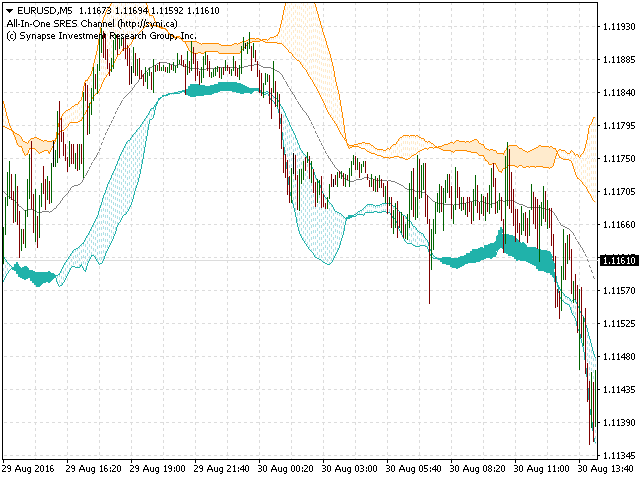

StdATR Squeeze Channel

- Indicateurs

- Libertas LLC

- Version: 1.4

- Mise à jour: 1 décembre 2021

- Activations: 20

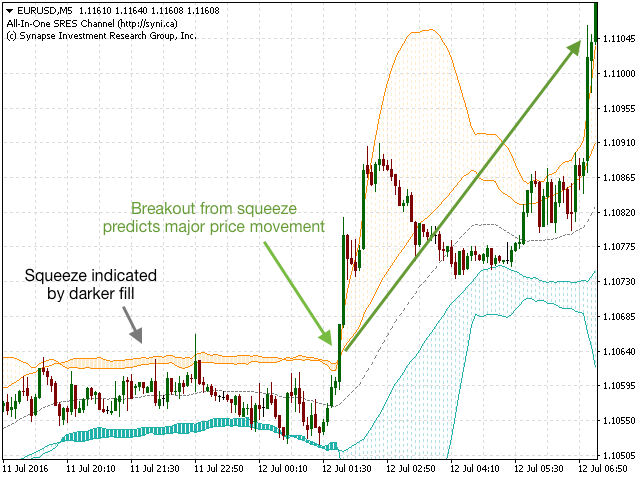

"The Squeeze indicator attempts to identify periods of consolidation in a market. In general the market is either in a period of quiet consolidation or vertical price discovery. By identifying these calm periods, we have a better opportunity of getting into trades with the potential for larger moves. Once a market enters into a "squeeze," we watch the overall market momentum to help forecast the market direction and await a release of market energy."

The StdATR Squeeze Channel combines standard deviation and average true range channels and email/message alerts to improve on the Bollinger band squeeze play. This is a great pattern that enables you to locate strong and profitable trade setups, and works on all time frames.

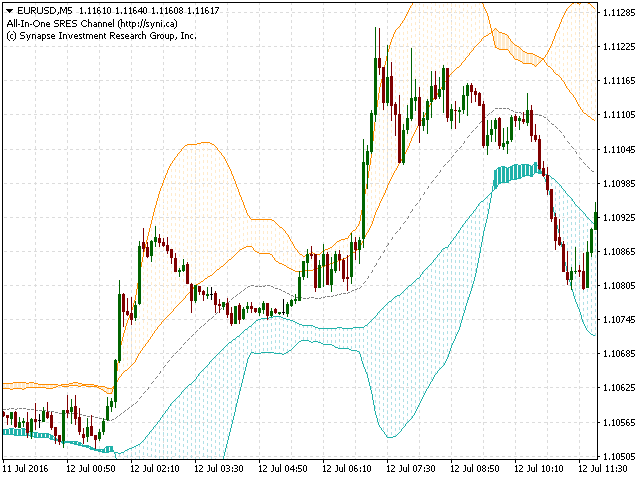

When the market slows, low volatility draws standard deviation bands inside the average true range channel ("squeeze"). Afterward, the release of a squeeze precedes a strong price movement, which can be very profitable if entered on time. This setup is great because the strong movement usually allows a tight stop loss and a wide target - in many cases a 1:10 SL to TP position is reasonable, i.e., great risk-to-reward ratio.

The key to the squeeze setup is entering on time, which is where StDATR Squeeze Channel excels. It clearly and quantitatively shows a squeeze onset and release, by comparing standard deviation to average true range channels. This is more robust, easier to use, and allows better entries than simple Bollinger bands, which would require you to estimate a squeeze onset/release. We have added email and message alerts to help you track multiple assets and enter on time.

This indicator is particularly well suited for traders who currently use Bollinger bands, and/or enjoy squeeze plays.

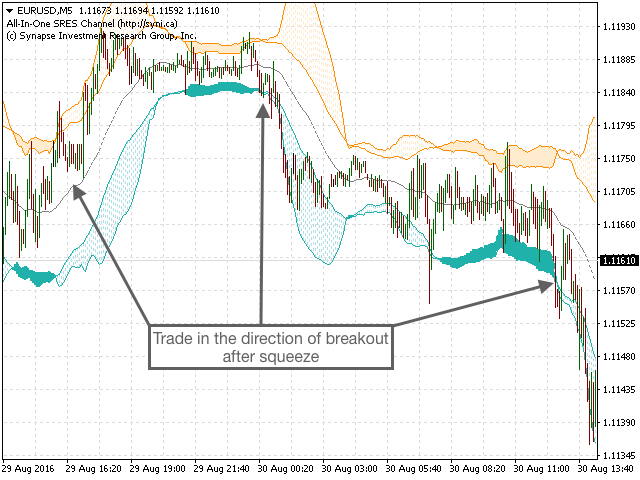

Sample Trading Strategy

- StDev bands inside ATR bands marks a 'squeeze,' and indicates a likely major upcoming price movement. The space between StDev and ATR bands indicates headroom for directional movement. Wait for squeeze that lasts more than 4 candles using squeeze channel.

- When squeeze is released, trade in the direction of price movement

Parameters

- Color Scheme: Select from one of the three pre-set color schemes, or choose "UserDefine" to enable defining your own colors (in Colors tab)

- StDATR: Plot StD/ATR channel squeeze: True=plot squeeze channel

- StDATR: Channel Period (Default=34): # bars used to calculate channel

- StDATR: Channel Shift (Default=0): Shifts channel N bars forward (+ value) or backward (- value) in time

- StDATR: Channel Deviations (Default=2.5): # stdev from the mean for calculating StD channel

- StDATR: Squeeze release alerts: True=alerts when squeeze is released

- StDATR: Turn on alerts message: Alert triggers a message box

- StDATR: Turn on alerts sound: Alert triggers a sound

- StDATR: Turn on alerts email: Alert sends an email (SMTP must be set up in MT4 options)

iCustom

Developers can use iCustom with this indicator, using the following code:

iCustom(NULL,0,"StdATR Squeeze Channel",1,34,0,2.5,false,false,false,false,0,0); // StDev upper band iCustom(NULL,0,"StdATR Squeeze Channel",1,34,0,2.5,false,false,false,false,1,0); // ATR upper band iCustom(NULL,0,"StdATR Squeeze Channel",1,34,0,2.5,false,false,false,false,2,0); // ATR lower band iCustom(NULL,0,"StdATR Squeeze Channel",1,34,0,2.5,false,false,false,false,3,0); // StDev lower band

You can download the StdATR Squeeze Channel here, or included with the All-In-One SRES Channel package (an inclusive charting package that also automatically plots support/resistance lines, H/L/O, and daily expected price range)