Line Heiken Ashi

- Indicateurs

- Andrei Gerasimenko

- Version: 4.0

- Mise à jour: 28 mars 2023

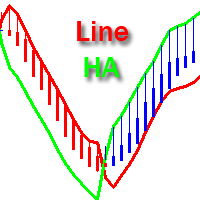

This is an unconventional version of the Heiken Ashi Smoothed indicator implemented as lines rather than a histogram.

Unlike a usual histogram, the indicator draws the readings of the two moving averages in the form of colored lines.

Example

If the candle crosses two indicator lines upwards, a trend is assumed to be changing from bearish to bullish.

If the candle crosses two indicator lines downwards, a trend is assumed to be changing from bullish to bearish.

The indicator is good at displaying flat and trend movements. If the indicator lines are often intertwined, the market is in a clear flat.

If the indicator lines have a directional movement, then the market is in a trend. The difference of the downward movement from the upward one is as follows:

- If the red (default) indicator line is higher than the green (default) one and the lines are facing down, such a trend is considered to be downward.

- If the green line is higher than the red one and the lines are facing up, a trend is assumed to be upward.

Inputs

- Method of the first moving average - first moving average smoothing method

- Period of the first moving average - first moving average period

- Method of the second moving average - second moving average smoothing method

- Period of the second moving average - second moving average period

Nice