PZ Open Range EA

- Experts

- PZ TRADING SLU

- Version: 5.0

- Activations: 20

- Easy to use and supervise

- Fully configurable settings

- Customizable break-even, SL, TP and Trailing-Stop

- Built-in money management

- Works for ECN/Non-ECN brokers

- Works for 2-3-4-5 digit symbols

- Trading is FIFO (NFA) Compliant

The Opening Range Breakout Strategy

The EA places a buy stop just above the open price plus the Stretch and a sell stop just below the open price minus the Stretch. The first stop triggered enters the trader into the trade and the other stop becomes the protective stop.

Crabel's research shows that the earlier in the trading session the entry stop is hit the more likely the trade will be profitable at the close. A market movement that kicks off a trend quickly in the current trading session could add significant profit to a trader's position by the close and should be considered for a multi-day trade.

Extending Crabel's research results it is obvious that as time passes and we are not filled early on then the risk increases and it becomes prudent to reduce the size of the position during the day. Trades filled towards the end of the day carry the most risk and the later in the day the trade is filled the less likely the trader will want to carry that trade overnight.

What is the stretch?

The Stretch is a Toby Crabe lprice pattern which represents the minimum average price movement/deviation from the open price during a period of time, and is used to calculate two breakout levels for every single trading day. It is calculated by taking the 10 period SMA of the absolute difference between the open and either the high or low, whichever difference is smaller. This value is used to calculate breakout thresholds for the current trading session, which are displayed in the indicator as two lines.

Input Parameters

- Stretch Settings - This parameter is the period of the Stretch. This value is used to calculate breakout thresholds for the current trading session.

- Position Management - This group of settings applies to trading decisions and trade management. You can customize the break-even level, break-even behavior, trailing-stop and take-profit.

- Money Management - In this settings block you can set the lotsize for the first trade, or allow the EA to calculate it by itself. I always recommend setting a manual lotsize for each trade.

- EA Settings - You can select the magic number for the trades, custom comment and manual pip value if you need to override the one the

default one. Do not change these unless you know what you are doing.

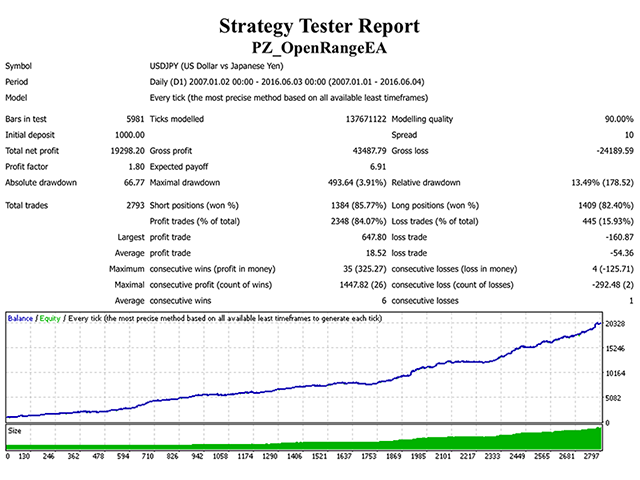

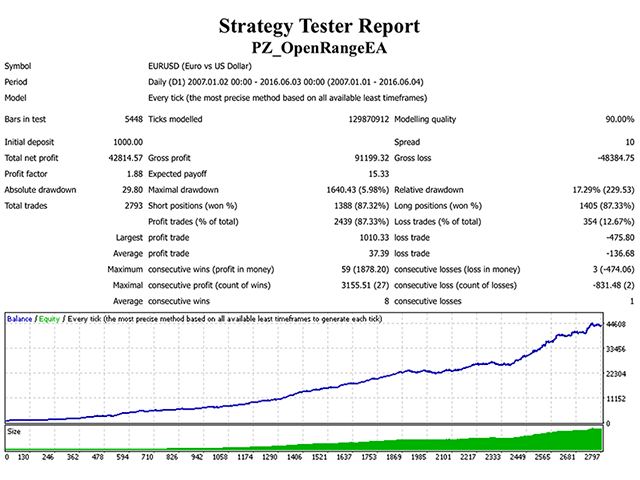

Backtests are good, forward tests only 2 days, but also very good. What i like about it that its a good solid strategy that WORKS. It trades only 1 trade a day. So bye bye to overtrading:)