ZLMA Trend Candles MT4

- Indicateurs

- Denys Babiak

- Version: 1.0

- Activations: 5

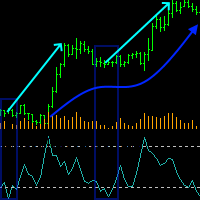

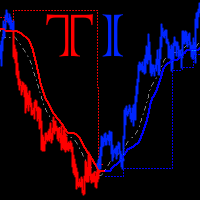

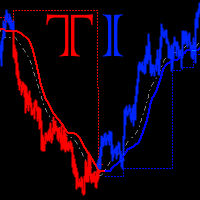

ZLMA Trend Candles indicator uses an enhanced Zero-Lag Moving Average to highlight key trend shifts, repainting candles in real time. It reacts faster than traditional moving averages, helping you spot potential market turns earlier. Gain clear entry and exit signals and filter out market noise with ease!

This product is also available for MetaTrader 5 => https://www.mql5.com/en/market/product/129278

1. What Is ZLMA Trend Candles?

ZLMA Trend Candles is a MetaTrader 4/5 indicator based on the Zero-Lag Moving Average (ZLMA). It applies an advanced formula that smooths out price noise without the lag often seen in traditional moving averages. When ZLMA indicates an uptrend, the candles are colored in one hue; when it signals a downtrend, they shift to another color.

2. How It Works

- Zero-Lag MA Calculation: It’s done in two steps. First, a standard EMA of closing prices is calculated. Then a correction step is applied, and finally, a second EMA is taken of the corrected data.

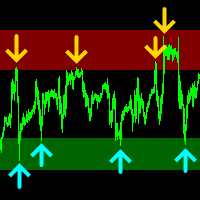

- Color-Coded Candles:

* If ZLMA is higher than it was a few bars ago (the Lookback parameter), candles are colored bullish.

* If lower, they turn bearish.

* This offers an immediate visual cue when the market starts to change direction.

3. Key Advantages

- Reduced Lag: Zero-Lag MA responds faster than classic EMA or SMA, helping you detect trend shifts sooner.

- Visual Clarity: Colored candles in the main chart provide a straightforward, clutter-free way to gauge market direction.

- Broad Applicability: Use it on any timeframe or asset (FX, stocks, metals, crypto).

- Customizable Settings: Adjust the length of the moving average and the Lookback period to fit your personal strategy.

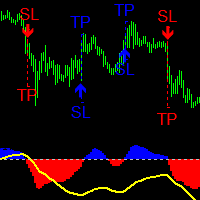

4. Use Cases

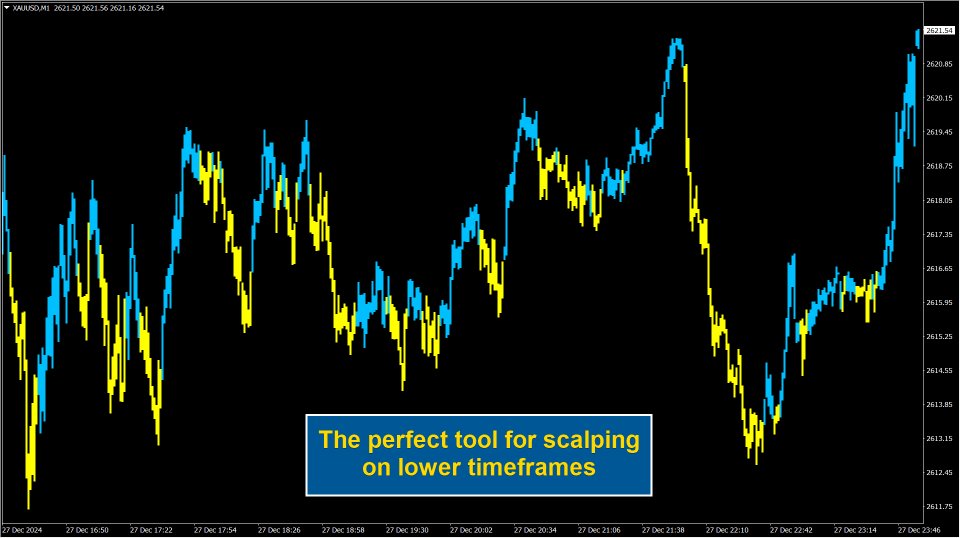

- Scalping: Quickly capture trend changes on lower timeframes.

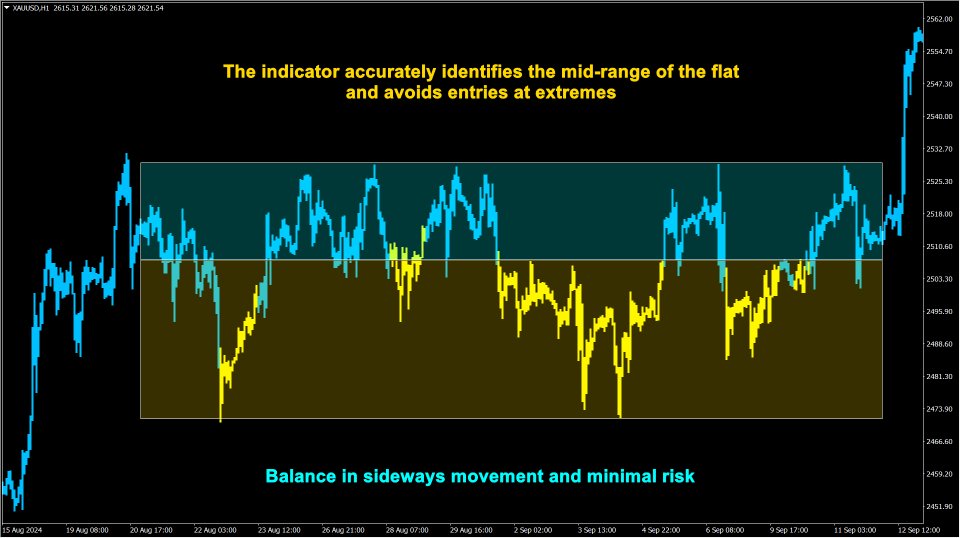

- Swing Trading: Identify and follow mid-term moves until the candle color changes.

- Signal Filtering: Combine the ZLMA color with other confirmations to enhance accuracy.

5. Recommendations

- Pair it with a confirming indicator (e.g., RSI, Stochastics, or volume) for robust trade setups.

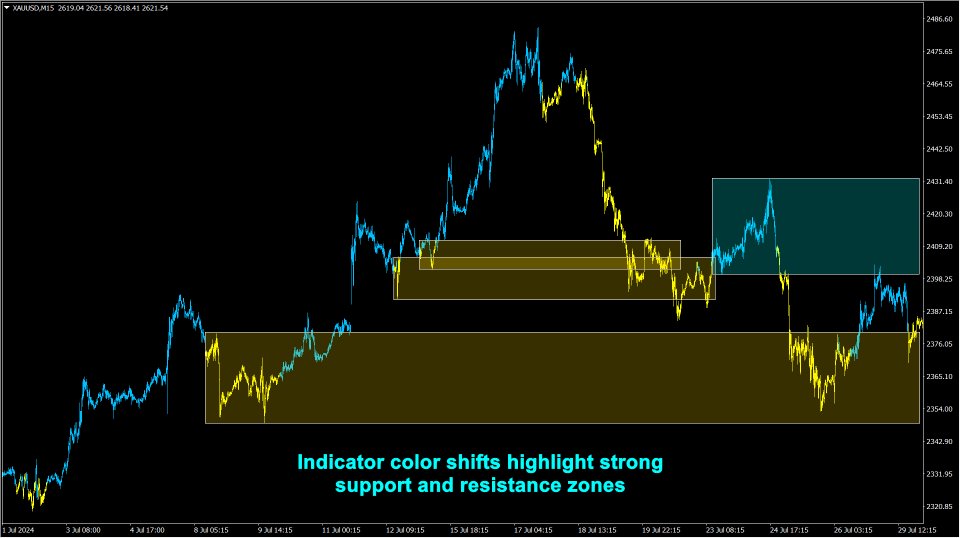

- Watch for critical support/resistance levels in conjunction with the ZLMA direction.

6. Conclusion

ZLMA Trend Candles is a convenient tool for rapidly interpreting market conditions and spotting trend changes with minimal lag. The improved Zero-Lag MA formula gives you clearer insights and more effective trade planning.

The Zero-Lag MA calculation uses a module based on Pine Script™ code (Mozilla Public Licence 2.0) from LuxmiAI. The source file Zero-Lag MA Candles.mqh is available on request.

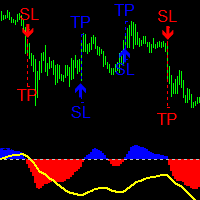

Input parameters:

| ZLMA Lookback Length | This is the period (length) for the Zero-Lag MA calculation. In fact, it is an analog of the EMA period, which is calculated twice (first a regular EMA, then a "correction", followed by another EMA). The larger the value of the parameter, the smoother and "slower" the ZLMA line will be, which means that trend change signals will be less frequent, but potentially more accurate. The smaller the value, the more "sensitive" ZLMA is to price fluctuations, which leads to earlier signals, but a possible increase in false positives. |

| Lookback For ZLMA Direction | Determines how many bars backward to compare the current ZLMA value to determine an upward or downward trend. The larger the value of the parameter, the more "global" the trend change is interpreted. Small intraday fluctuations have less influence on candlestick coloring, but the signal may be slightly delayed. The smaller the value of the parameter, the earlier ZLMA "reacts" to local changes, but it can lead to more frequent coloring changes. |