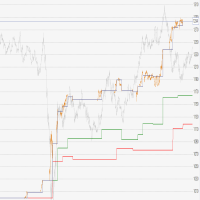

Trend trading of MA combined with ATR

The EA is used to capture trends by both MA and ATR. EA can adjust the number of hands, cycle, reference multiplier and other parameters to optimize EA. The optimized parameters can bring a better profit. It is a tool to facilitate the capture of trend investors. It is recommended that the demand multiplier of the stop loss should be less than that of the stop profit when used, so that the EA can better control your funds. The following is a brief introduction to the parameters in EA: MA cycle, mode, price and parameter settings. ATR's stop, stop and angle multiplier settings. The number of hands is set. In addition, the EA does not cover the wind control capital parameters. It is recommended that the demand side should not be used with other EA when it is used (if wind control fund is needed). The above is the point of attention of the product. The advantage is that the EA can capture the trend for users. When oscillating quotation, EA can also be more likely to evade risk due to the multiple limit of ATR index. The EA produced by SJ personal, private letter welcome fans to joint research, discussion, study.