Dollar Yen Trader EA

- Experts

- Robots4Forex Ltd

- Version: 1.1

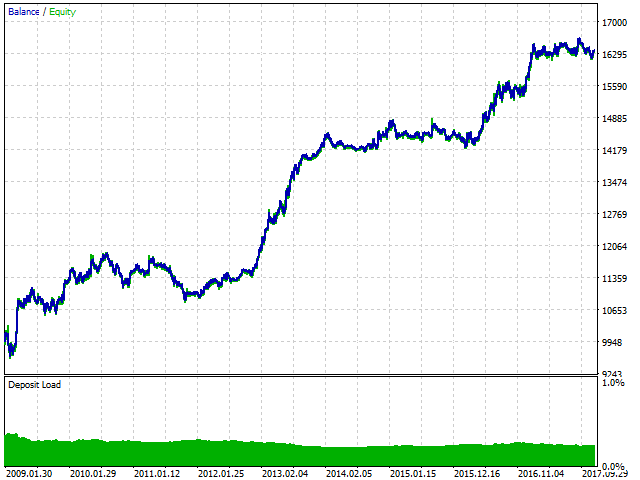

The USDJPY Trader EA is an automated trend following system that is always in the market and trades using sell stop and buy stop orders with trailing stop losses to capture large movements in the market.

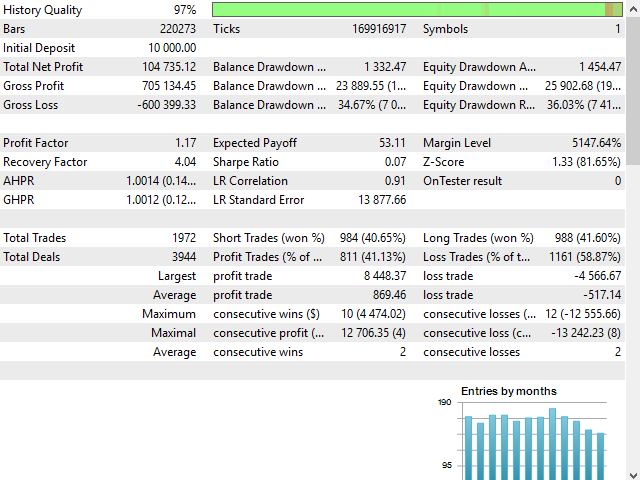

It also includes a money management feature which calculates lot size based on account size and risk with an option to set a maximum draw down at which the EA will stop trading.

This is a long term strategy combined with money management and will work on any pair but works best on USDJPY M15.

View More Products - https://www.mql5.com/en/users/robots4forex/seller#!category=1

Monitoring Signals - https://www.mql5.com/en/signals/author/robots4forex?orderby=gain

Features

- Fully automated

- Risk Money Management

- Works on any account size

- Only one trade open at any time

- Always a stop loss in place

- No Scalping

- No Grids

- No Martingale

Input Settings

General Settings

- TextColour - Colour of screen text

Order Settings

- MagicOrderNumber - Unique number for the EA to identify its trades - Any integer

- Lots - Number of fixed lots per trade if money management is off - Values 0.01 to 50.0

- Slippage - Slippage in pips - Values 1 to 10

- MoneyManagement - If turned on trade lot sizes are calculated on account risk - TRUE/FALSE

- MoneyManagementRisk - Risk per trade if money management is on - Values 0.01 to 0.1

- AllowNewTrades - Turn this of to disable new trades - TRUE/FALSE

- AccountProfitLock - If money management is on the EA will stop trading if the account balance drops to this fraction of the maximum account balance (0.5 = 50% of account balance) - Values 0.0 to 1.0

Entry Settings

- TimeFrame - Timeframe drop-down selection to lock EA to a timeframe so that selection of the chart timeframe doesn't affect the EA. When testing ensure the tester timeframe is set to the same value.

- MaxSpread - Maximum spread in pips that the EA will trade - Values 1.0 to 10.0

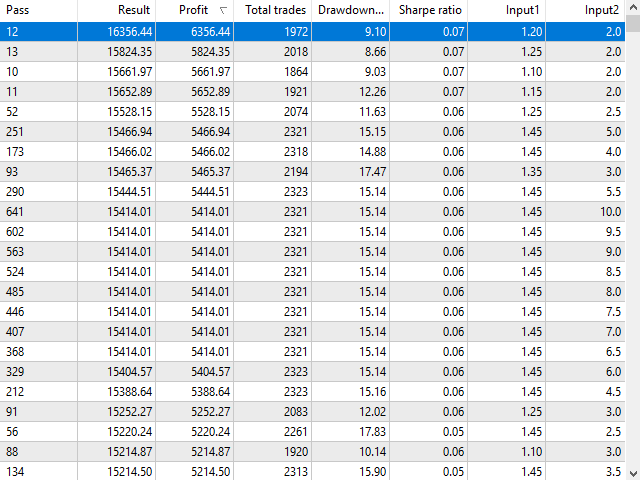

- Input1 - Strategy control value 1, should be smaller than control value 2 (Input2), adjust to find optimum value for each pair - Values 0.01 to 3.0

- Input2 - Strategy control value 2, should be larger than control value 1 (Input1), adjust to find optimum value for each pair - Values 0.1 to 10.0

- EmergencyStopLoss - Initial stop loss before trailing algorithm takes over - Values 25 to 1000

Optimization & Defaults

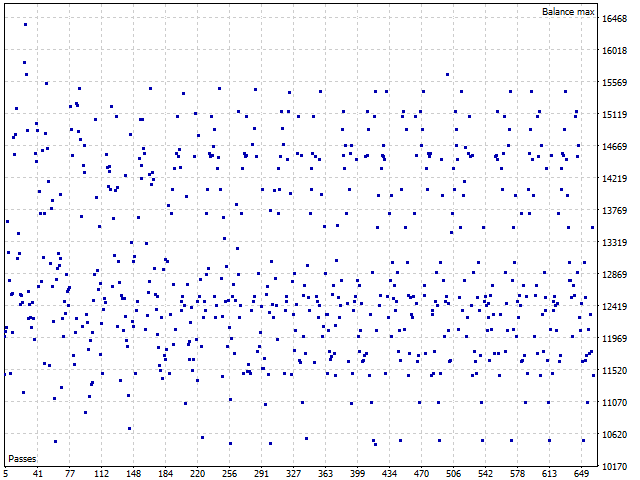

Default input values are for USDJPY, if using on other pairs optimization of Input1 and Input2 are needed to find the best results. Turn money management off when optimizing so that performance in the latter half of the test isn't weighted and better overall results are easier to spot. When optimizing, test over a year period or more, and when checking which settings are best, test an even longer period to check out of sample data, this will reduce the chance of settings being overfit.

Good