QuanTicks

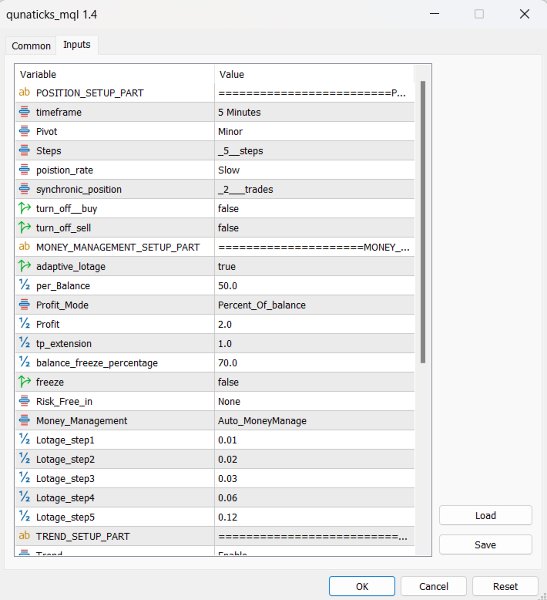

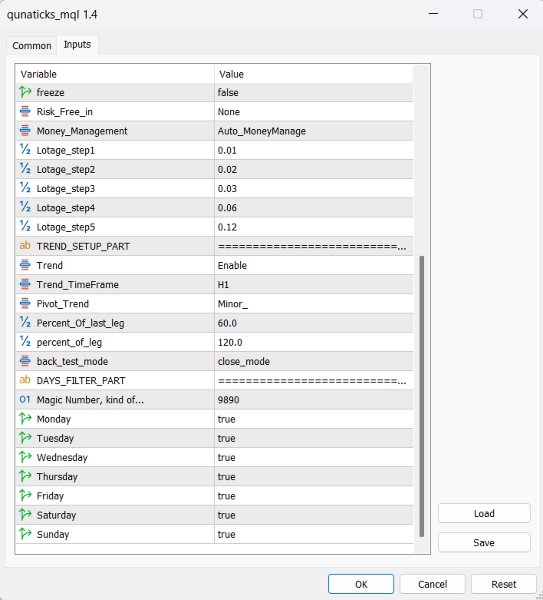

- Experts

- Sirwan Kermanji

- Version: 1.4

- Activations: 5

Trading in financial markets, especially in highly volatile markets like Forex, has become one of the major challenges for many investors. These challenges are so significant that they lead to the failure of more than 90% of market participants. A deeper analysis of these challenges and possible solutions can help in gaining a better understanding of the market and developing successful trading strategies.

Major Challenges in Trading

1. Economic and Political Factors:

-

Economic News: Economic data such as unemployment rates, GDP, and inflation directly impact financial markets. Traders must stay updated and analyze the effects of these reports on prices.

-

Political Developments: Political changes in different countries can suddenly cause extreme market fluctuations. For instance, wars, political decisions regarding tariffs, or international agreements can significantly influence currency values.

2. Trader Psychology and Emotions:

-

Fear and Greed: These are the two dominant emotions in trading that can lead to impulsive and irrational decisions. Recognizing and managing these emotions is crucial for trading success.

-

Lack of Emotional Control: Traders must develop self-awareness and the ability to manage stress and pressure effectively.

3. Insufficient Education:

-

Many novice traders enter the market without adequate knowledge and training, leading to continuous losses and capital depletion. The importance of educational courses and continuous learning in this field is undeniable, requiring substantial investments in both time and financial resources.

4. Hasty Decision-Making:

-

Impulsive decisions, especially during market volatility, can lead to significant losses. Careful analysis and patience in trading are essential.

Solutions and Innovations

Given these challenges, utilizing QuanTicks Trading Bot emerges as an innovative and effective solution in this field.

QuanTicks Trading Bot:

-

The QuanTicks team, aiming to develop a powerful trading bot, has assembled experts in data analysis, programming, and data science. This bot is designed to help traders overcome existing challenges and seize profitable opportunities. With high precision, the bot analyzes market uncertainties and identifies trend weaknesses across various trading instruments. Using complex mathematical computations and AI algorithms, it enters trades at optimal times and exits with desirable profits.

Functionality of the QuanTicks Trading Bot:

-

Automated Data Analysis: The bot utilizes advanced algorithms to rapidly analyze market data and identify trading opportunities, a process far quicker and more accurate than human analysis.

-

Data-Driven Decision-Making: By leveraging complex calculations and AI models, the bot makes decisions based on factual evidence and data rather than emotions.

Advantages of Using QuanTicks Trading Bot

1. Reduced Stress and Psychological Pressure:

-

By delegating decision-making to the QuanTicks bot, traders can relieve themselves from the mental burden of rapid and sudden decisions, allowing them to focus on other aspects of life.

2. Time Efficiency:

-

No longer is there a need to spend countless hours analyzing charts and market data. With just a few clicks, the QuanTicks bot can be activated, allowing traders to engage in daily activities.

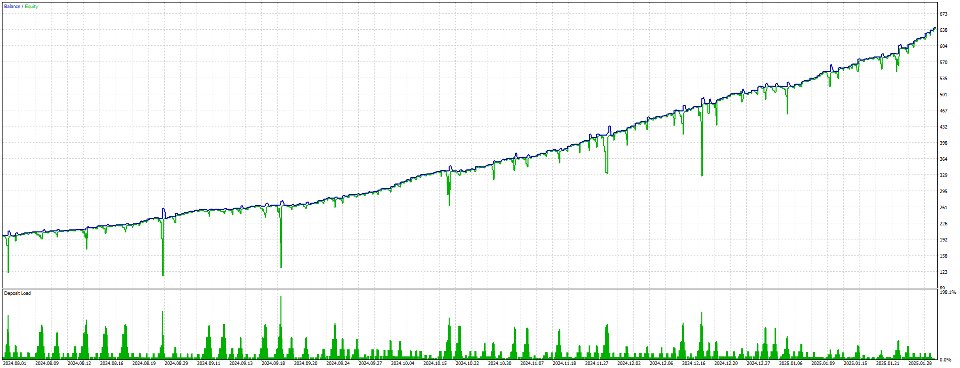

3. Achieving Consistent Profits:

-

Using advanced algorithms, the QuanTicks bot can accurately identify market trends and seek profitable opportunities.

Ultimately, financial markets inherently possess significant complexity and uncertainty. Understanding these challenges and gaining deeper insights into them enable traders to leverage innovative solutions like the QuanTicks Trading Bot to achieve remarkable success. This approach not only enhances the likelihood of successful trades but also improves traders’ quality of life and psychological well-being.

How the Bot Works

The QuanTicks Trading Bot is designed to identify market trend weaknesses in any direction and determine optimal entry points using AI algorithms and complex mathematical formulas. This gradual entry approach increases the chances of success and allows the bot to effectively manage market uncertainties. The operational details of the bot are outlined below:

1. Identifying Trend Weaknesses:

-

Detecting Bullish and Bearish Trends: The QuanTicks bot can recognize weak points in price trends, enabling it to act at critical market moments.

-

Data Analysis: Utilizing historical and real-time data, the bot identifies market behavior patterns and provides precise predictions. This analysis includes price changes, trading volume, and market volatility.

2. Utilizing AI Algorithms:

-

Self-Learning Capability: One of AI’s primary advantages is its ability to continuously learn and improve. The QuanTicks bot updates its algorithms based on new data, enhancing prediction accuracy.

-

Rapid Decision-Making: The bot can perform complex analyses within fractions of a second, swiftly responding to market changes and capitalizing on trading opportunities.

3. Gradual Trade Entry:

-

Risk Management: Entering trades in multiple stages allows the bot to mitigate risks associated with market fluctuations. This cautious approach prevents significant losses.

-

Adaptability to Market Movements: The bot continuously monitors market conditions and adjusts its strategy accordingly, increasing the success rate of trades and minimizing unexpected losses.

4. Managing Uncertainty:

-

Advanced Analysis: By leveraging complex mathematical formulas, the QuanTicks bot effectively analyzes market uncertainties and identifies optimal entry and exit points, increasing decision-making precision.

-

High Adaptability: The bot can swiftly react to sudden market changes, updating its strategies based on new data. This adaptability enables it to perform better in dynamic market environments.

With its cutting-edge technology and AI-driven algorithms, the QuanTicks Trading Bot effectively identifies optimal entry points, increasing the probability of trading success. Through gradual entries and meticulous risk management, the bot navigates market uncertainties, providing traders with greater confidence in their trading activities. This innovation in trading not only enhances profitability but also significantly reduces the psychological burden and stress associated with rapid decision-making.

***It is necessary to explain that one of the unique advantages of this expert is the ability to implement it on all trading symbols available in the Forex market simultaneously***

For More Information

For further details and to receive the QuanTicks Trading Bot manual, including setup instructions and configuration guidelines, please contact us via the following email:

***Quanticksexpert@gmail.com***