HC Candlestick Pattern

- Indicateurs

- Harun Celik

- Version: 1.2

- Mise à jour: 9 janvier 2023

- Activations: 20

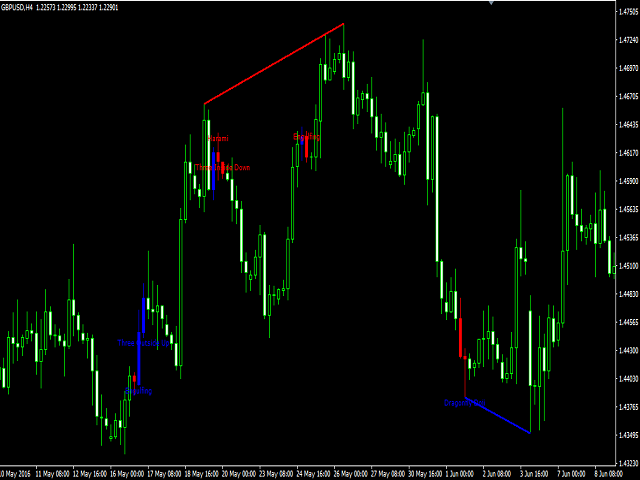

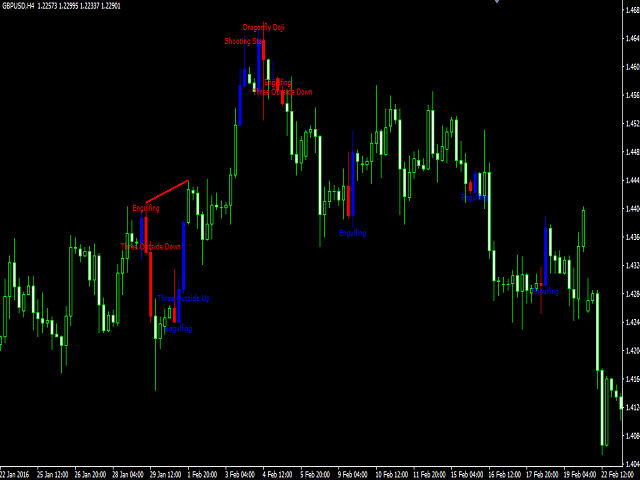

HC candlestick pattern is a simple and convenient indicator able to define candle patterns. Candlestick charts are a type of financial chart for tracking the movement of securities. They have their origins in the centuries-old Japanese rice trade and have made their way into modern day price charting. Some investors find them more visually appealing than the standard bar charts and the price action is easier to interpret.

Hc candlestick pattern is a special indicator designed to find divergence pattern, candlestick pattern, bullish pattern, bearish patterns. This indicator has over 40 pattern finding and tactical features. It clearly shows these patterns on the graph.

Features

- Has the feature to send the notification.

- It has candlestick patterns feature.

- There is divergence patterns feature.

- Bullish patterns feature.

- Bearish patterns feature.

- Trend filter and reliability features.

- Candle Designs: Morningstar, Piercing line, Abandoned baby bottom, Three inside up, Three outside up, Three white soldiers, Concealing baby swallow, Bullish engulfing, Dragon Doji, Gravestone Doji, Doji star, Bullish, Three stars the south, Bullish breakaway, Bullish harami, Hammer, Inverted hammer, Rising continuation, Bullish three line strike, Bullish mat hold, Evening star, Dark cloud cover, Abandoned baby top, Three inside down, Three outside down, Upside gap two crows, Bearish engulfing, Dragonfly Doji top, Gravestone Doji top, Doji star top, Bearish, Advance block, Two crows, Bearish breakaway, Bearish harami, Shooting star, Hanging man, Falling three methods, Bearish three line strike, Bearish mat hold

Parameters

- Show alert - Send alert

- Send email - Send alerts to mail address.

- Look back - Retrospective calculation

- ===PATTERN SETUP===

- Show candlestick patterns - Open close feature

- Show divergence patterns - Open close feature

- Show bullish patterns - Open close feature

- Show bearish patterns - Open close feature

- Trend filter - Open close feature

- Reliability - Open close feature

- ===CANDLESTICK PATTERNS===

- Bullish reversal - Open close feature

- Morningstar - Open close feature

- Piercing line - Open close feature

- Abandoned baby bottom - Open close feature

- Three inside up - Open close feature

- Three outside up - Open close feature

- Three white soldiers - Open close feature

- Concealing baby swallow - Open close feature

- Bullish engulfing - Open close feature

- Dragonfly Doji bottom - Open close feature

- Gravestone Doji bottom - Open close feature

- Doji star bottom - Open close feature

- Bullish harami cross - Open close feature

- Three stars in the south - Open close feature

- Bullish breakaway - Open close feature

- Bullish harami - Open close feature

- Hammer - Open close feature

- Inverted hammer - Open close feature

- ===BULLISH CONTINUATION===

- Rising three methods - Open close feature

- Bullish three line strike - Open close feature

- Bullish mat hold - Open close feature

- ===BEARISH REVERSAL===

- Evening star - Open close feature

- Dark could cover - Open close feature

- Abandoned baby top - Open close feature

- Three inside down - Open close feature

- Three outside down - Open close feature

- Three black crows - Open close feature

- Upside gap two crows - Open close feature

- Bearish engulfing - Open close feature

- Dragonfly Doji top - Open close feature

- Gravestone Doji top - Open close feature

- Doji star top - Open close feature

- Bearish harami cross - Open close feature

- Advance block - Open close feature

- Two cross - Open close feature

- Bearish breakaway - Open close feature

- Shooting star - Open close feature

- Hanging man - Open close feature

- ===BEARISH CONTINUATION===

- Falling three methods - Open close feature

- Bearish three line strike - Open close feature

- Bearish mat hold - Open close feature

- ===DIVERGENCE PATTERN===

- Only regular divergence - Open close feature

- Only deep divergence - Open close feature

- Show pattern names - Open close feature

L'utilisateur n'a laissé aucun commentaire sur la note