Regent Street

- Indicateurs

- Icham Aidibe

- Version: 1.13

- Mise à jour: 10 mars 2019

- Activations: 5

Regent Street, rather than an expert or an indicator, is an all-in-one trading assistant easing your trading sessions by providing signals and notifications. It's an assistant rather than a robot - "an assisted steering rather than an autopilot", and now, it autoadjusts itself to any instrument, any timeframe & any circumstance.

Note from the author: Regent Street's frontend is exactly the same as an other product Ermou Street, but the backend is different. Performances for each are very relative to the financial instrument.

How to

First, you should watch the video. Then here's some explanation:

By default, attaching Regent Street to a chart, you’ll get:

- A panel

- Signals: buy (default blue arrow) / sell (default red arrow)

Back end inputs: these parameters are available from the EA tab:

- Bull/Long/Positive; R1/R2/R3 levels' color: default blue

- Neutral; Pivot: default white

- Bear/Short/Negative; S1/S2/S3: default red

- Signal shift in points: shift of 150 points higher/lower than entry candle by default

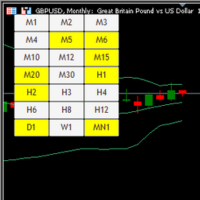

The panel is organized so - from left to right:

- Indicator settings:

- Optimize using an interval of x bars: number of bars used to optimize, should be inferior to the chart max bars and superior or equal to 1000

- ... searching for at least x deals: expected numbers of deals for x bars when optimized - should be superior or equal to 2

- ... starting parameters search from: value to start research from

- ... to: value to end research to

- ... with a step of: step between the above values

- Consider volatility: will filter signals using volatility - be aware that then important signals may be omitted

- Optimization process: interval, numbers of passes remaining, gain in points by passes, gain in local currency with 1 lot

- Run optimization: will start optimizing on selected interval

The best profit in points matching your choice for deal frequency is automatically selected.

- Trade settings:

- Distance to place orders: the order stop is placed at x points from the signal price (0 - deactivated)

- Take Profit in points: distance for taking profit at (0 - deactivated)

- Stop Loss in points: distance for cutting loss at (0 - deactivated)

- Trailing Stop in points: will follow far of x points a winning deal

- Risk in %: for automatic lot size adjustment

- Time filtering - day1:from1-to1/day2:from2-to2

- Days are: Mon(day), Tue(sday), Wed(nesday), Thu(rsday), Fri(day), Sat(urday), Sun(day), All (everyday)

- There are no limitations, many time-slot per days are possible (ex.: Mon:8-9/Mon:15-17/Tue:16-18 etc...)

- Enter "help" inside the box for a memo

- Losing deals' hedged x times: default 2, depending on your margin, the assistant will try to recover from a loss by hedging the position. 0 = disable.

- Keep synced order pool with signals: no opposite order to new signal will be left in the order pool (ex: signal is now "buy", sell orders are removed)

- Autoclose position on trend change: no opposite position to new signal will stay opened (ex: signal is now "sell", buy positions are closed)

- Daily pivots: hide - show

- Notifications: sound, push, sound and push.

When Regent Street is attached to a chart, a first optimization is mandatory.

Using 0 as a step, stop loss & trailing reproduces the arrow-to-arrow strategy used to calculate optimization results - it's not more dangerous, as a new signal close automatically the previous one.

ie: BUY - LONG POSITION - BUY - BUY - BUY - SELL (close the position).

When a new signal appears, the levels are automatically calculated, you're notified about and is placed only by clicking the Deal button or from the MT5 app of your phone/tablet. The deal opportunity remains until an opposite signal occurs.

The daily pivots are particularly useful for swing-traders, to adjust stops by yourself (trailing = 0) for example.

- Notifications:

- Push notification: stay connected with the MetaTrader 5 app

- Sound notification

- Both: sound & push

Testing

Testing the EA within the tester is done using an arrow to arrow strategy. To reproduce it in live, you'll just need to set stop loss, take profit, trailing stop to 0 & default step value. Depending the selected symbol, timeframe, results may be from excellent to deceiving.

Known bugs

Let me know.

Enjoy!