DayLong

- Experts

- Khalid Ait

- Version: 2.0

- Activations: 19

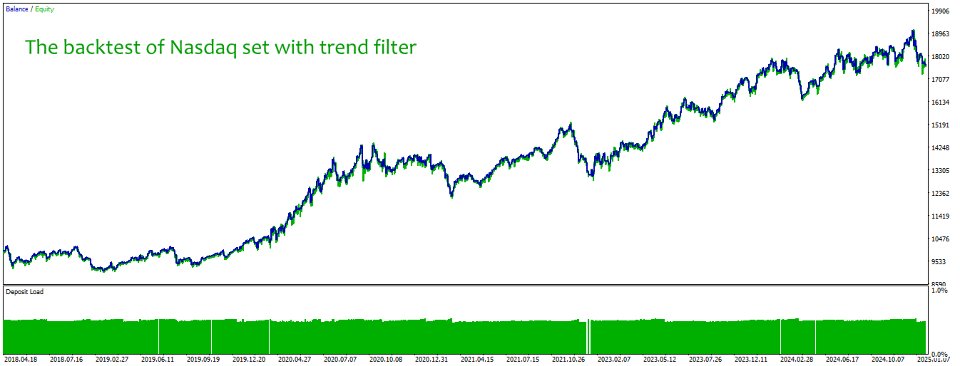

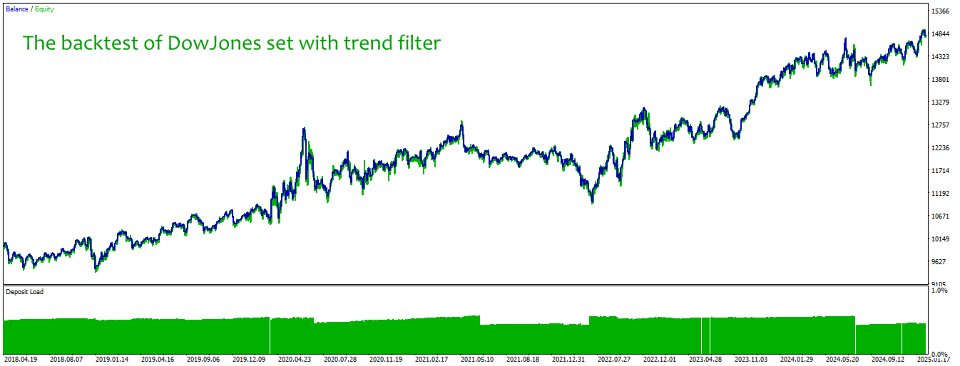

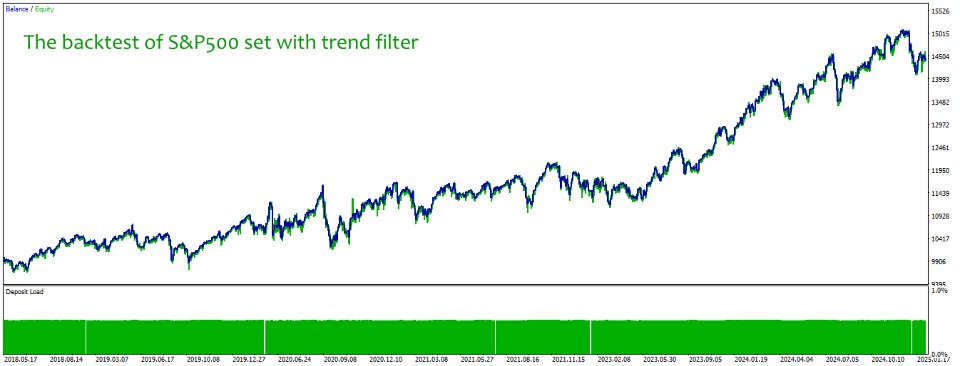

If you don't use a program like this in your portfolio, you're missing out on huge uptrends.

In 2024 alone, the Nasdaq index has gained over 28%.

The Dow Jones has gained 12%, and the S&P 500 returned 23%.

Bitcoin was flying around $100,000 following a 121% rally, while Gold has one of its best years, with gains over 27%.

And so on for other assets...

My question to you is very simple:

What were your gains in the last year?

If you're embarrassed by your answer, DayLong must be added to your portfolio right now.

Is This is For You?

If you ask some of the greatest investors out there for advice for beginners, they would simply say to start with indices.

In the long run, indices tend to follow the growing economy and keep rising.

This often overlooked fact made me regret the many years I wasted because I didn't believe it.

I kept searching for that elusive secret that would earn me 100% daily... but it doesn't exist.

My question for you is quite simple:

Did you make the same mistake, or are you about to repeat it today by simply leaving this page?

I assume you're smarter than most of us, so I'll show you how this EA works.

Leveraged Products VS Spots

If you buy the underlying asset, you probably already know that 100% of your initial position size is taken from your purchasing power.

This is obvious because you're not using any margin.

However, the situation changes when you use leverage: you gain the power to seize every available opportunity if you calculate your risk properly.

In general, there's one rule you should never violate: uneducated traders use leverage to increase risk, while smart traders use leverage to increase their buying power.

That's exactly what DayLong was designed for.

The Inputs of DayLong Explained

You have 17 simple inputs, most of which are self-explanatory.

However, some of them are a bit tricky, so we'll break them down:

Max Lowest Expected Drawdown %:

Have you ever seen an index drop from its all-time high to zero?

Never happened!

This input allows you to increase your lot size based on a worst-case drawdown scenario.

For example, the Nasdaq has experienced a worst historical drawdown of 78%. If you set this parameter to 80, you're risking 100% of your chosen balance if the Nasdaq drops by 80%.

Consider All-Time-High:

This feature won't work if you keep the "Max Lowest Expected Drawdown %" at 100.

Under normal circumstances, risk is calculated based on the current price:

SL = current price * "Max Lowest Expected Drawdown %" / 100

However, when you activate this feature, the asset's all-time high is used instead of the current price, resulting in a tighter stop loss. Which means bigger lot size.

Recommend Instruments

The default settings are optimized for the Nasdaq, but I encourage you to test them on other assets.

I recommend focusing on indices, as most brokers offer more favorable trading conditions for these instruments.

You have many options, including US100, US500, DAX...

Make sure to backtest before going live.

Important Notes

If your broker charge overnight fees, the positions will be closed by the end of the day.

It's recommend to use the 1min OHLC model to backtest.

The minimum deposit must be at least:

(Instrument price * minimum lot size * contract size) * "Max lowest expected drawdown %" / 100

The default settings are optimized for Nasdaq only.

You're welcomed to have a conversation with the author on how to build a portfolio.