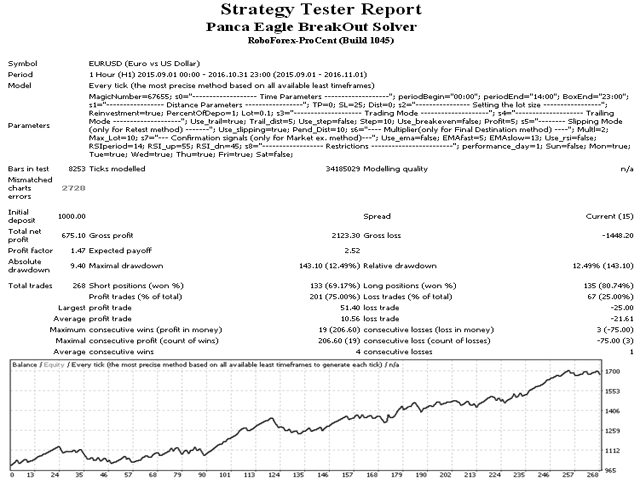

Panca Eagle Breakout Solver

- Experts

- Mikhail Kontsevoy

- Version: 2.11

- Mise à jour: 17 novembre 2021

- Activations: 5

This expert is an implementation of 4 different strategies for trading with the PANCA EAGLE Break Out indicator. The indicator will be useful for traders who already use the PANCA EAGLE Break Out indicator, working with it manually.

Features

Break Out PANCA EAGLE is a channel indicator for Forex, which displays the operating channel of the currency pair during the Asian trading session. The indicator determines the maximum and minimum price for the selected trading period and offers to make trades on a breakout of this range. However, as shown by tests, sometimes the expert should be configured so that the working range of the prices also includes the period of the European session. The operation of the EA does not require the Break Out PANCA EAGLE indicator to be present.

Strategies

All strategies are united by the fact that in the period from periodBegin to periodEnd a price channel is formed, and at the time specified in the BoxEnd parameter all orders will be closed regardless of their profit or loss. In the period from periodEnd to BoxEnd:

- for the BreakOut method - BUYSTOP and SELLSTOP orders are placed at the distance of Distance points from the channel. After a breakout of a level, order can be transferred to breakeven or trailing can be activated.

- for the Market execution - virtual levels are placed at the distance of Distance points from the channel. When levels are crossed, BUY or SELL orders are opened. In case the “use_ema” or “use_rsi” options are selected, the additional conditions for opening orders will be the relative location of EMAfast and EMASlow or the RSI level.

- for the Retest execution - virtual levels are placed at the distance of Distance points from the channel. When the price crosses one of those levels, BUYSTOP or SELLSTOP pending orders are placed at the distance of Pending Distance from the price. If the “use_slipping” option is selected, the pending orders will "follow" the price for entering the market at a better price.

- for the Final Destination strategy - a BUYSTOP order is placed above the upper level at the distance of Distance, and a SELLSTOP order is placed below the lower level at the distance of Distance points, both with the same lot sizes. After one of the orders is triggered, a new order is placed in the place of the other order with the lot size multiplied by Multiplier. The strategy follows the logic of the Final Destination (с) EA. (It is recommended to set the stop loss at a distance greater than the breakeven level.)

Parameters

- MagicNumber - magic number

- periodBegin - beginning of the channel formation period

- periodEnd - end of the channel formation period. Beginning of the trading period

- BoxEnd - end of the trading period

- TakeProfit - take profit

- StopLoss - stop loss

- Distance - distance from the channel boundaries to orders in points

- Reinvestment - trade a percentage of the deposit. Related to the value of PercentOfDepo

- PercentOfDepo - lot size calculated as a percentage of free margin value

- Lot - initial lot size, if Reinvestment = false

- mode - selection of the strategy

- Use_trail - use trailing stop. Starts after reaching Profit.

- Trailing Distance - minimum distance between the current price and trailing stop in point.

- Use_step - use trailing stop step.

- Step - the distance (step) in points for the price to pass to move the trailing stop.

- Use_breakeven - use breakeven at the level of Profit.

- Profit - close all orders after reaching the target level.

- Use_slipping - use the "slipping" mode for the pending orders for the Retest method.

- Pending Distance - the distance between the price and the pending orders for the Retest method.

- Multiplier - lot multiplier for the Final Destination method.

- Max_Lot maximum allowed lot for the Final Destination method.

- Use_ema - use the order opening condition for the Market execution method. Checks if EMAfast and EMASlow and located above or below.

- EMAfast - fast EMA period.

- EMAslow - slow EMA period.

- Use_rsi - use the order opening condition of the RSI indicator for the Market execution method.

- RSIperiod - RSI period.

- RSI_up - if RSI is greater than the threshold value, a BUY order is opened.

- RSI_dn - if RSI is less than the threshold value, a SELL order is opened.

- performance_day - maximum number of orders opened on one instrument per day (excluding the Final Dest. strategy)

- Sun,Mon,Tue,Wed,Thu,Fri,Sat - days of the week for the EA to work.

Отличные результаты,спасибо Михаил