Advanced Wave Statistics Scanner

The Advanced Wave Statistics Scanner is an enhanced MQL5 tool for MetaTrader 5 that combines traditional price volatility analysis with ATR(Average True Range)indicator analysis.This sophisticated tool provides deeper insights into market volatility patterns by comparing standard price wave measurements with ATR-based volatility metrics,enabling traders to identify abnormal market conditions and potential trading opportunities with greater precision.

#Key Features

-Multi-symbol Scanning:Analyze volatility across multiple trading instruments

-Dual Volatility Analysis:Combines high-low range analysis with ATR indicator

-Automatic ATR Thresholds:Self-adjusting volatility thresholds based on market conditions

-Advanced Wave Categorization:Classifies waves by size and ATR relationships

-Visual Progress Display:Real-time progress indicators during analysis

-Enhanced Time Filtering:Precise control over analysis periods and days

-Comprehensive Visualization:Color-coded identification of different volatility types

-Detailed Data Export:Extended CSV output with ATR correlation data

-Anomaly Detection:Identifies unusual volatility events compared to historical norms

#Technical Approach

The tool extends the base wave scanner functionality by incorporating the ATR indicator,which provides a more nuanced view of volatility by considering gaps and previous bar relationships.It calculates automatic thresholds based on historical ATR values,allowing for more context-aware volatility analysis that adapts to different market conditions.

Installation

1.Download the WaveStatisticsScanner_Advanced.ex5 file

2.Open MetaTrader 5 platform

3.Navigate to File→Open Data Folder

4.Place the file in the MQL5/Scripts folder

5.Restart MetaTrader 5 or refresh the Navigator panel

6.The script will appear in the Navigator under"Scripts"

Running the Analysis

1.Open a chart for any symbol you wish to analyze

2.Double-click on the WaveStatisticsScanner_Advanced script in the Navigator panel

3.Configure the input parameters in the dialog that appears:

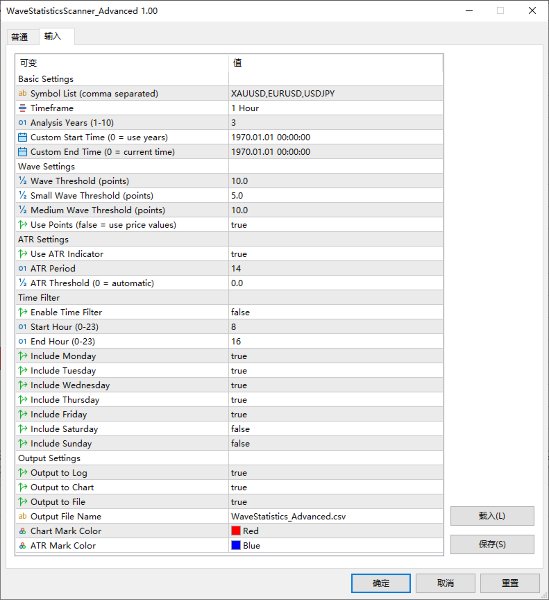

-Basic Settings:Define symbols to analyze,timeframe,and time range

-Wave Settings:Set wave thresholds and measurement method

-ATR Settings:Configure ATR period and threshold values(or use automatic)

-Time Filter:Configure specific time periods for analysis(optional)

-Output Settings:Select desired output methods and visualization options

4.Click"OK"to start the analysis

5.A progress bar will appear showing the analysis status

Interpreting Results

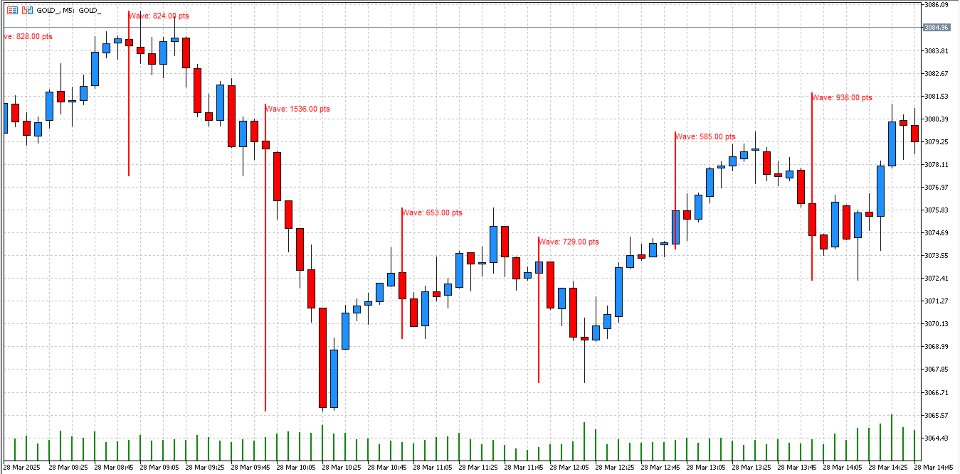

-Chart Visualization:

-Red vertical lines show significant price waves

-Blue vertical lines indicate ATR anomalies

-Labels display the wave size or ATR value

-Dual-colored areas indicate where both high volatility and ATR anomalies occur

-Experts Log:

-Check the"Experts"tab for detailed statistics

-ATR statistics section shows threshold values and frequency

-Summary compares wave-based and ATR-based volatility patterns

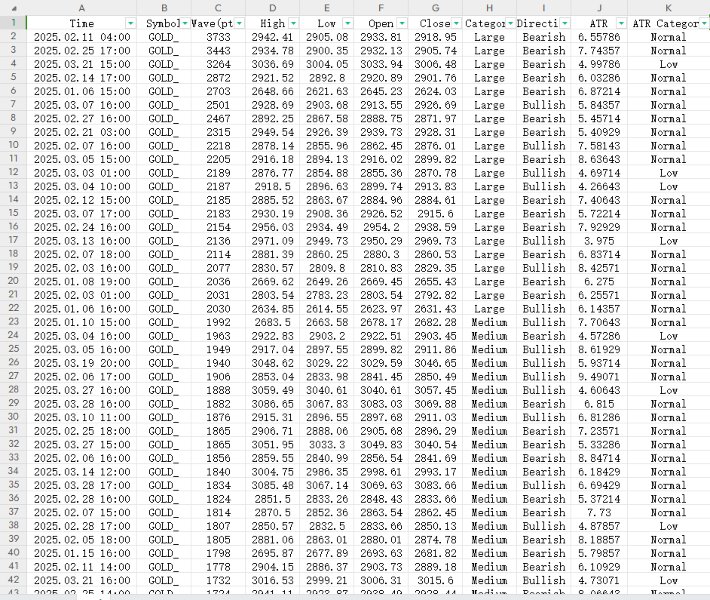

-CSV Export:

-Find the CSV file in the MQL5/Files directory

-Extended data includes ATR values and ATR categories

-Allows for correlation analysis between price waves and ATR

Advanced Usage

-Use automatic ATR thresholds for adaptive volatility analysis across different markets

-Compare ATR anomaly frequency with standard wave frequency to identify divergences

-Apply time filters to analyze how ATR-based volatility differs across trading sessions

-Use the extended categorization system to build more sophisticated trading strategies

-Monitor the relationship between ATR and price waves to anticipate volatility shifts