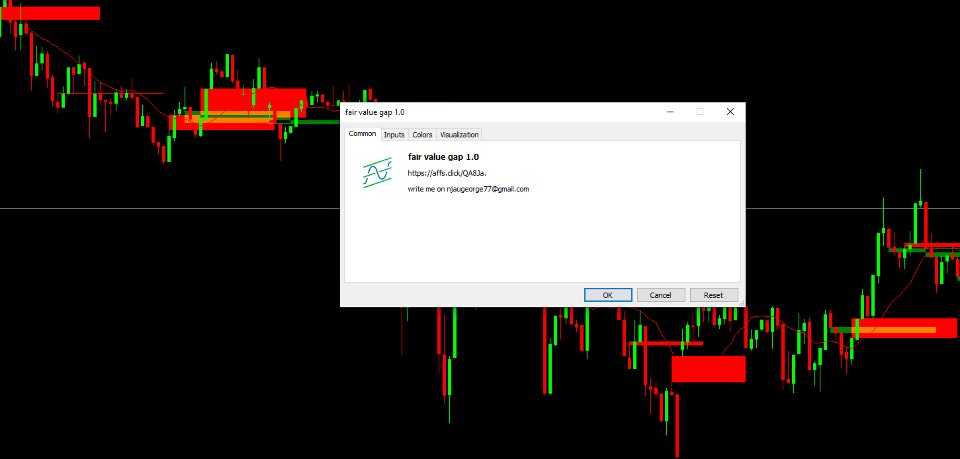

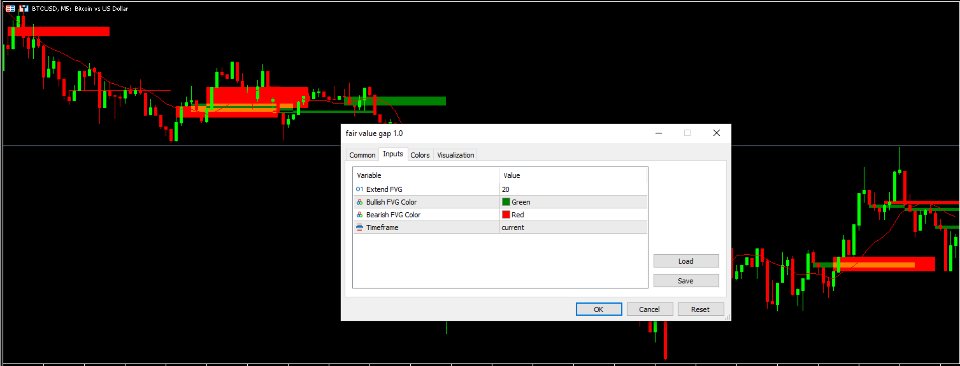

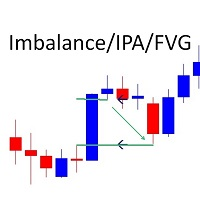

Fair Value Gap FVG

- Indicateurs

- George Njau Ngugi

- Version: 1.0

- Activations: 5

A fair value gap (FVG) is a temporary price gap that occurs when the price of a stock or security is out of line with its fair value. This gap is often caused by an imbalance between buyers and sellers.

- Price imbalanceWhen there is an imbalance between buyers and sellers, the price of a security can move too quickly.

Why it's important

-FVGs are a valuable tool for traders because they can help predict price movements.

-Traders can use FVGs to identify when to buy or sell.

-FVGs can be caused by major news events, such as interest rate increases, political news, or natural disasters.