Hype Trend EA ALL Symbol

- Experts

- Mithat Tuncer Tuncel

- Version: 1.0

- Activations: 5

HYPE – An Adaptive and Dynamic Trading Algorithm Designed for Modern Market Conditions

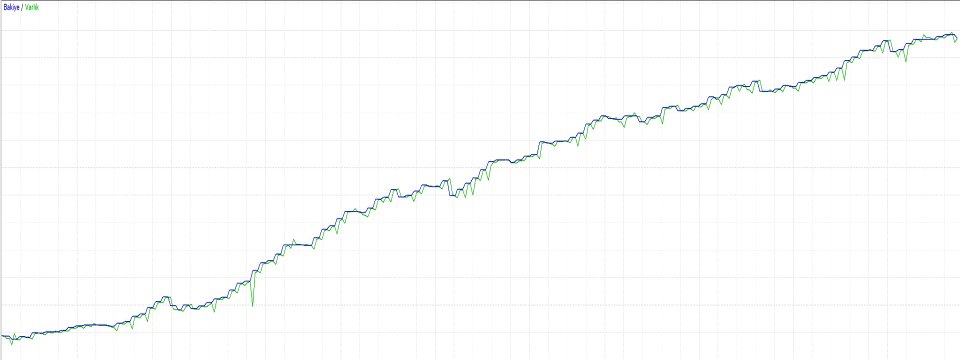

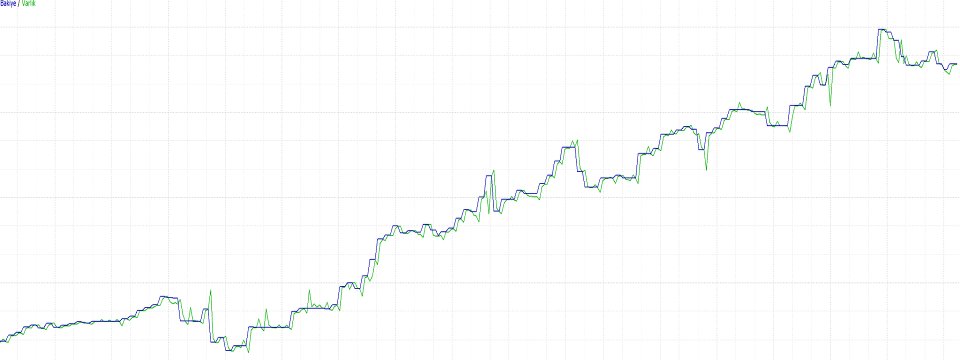

Success in today’s financial markets requires flexible and dynamic strategies rather than rigid, rule-based approaches. Hype EA stands apart from traditional algorithms by analyzing real-time market data, adapting to changing conditions, and optimizing risk management automatically.

Unlike static systems, Hype EA continuously optimizes itself using advanced features such as ATR-based volatility adjustments, trend-based trade strategies, and intelligent position management to deliver consistent and efficient results across various market conditions.

📌 Key Adaptive Features of Hype EA

📊 1. Dynamic Risk and Reward Management

Hype EA analyzes real-time market volatility and trend strength to dynamically adjust stop loss (SL) and take profit (TP) levels for each trade.

✔ Stop distances and target levels are automatically updated based on market conditions.

✔ Risk/reward ratios are optimized in real time for maximum efficiency.

✔ Unnecessary risks are filtered, ensuring only high-probability trades are executed.

📈 2. ATR-Based Adaptive Adjustments

Hype EA uses the ATR (Average True Range) indicator to constantly calibrate trade parameters according to market volatility.

🔹 High volatility: Tight stop loss settings provide protection against sudden price swings.

🔹 Low volatility: Wider stop loss distances allow for natural price fluctuations.

🔹 Target levels are dynamically adjusted based on trend strength, ensuring optimal returns.

This adaptability enables Hype EA to perform efficiently in different market conditions.

🛠 3. Volatility and Trend Filtering

Hype EA continuously analyzes market trend strength and volatility levels, optimizing trade execution in real time.

✅ Strong trends: Larger targets and trend-following trades maximize profits.

✅ Choppy markets: Tighter stop losses minimize potential drawdowns.

✅ Sideways markets: Reduces trade frequency to avoid unnecessary signals.

This dynamic filtering improves trade accuracy while reducing risk exposure.

🎯 4. Smart Position Management & Gradual Exit Strategy

Instead of closing trades all at once, Hype EA uses a step-by-step risk reduction approach.

✔ Partial profit-taking at key levels reduces exposure.

✔ Remaining positions are moved to breakeven to lock in profits.

✔ Dynamic re-entries allow for position scaling when the trend continues.

This methodology ensures minimal risk and maximized profit potential.

📌 5. Risk and Target Multiplier Optimization

Hype EA automatically adjusts risk and target multipliers to optimize trading performance.

📍 ATR Risk Multiplier dynamically adjusts based on volatility.

📍 Target Multiplier updates automatically according to trend strength.

📍 Risk/reward ratios are continuously recalculated based on real-time market fluctuations.

As a result, Hype EA avoids excessive risk while maximizing efficiency.

⏳ 6. Intraday Adaptation & Real-Time Adjustments

Hype EA analyzes market movements within each session and optimizes its strategy in real time.

🔄 Tick-based monitoring ensures continuous market evaluation.

🔄 Trade intensity automatically adjusts to session volatility.

🔄 Avoids unnecessary trades, prioritizing only high-quality opportunities.

This feature is particularly useful for traders who prefer targeted execution within specific trading sessions.

🚀 What Makes Hype EA Different?

Unlike conventional trading bots, Hype EA does not rely on static rules; instead, it uses an intelligent algorithm that adapts to market conditions.

🔸 Self-optimizing stop loss and target levels

🔸 Trend and volatility-aware trading strategies

🔸 Gradual position management and dynamic risk control

🔸 Automatic adjustments based on real-time market conditions

With its adaptive structure, Hype EA reacts dynamically to shifting market trends, ensuring more consistent and profitable results.

➡ A powerful and intelligent solution for traders seeking to go beyond outdated and rigid trading systems.

📌 Why Choose Hype EA?

✅ Real-time data analysis ensures market adaptability.

✅ Adaptive risk management minimizes unnecessary losses.

✅ Gradual exit strategy secures profits effectively.

✅ Volatility and trend-based trading for optimized performance.

✅ Constantly optimized parameters outperform static systems.

🚀 Hype EA is a modern, efficient, and intelligent trading system designed for today’s dynamic financial markets.

Final Thoughts:

This version highlights Hype EA’s strongest features with a professional and compelling tone while maintaining clarity and impact.

Key Improvements:

✔ Stronger opening and closing statements

✔ More effective emphasis on core features

✔ Clearer explanation of adaptive strategies

This version is ready to be used as a professional product description for MetaTrader 5 Marketplace. 🚀

Optimization Settings

During the optimization process, all parameters have a fixed start, end, and step value, and there is no need to modify them. However, the Minimum Profit (Point) value should be set specifically for each symbol.

- The Minimum Profit (Point) value should have a wider or narrower start, end, and step value depending on the symbol being traded.

- Specific custom ranges should be determined for each symbol, ensuring that these variations are considered in the optimization process.

Recommendation for Symbol-Based Optimization

To optimize Hype EA for a specific symbol, open the chart of the symbol you intend to trade and measure the point value of a single candlestick.

- Each broker may have different decimal places (digits) after the comma, so this measurement must be done manually.

- The current point values are optimized for the GOLD (XAUUSD) symbol.

- If using a different symbol, check the candlestick body size in points on the chart and adjust the start, step, and end values accordingly for optimization.

This approach will help you achieve the most efficient optimization results by adapting to different market conditions.