Shadow Effect

- Experts

- Volodymyr Hrybachov

- Version: 1.1

- Mise à jour: 4 mars 2022

- Activations: 5

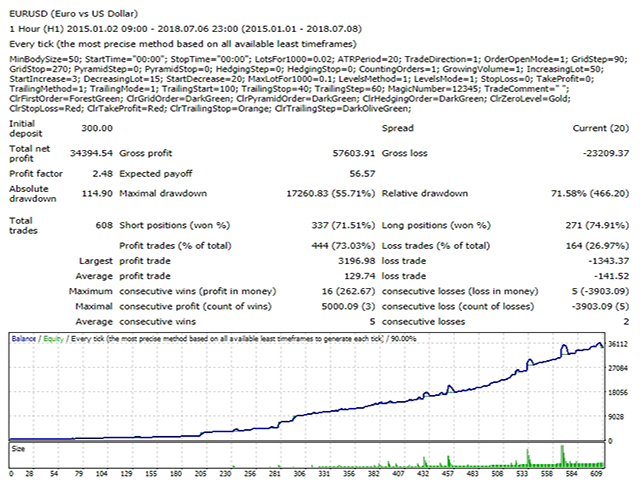

This non-indicator trading strategy searches for the candles having wicks exceeding the candle body. The strategy is somewhat similar to trading by Pin Bar pattern. The EA buys when the lower wick exceeds the candle body and the upper wick. The minimum candle body size is set as % of ATR.

The EA works by a new bar open prices, so that test/optimization results are as close to real trading as possible. The EA applies dynamic order placement levels, stop loss, take profit and trailing stop levels invisible for brokers. Their values can be calculated in pips, money, as a % of the balance or volatility (ATR).

The EA is designed for intraday trading with all major currency pairs on any timeframe. Depending on the settings, it can be used for any trading style: scalping, averaging, pyramiding, hedging, which makes it not just a trading robot, but a multifunctional flexible constructor.

Each block responsible for management of a particular function can be customized separately and operate as a single unit. The EA can simultaneously manage and close oppositely directed positions (both single ones and order baskets), as well as interact with positions opened manually or by another EA (start managing deals distinguished by magic number). Since the EA works at a bar opening, it can be optimized quickly and easily.

Recommendations

- before using on a live account, test the EA with minimal risk on a cent account;

- use VPS or hosting server with minimal network latency to the broker's server;

- low spreads + low commission + high quality execution are important when choosing a broker to trade;

- use the EA on highly liquid currency pairs, such as EURUSD, GBPUSD, AUDUSD, USDJPY, USDCHF, USDCAD and NZDUSD;

- minimum deposit - 1000 currency units per 0.01 lots;

- timeframe H1.

Main parameters

- MinBodySize - minimum candle body size, set as % of ATR;

- StartTime, StopTime - time for opening orders, not used if 00:00;

- LotsFor1000 - initial lot size per 1000 units of base currency;

- ATRPeriod - period for calculating the average daily volatility, in days;

- TradeDirection - trading method: trade in one or both directions simultaneously;

- OrderOpenMode - calculation of step for opening orders: in pips, in deposit currency, as a percentage of the balance or as a percentage of ATR;

- GridStep, GridStop - position averaging step, 0 - not used;

- PyramidStep, PyramidStop - position increase step, 0 - not used;

- HedgingStep, HedgingStop - position hedging step, 0 - not used;

- CountingOrders - order counting: each series separately or the total number of orders in different directions;

- GrowingVolume - scale in to positions by the amount of orders or by lot increment;

- IncreasingLot, DecreasingLot - increase/decrease the lot by the specified percentage, not used if -0;

- StartIncrease, StartDecrease - position to start increasing/decreasing the lot;

- MaxLotFor1000 - maximum lot per 1000 units of base currency;

- LevelsMethod - setting take profit/stop loss: separately for short and long positions or for the entire basket of orders;

- LevelsMode - calculation of take profit/stop loss: in pips, in the deposit currency, as a percentage of the balance or as a percentage of ATR;

- StopLoss, TakeProfit - stop loss and take profit, 0 - not used;

- TrailingMethod - trailing stop method: separately for short and long positions or for the entire basket of orders;

- TrailingMode - calculation of trailing stop: in pips, in the deposit currency, as a percentage of the balance or as a percentage of ATR;

- TrailingStart - minimum profit for enabling trailing, 0 - not used;

- TrailingStop, TrailingStep - trailing stop and trailing step;

- MagicNumber - magic number, the EA manages all positions opened manually or by another EA if set to -1;

- TradeComment - trade comment.