US100 Nasdaq Scalper V2

- Experts

- Benrashi Sagev Jacobson

- Version: 1.0

- Activations: 10

Only a few copies left at the current price! Final price: 2000$

Live Signal (Darwinex Zero live signal) - results before this EA's published date were not produced by this EA

Assessing Strategy Stability and Flexibility

Various stress-testing techniques are utilized to explore how an EA might react to different market conditions and parameter adjustments. Walk Forward Optimization (WFO) and Walk Forward Matrix (WFM) examine performance on previously unseen data and varying market environments while identifying possible intervals for re-optimization. WFM can also help assess whether re-optimization could allow the EA to maintain similar performance over time. Monte Carlo simulations introduce randomness to observe how the strategy may perform under diverse conditions. Sequential testing modifies entry, exit, and indicator parameters to identify potential areas of stability, while system permutation stress testing examines performance across a wide range of settings. These methods aim to analyze factors such as the likelihood of overfitting, adaptability to past market conditions, and performance under different spread levels. Additionally, mathematical models are used to help gauge when re-optimization may be needed.

Contact me to learn more about the reasoning behind the stress-tests and related information.Strategy overview & back-testing

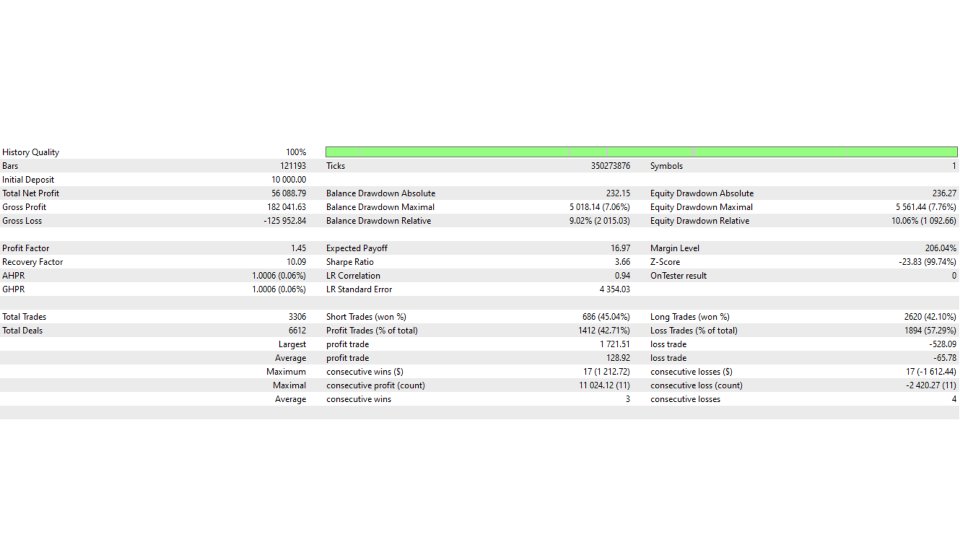

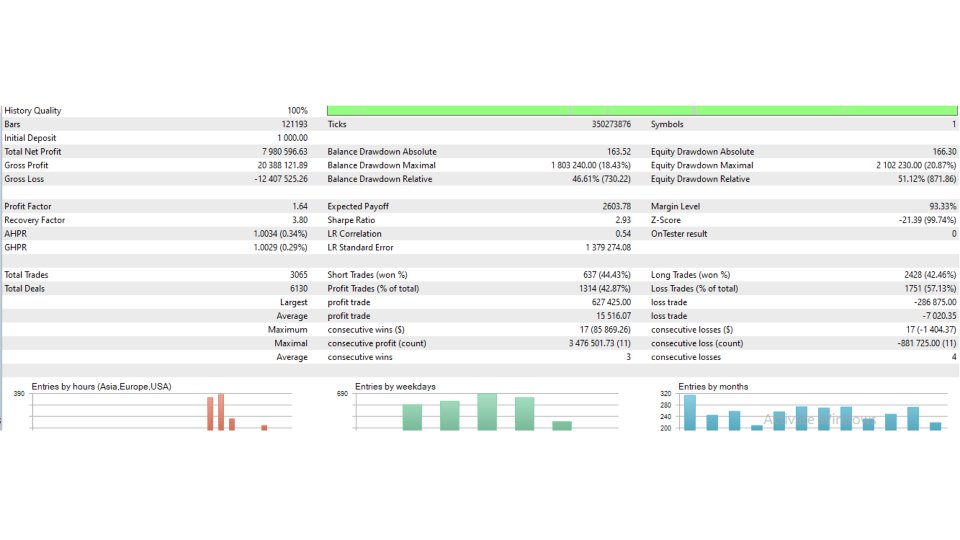

The approach does not incorporate martingale or grid trading strategies. It applies an ATR-based stop loss and trailing stop that automatically adapt to market volatility, aiming to regulate risk while enabling successful trades to develop. Entry signals are generated using the Bull Power and Bear Power indicators.

Broker requirements & Prop firm information

The strategy is designed to adapt to volatility-driven market movements. While it is not highly sensitive to spread, using a broker with lower spreads is recommended, with an optimal spread at or below 3 index points during lower volatility periods.

The strategy is designed for use on prop trading accounts, with FTMO being the recommended option. It is advised to avoid using Darwinex Zero to prevent account correlation that could impact allocation.

Setup Guide

The strategy is designed for the M15 NASDAQ CFD or Futures, with a low-spread broker or ECN account recommended, and while different broker time zones typically do not impact performance, trades should be set exit 15 minutes before the U.S. market closes on Friday (4:00 PM in your time zone) contact me for assistance if required.