Smart Range Detector

- Indicateurs

- Mohamed Elyes Hantous

- Version: 1.0

- Activations: 10

Overview

The Smart Range Detector is an advanced trading indicator designed to automatically identify key price ranges where market consolidation, accumulation, or distribution occurs. This tool helps traders spot high-probability breakout zones, liquidity areas, and potential trade setups by detecting significant price ranges that the market respects.

Unlike traditional range indicators, the Smart Range Detector dynamically adjusts based on market volatility, ensuring that traders always have up-to-date information on potential trading zones. Whether you're a day trader, swing trader, or scalper, this indicator provides valuable insights into market structure and trend continuation or reversal signals.

Key Features

✅ Automatic Range Detection – Identifies critical price ranges where the market is accumulating or distributing.

✅ Dynamic Adjustments – Updates in real-time based on price action and market conditions.

✅ Multi-Timeframe Support – Works on multiple timeframes (1M to Daily) for a broader market perspective.

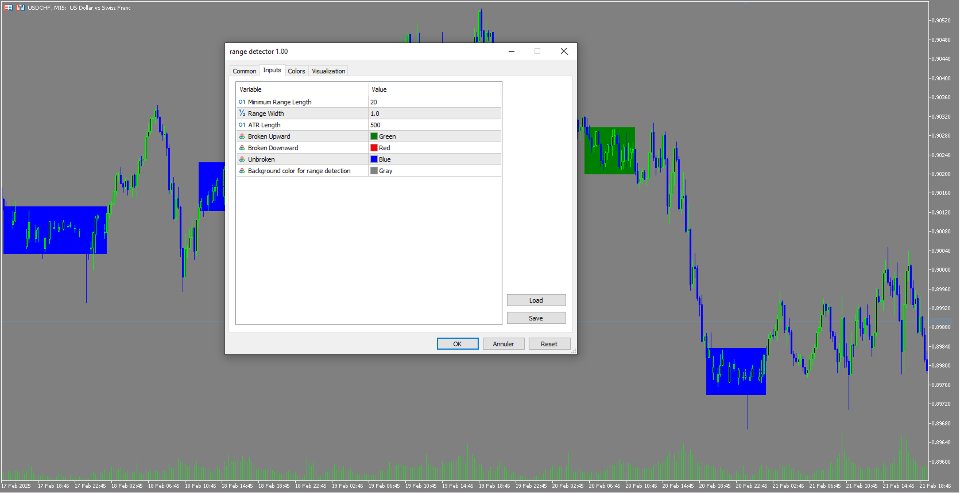

✅ Customizable Parameters – Allows traders to fine-tune the range sensitivity, breakout levels, and alert settings based on their trading strategy.

✅ Works on All Forex Pairs, Indices, and Commodities – Adaptable to different market conditions.

How the Smart Range Detector Works

-

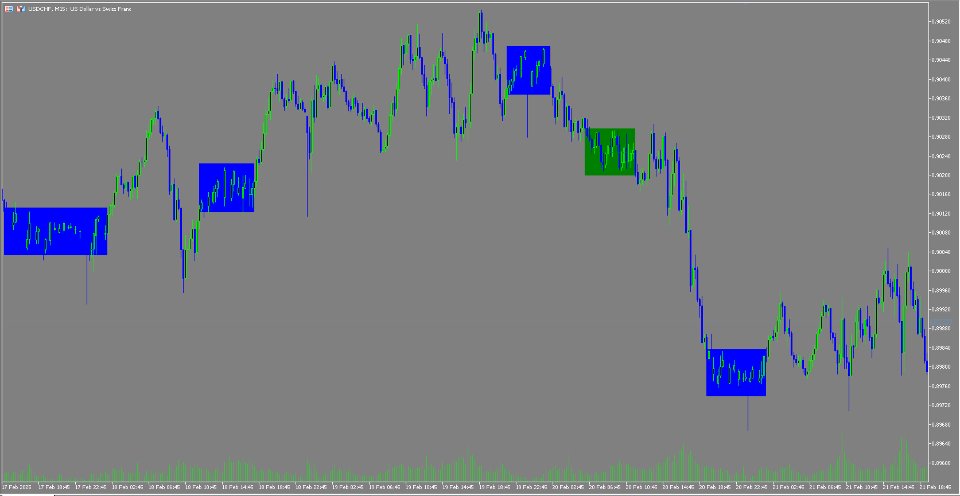

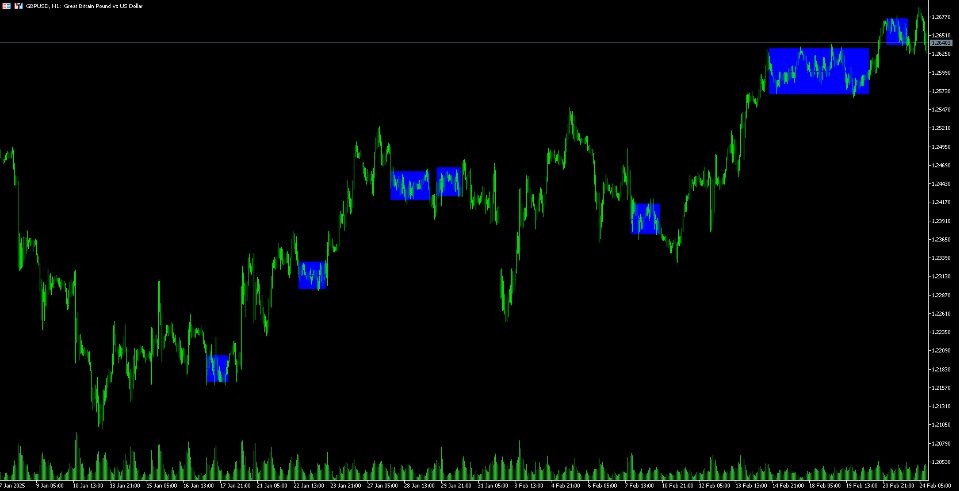

Range Identification

- The indicator scans historical price data and detects areas where price movement has been limited within a certain range.

- It marks the upper and lower boundaries of the range, highlighting the key resistance and support zones.

- It adjusts dynamically based on the latest price action.

-

Breakout & Retest Confirmation

- When price moves outside the detected range, the indicator checks if the breakout is strong or weak.

- A breakout with momentum suggests a continuation trade opportunity, while a weak breakout may indicate a fakeout.

- If price returns to the broken range and retests it successfully, it offers a high-probability trade setup.

-

Reversal & Liquidity Traps

- The indicator highlights areas where liquidity is being grabbed before a major move.

- It detects potential reversals when price repeatedly rejects a range boundary.

How to Use the Smart Range Detector in Trading

1. Identifying High-Probability Trade Setups

- Look for tight ranges forming in the market, as these indicate areas of consolidation before a major move.

- Watch for breakouts and determine whether they have strong momentum or not.

- Wait for a retest of the broken range to confirm a valid breakout before entering a trade.

2. Trading Breakouts and Fakeouts

- If the price breaks above the upper boundary of the range with strong volume, consider entering a long position.

- If the price breaks below the lower boundary, consider a short position.

- If price quickly returns into the range after a breakout (fakeout), it signals a possible reversal.

3. Using Multi-Timeframe Confirmation

- Check the higher timeframe ranges (e.g., 4H or Daily) to see if the smaller range aligns with key support/resistance levels.

- Use lower timeframes (e.g., 15M or 5M) for precise entry timing when trading breakouts.

4. Stop-Loss & Take-Profit Placement

- Place stop-loss orders slightly outside the range to protect against fakeouts.

- Set take-profit levels at the next significant support/resistance zone or based on risk-reward ratios (e.g., 1:2 or 1:3).

5. Enhancing Your Strategy with Smart Range Detector

- Combine it with trend indicators (like moving averages) for stronger confirmation.

- Use it alongside Fibonacci retracement to refine entry and exit points.

- Pair it with volume analysis to detect strong or weak breakouts.

Why Use the Smart Range Detector?

📌 Improves Trade Accuracy – Helps filter out false breakouts and identify strong trend continuations.

📌 Saves Time – Eliminates the need for manually drawing support and resistance zones.

📌 Adapts to Any Market Condition – Works in trending and ranging markets.

📌 Suitable for All Trading Styles – Scalpers, swing traders, and position traders can benefit from its signals.