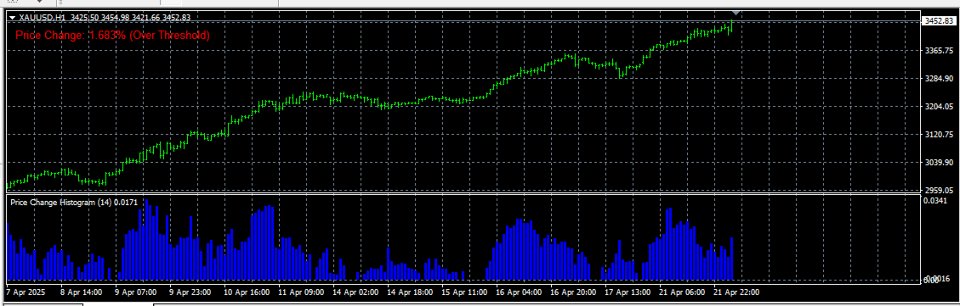

Price Change Indicator Introduction

- Indicateurs

- Hong Ling Mu

- Version: 1.0

The Price Change Indicator is a powerful tool designed to help traders identify significant price movements over a specified period. By calculating and visualizing percentage changes between current and historical prices, it allows traders to quickly spot potential trading opportunities when markets show unusual volatility or momentum.

Features

- Real-time monitoring of price changes

- Visual histogram display when changes exceed threshold

- Text display showing current price change percentage

- Customizable period and threshold settings

- Color-coded alerts when threshold is exceeded

- Works in a separate indicator window

Input Parameters

- period (default: 14): The lookback period used to calculate price changes. This determines how far back the indicator compares the current price against. A smaller period will make the indicator more sensitive to recent price changes, while a larger period will highlight longer-term movements.

- threshold (default: 0.002): The minimum percentage change (0.2%) required to trigger the histogram display. This acts as a filter to highlight only significant price movements. Increase this value to focus on larger price swings or decrease it to capture smaller movements.

How to Use

- Apply the indicator to any chart timeframe

- Adjust the period and threshold parameters to match your trading style

- Watch for histogram bars that indicate significant price changes

- Use the real-time text display to monitor the current price change percentage

- Consider entering trades when the indicator signals unusual price activity

Trading Applications

- Identify potential breakout opportunities when price changes suddenly accelerate

- Confirm trend strength by monitoring the magnitude of price changes

- Spot market volatility increases that may signal important news or events

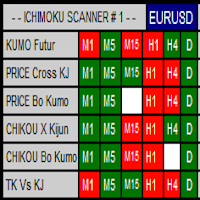

- Use as a filter for other technical indicators in your trading system

This indicator is particularly useful for traders focused on momentum and volatility-based strategies, helping them capitalize on significant market movements while filtering out normal price noise.