of money you have set. The single position is closes it when the calculated take profit is hit. Instead, if the market goes against, the position is increased and the take profit moved properly. This goes on for a strictly limited number of times till the new take profit is hit. After that, the process will start again from the beginning.

To avoid increasing too much the positions and overexposures to a single stock, an appropriate money management is continously running.

STOCKS SQUEEZERS FEATURES

- High diversification (till 15 stocks on each application of the EA)

- Low volatility and limited drawdown compared to the expected return

- No overexposure on 1 single stock

- Money management always running

- Very high performance compared to the classic investment

- Only LONG trading, no short, no hedging

- Low Commissions and interest rate recommended but not strictly necessary

- Notifications on your smartphone (if you activate them)

- Running on both NETTING AND HEDGING ACCOUNTS

STEPS TO GET STARTED

- Choose the stocks choosing good and historical companies (no startups) that have a stable market (for example COCA COLA, ADIDAS, ALLIANZ, TOYOTA, etc)

- Specify the initial amount to invest on each stock in the currency of your account (the algorithm will convert that amount in the stock currency)

- Be sure there is always enough funds on the account* and that the leverage applied to the specified stocks is 1:5 or more

- Let the EA run without ever intervening in any way

* I recommend to load on your account and for each stock an amount of money that is around 5 times bigger than the the initial investment. Example: you decide to trade BANK OF AMERICA initially investing 600€ and ADIDAS with 500€ (account in Euro). For these 2 stocks, consider 600*5=3.000€ plus 500*5=2.500€, totally 5.500€. You could also start with much less money but, in that case, you have to be ready to load funds (only) if market goes strongly down.

PARAMETERS

- Symbol 1 (empty if no trading): for example EBAY.US, GOOG.US, ALV.GE, SAN.ES, ENI.IT…. If don’t want to specify any stock here, just leave empty

- Initial invested Amount on

Symbol 1 (in your account currency): for

example 500 (if your account currency is Euro, that will be 500 € and will

be converted in the currency of the symbol – in US dollars if you invest

EBAY.US -)