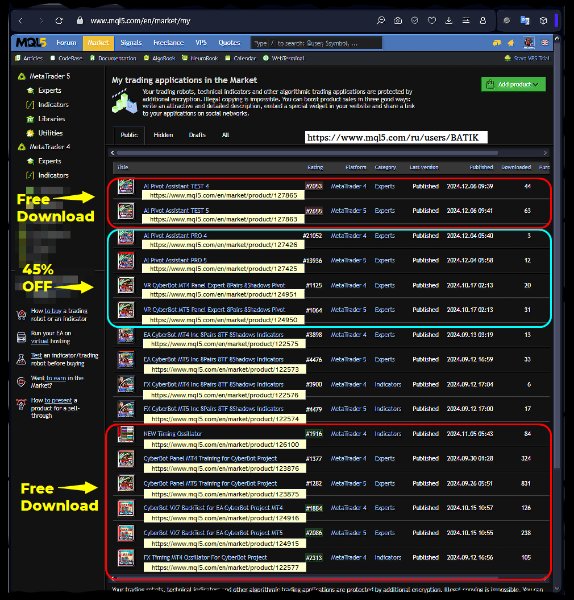

Al Pivot Assistant PRO 5

- Experts

- Tjia Elisabeth Jasmine Canadi

- Version: 24.21

- Activations: 8

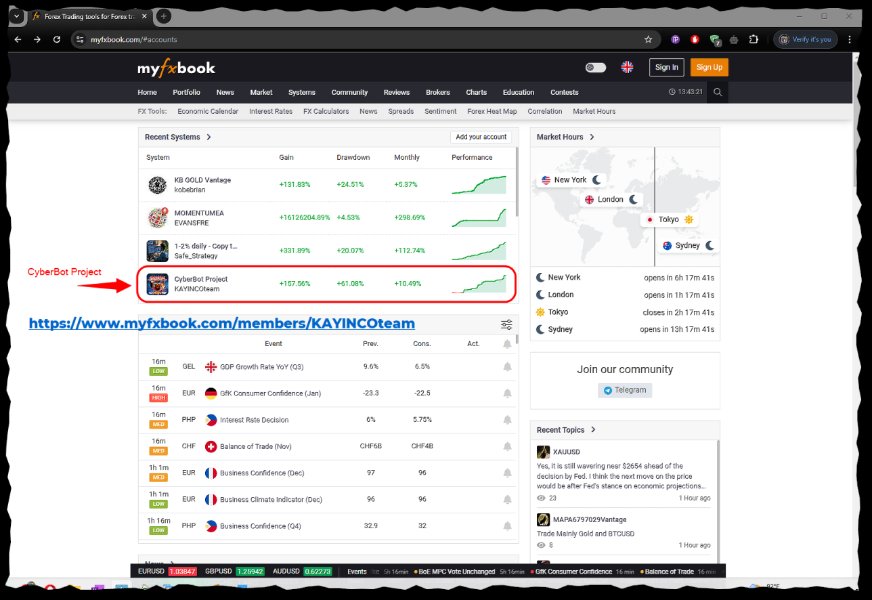

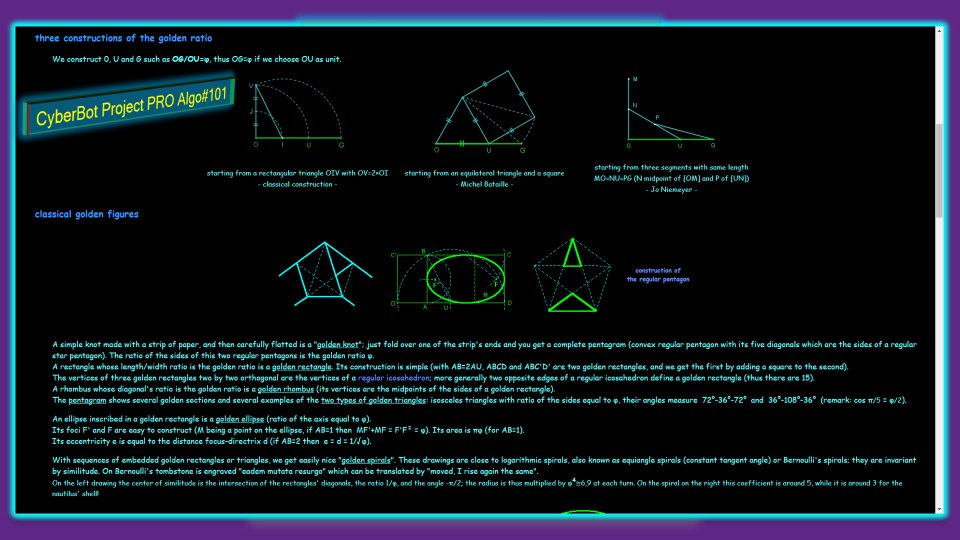

| [ The “Last Call” promotion offers a 45% discount, before it returns to $688 after the 10th buyer ] Motto ★ PORTFOLIO target ► 95% Blue ★ every trader becomes the instant winner > Dedicated to serious traders, who need a genuine, state-of-the-art product ‼ [ PORTFOLIO target ► 95% Blue ] In 2024, products with the "CyberBot Project" formula have the capacity to achieve a target of over 95% Blue. As proof, we practice trading activities in real execution while coaching and developing the program, following the steps of the method and strategy to demonstrate its capacity to reach the target of over 95% Blue. Please explore the myfxbook/members/KAYINCOteam website on the "CyberBot Project" account in the "History" column of its transactions. [This real account is used by the team in between product development "CyberBot Project" in the MQL5 market. to prove the execution method according to the secret formula of "CyberBot Project"] Look for a product that offers real, sophisticated visual proof, not just theoretical promises. If you're serious about trading, find a product made for serious traders, even if it's just a free version for training and presentations. |

|---|

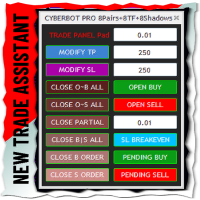

The “CyberBot Project” product represents one of the most advanced offerings available for future trading ventures. With its “out of the box” capabilities of the Expert Advisor platform integrated with an Artificial Intelligence (AI) Hybrid Assistant, it functions not only as an automated Trading Robot but also includes advanced signal analysis features, serving as a manual trading assistant. This functionality enables traders, including those who are novices, to operate with the expertise of seasoned professionals. Users can effortlessly drag and drop to open or modify positions on more than eight selected favorite currency pairs, thereby ensuring a practical, functional, rapid, and precise trading experience!

Is it verifiable? Indeed, it is, as a trial version is provided, which can be downloaded free of charge. There is no deception involved, as the trial product is derived from a paid premium product that is 80% limited in its capabilities, yet still offers a robust platform for practice with WYSIWYG (What You See Is What You Get) visuals. It can serve as a valuable tool to enhance the quality of your trading endeavors. Also still powerful enough for practice. It can even be a tool to help you create the quality of your trading with multi pairs with the agility to control dozens of open + order positions and Take Profit (TP) & Stop Loss (SL) at a more professional trader level..

FREE Download T E S T E R | \Experts\ | [ MT4 ] Al Pivot Assistant TEST 4 [ TESTER the best variable + pair ] | [ MT5 ] Al Pivot Assistant TEST 5 [ TESTER the best variable + pair ] |

|---|

FREE Download T R I A L | \Experts\ | [ MT4 ] CyberBot Panel Training [ Indicators + TRIAL Panel Pad EA ] | [ MT5 ] CyberBot Panel Training [ Indicators + TRIAL Panel Pad EA ] |

|---|

Attention: For all Metatrader 4 platform products, equipped with the \Indicators\"TIMING oscillator.ex4" [free download]. Just activate it for the first time, then it will be activated automatically when the main product is running!

> How to use the strategy on the "CyberBot Project" products

---------------------------------------------------

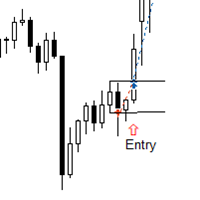

topic#1: Pivot Points Method, Support and Resistance Strategy with Buy Limit and Sell Limit Orders

---------------------------------------------------

The product has been rigorously tested for application with the Pivot Points Method and the Support and Resistance Strategy. By placing limit orders at level three and a take profit (TP) at a minimum of level two, this tool proves invaluable for managing multiple orders daily. However, it is essential to possess additional skills, including a foundational understanding of the market, when determining stop loss (SL) settings and placing supplementary orders at a distance greater than level three to achieve consistent substantial gains.

Step 1: [BACKTEST] Coaching for observation of Pivot Sup123 Res123 position using the "Strategy Tester" facility displayed every day according to the target pair to be traded, better pattern consistency.

Step 2: [INSTRUMENT] Practice on the panel in Trade Assistant, drag & drop on the pair chart at level 3 for limit orders and TP positions at level 2 for conservative, if aggressive to a smaller level.

Step 3: Master the world's fundamental information that is currently hot such as war etc.; In order to get greater profits with multi limit orders, further positions. It takes skill and experience.

Step 4: Can place many limit orders on several pairs; but don't forget to adjust its position according to the conditions of the next day following the pivot point, the latest Sup123 Res123.

Step 5: This strategy is like spreading a position of hope that has a smaller risk than directly executing an open position. If luck comes, this hook tool can profit more certainly & safely.

Basic knowledge and strategies that are important information to understand are here. Also equipped with references from GPT-4o, Google Gemini Ai, for professional trading psychology!

Here's a detailed description and execution strategy for derivative trading using Pivot Points, Support, and Resistance, based on technical analysis, geared toward advanced traders:

> Advanced Derivative Trading Strategy Using Pivot Points, Support, and Resistance

Overview

In advanced derivative trading, using pivot points, support, and resistance levels is essential for identifying high-probability price levels and potential market reversals or continuations. These key levels serve as the basis for developing strategies that maximize risk/reward ratios. Expert traders utilize a combination of these technical indicators alongside other tools to refine entry and exit strategies.

Pivot Points: Key Concept

Pivot points are a series of calculated levels derived from the previous day's high, low, and close prices. These levels act as a reference for potential turning points or areas of price action momentum. Pivot points are widely used in intraday trading to predict market sentiment, momentum, and likely price directions.

The basic pivot point (PP) is the central level, with subsequent levels defined as support and resistance zones:

- PP (Pivot Point) = (High + Low + Close) / 3

- S1 (Support 1) = 2 * PP - High

- S2 (Support 2) = PP - (High - Low)

- S3 (Support 3) = Low - 2 * (High - PP)

- R1 (Resistance 1) = 2 * PP - Low

- R2 (Resistance 2) = PP + (High - Low)

- R3 (Resistance 3) = High + 2 * (PP - Low)

Support and Resistance: Key Concept

-

Support refers to price levels where demand is thought to be strong enough to prevent the price from falling further. It represents a "floor" where the market may reverse or consolidate.

-

Resistance refers to price levels where selling pressure may be strong enough to prevent the price from rising higher. It represents a "ceiling" where the market might reverse or consolidate again.

Strategic Application in Derivative Trading

Derivative trading involves contracts whose value is derived from the performance of an underlying asset (like futures, options, CFDs). The use of pivot points, support, and resistance becomes even more critical due to the amplified risk/reward profile of derivatives.

1. Identifying Market Conditions Using Pivot Points

- Bullish Trend Confirmation: If the price is trading above the pivot point (PP), the market is generally in an uptrend. R1, R2, and R3 become potential targets for long positions.

- Bearish Trend Confirmation: If the price is trading below the pivot point (PP), the market is in a downtrend. S1, S2, and S3 become targets for short positions.

- Range-Bound Markets: When the price is oscillating between support (S1, S2) and resistance (R1, R2), traders can use these levels to execute range-bound strategies, buying at support and selling at resistance.

2. Support and Resistance Breakouts

- Breakout Strategy: If the price breaks above resistance (R1, R2, or R3) or below support (S1, S2, or S3), it suggests strong momentum in the direction of the breakout.

- Confirmation with Volume: A breakout is considered more reliable when confirmed by higher-than-average trading volume.

- Pullback to Support/Resistance: After a breakout, traders often wait for a pullback to retest the broken level as a new support or resistance before entering the trade.

3. Pivot Point Confluence Strategy

- Multiple Time Frame Analysis: Combine pivot points from different timeframes (e.g., daily, 4-hour, and 1-hour) to identify strong support/resistance confluence areas. For instance, if daily R1 and 4-hour R2 align, the level becomes more significant.

- Price Action at Pivot Levels: Wait for price action signals (e.g., candlestick patterns, pin bars, engulfing candles) at critical support/resistance levels to confirm the trade direction.

4. Risk Management Using Support and Resistance

- Stop Loss Placement:

- For long trades: Place stop loss just below the nearest support level.

- For short trades: Place stop loss just above the nearest resistance level.

- Take Profit Levels: Target the next significant support or resistance level for take-profit orders. For example, in a bullish trend, if price breaks R1, target R2 as the next profit-taking level.

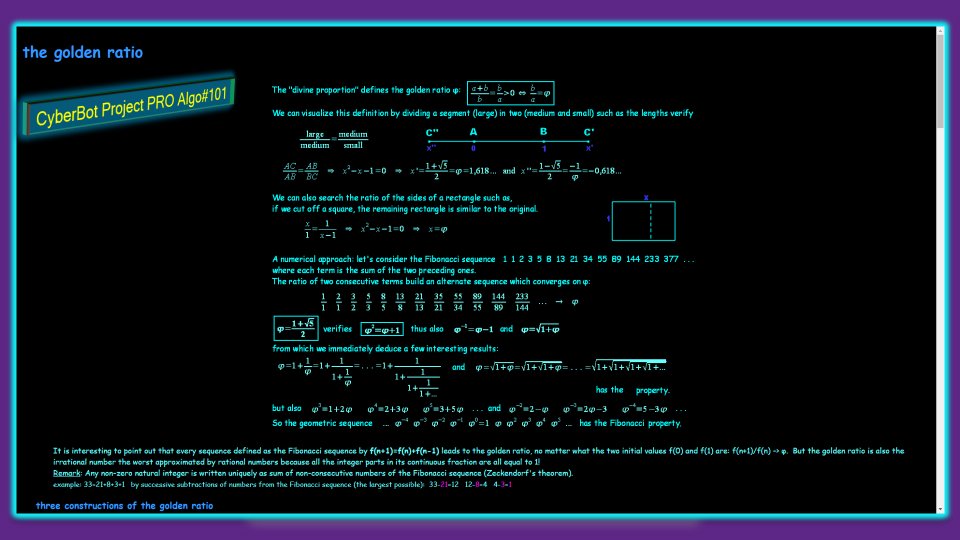

5. Advanced Strategy: Fibonacci Retracements with Pivot Points

- Combining Pivot Points with Fibonacci: Use Fibonacci retracement levels (23.6%, 38.2%, 50%, 61.8%) in conjunction with pivot points to enhance the precision of support and resistance zones.

- Example: If a strong trend is in place, wait for a pullback to a key Fibonacci level aligned with a pivot point. For example, if a retracement meets the 61.8% Fibonacci level at the S1 support, it may be a strong signal for a long trade.

Execution of Advanced Trading Strategy

Step-by-Step Execution:

-

Identify Market Trend:

- Determine if the market is bullish or bearish by comparing the current price to the pivot point. If the price is above the pivot, the market is likely bullish; below the pivot suggests a bearish market.

-

Set Entry Levels:

- For long trades, enter when the price breaks above R1 (if confirmed by volume and price action signals). If the price pulls back to PP or S1 and forms a reversal pattern, that can be an additional entry signal.

- For short trades, enter when the price breaks below S1 or S2, or after a pullback to a resistance level (e.g., R1 or R2).

-

Use Multi-Timeframe Analysis:

- Look for alignment of pivot levels and support/resistance zones on different time frames (e.g., daily and 4-hour charts) to increase the probability of success.

-

Set Stop Losses and Take Profits:

- Place stop-loss orders below the nearest support for long trades and above the nearest resistance for short trades.

- Set take-profit levels at R1, R2, or R3 (for long positions) or S1, S2, or S3 (for short positions), depending on your risk/reward ratio.

-

Risk Management:

- Only risk a small percentage of your account balance per trade (e.g., 1-2%). Use trailing stops as the market moves in your favor to lock in profits while allowing the trade to run.

-

Monitor Price Action and Adjust:

- Monitor price action as it approaches key support/resistance levels. Be ready to adjust your stop loss, take profit, or even exit early if the market shows signs of reversal.

Conclusion

Advanced traders use pivot points, support, and resistance as foundational elements in derivative trading. By combining these techniques with other technical indicators, such as Fibonacci retracements, volume analysis, and multi-timeframe strategies, traders can increase their accuracy and improve their chances of success. Consistent risk management, clear entry/exit strategies, and a strong understanding of market psychology are all critical in executing this advanced strategy effectively.

---------------------------------------------------

topic#2: Advanced level || This material is intended for a comprehensive understanding of "patterns". It also provides the best solution in cases of very strong current pressure

---------------------------------------------------

||Watch visualizations with moving images and explanatory descriptions > Explanation of the sideways corridor/trend image in the slide show > Watch first, the slideshow is at the bottom of this description.

S C A L P I N G | The explanation is in the picture with stable and sideways up and down waves. [on the attached image "SCALPING | SWING"] You have gone through the BASIC session material, hopefully by following the existing stages with great discipline. You have the opportunity to create a positive portfolio with a 95% "blue" probability. In addition to compliance in following the signal "pattern" in the BASIC session, accuracy is also required in executing IN and discipline in OUT with measurable targets at every opportunity [200 pips/TP=200]. If this is ignored, there is a risk that not only will the target not be achieved, but the amount of equity will also be eroded due to unexpected "swings" in the market. The SCALPING strategy in BASIC that we have created focuses on waiting for the "correction" process to occur. This is the safest position to execute trading because it is at the farthest point from the chart movement, which always has a wavy shape. The safest positions are arranged to form a "corridor" formation at the upper and lower boundaries of the wave. Some of you might be wondering why we don't aim for a profit of over 500 pips, especially since it seems more profitable than our target of 200 pips. From the picture above, it does look like there’s potential for greater gains. However, CYBERBOT's mission is to ensure that your trading experience is safe and healthy for your peace of mind. We don’t force ourselves to predict market direction because the market is dynamic. Instead, we assume that after a "correction," the market will often try to exceed the initial range by pushing into a broader corridor. To illustrate, think of the "sea" as being made up of small, medium, and large waves. Small waves can feel stable while larger waves are on the way. When the time comes, the activity of the small waves will shift to follow the direction set by the larger waves. So, there’s no need to worry. We’ve conducted measurable mapping to provide a more controlled analysis of your predictions. Here’s how it works. | S W I N G |

M I D T E R M | The explanation is in the picture with waves that rise several corridors and fall into a trend. [on the attached image "CORRIDORS | TREND"] When the "pattern" [H1] of BASIC is formed, its peak boundary becomes corridor #1. In a "sideways" market condition, movement will remain within this corridor. However, caution is necessary, as the market will eventually shift towards the next corridors under strong pressure. When the next "pattern" [H1] appears, there will be opportunities for "reversal" executions with a profit target of at least 200 pips. The furthest corridor typically reaches level 4, with each level taking one week to one month to complete. [Factor "pattern" of MIDTERM & LONGTERM]. If you reach the furthest stage, an excellent position will emerge, characterized by strong resilience that leads to a "reversal" direction followed by an extreme "trend" targeting ±1000 pips. In conclusion, the further the corridor, the stronger the resilience [X<Y<Z]. Seek this opportunity for a significant gains. [recommendation] | L O N G T E R M |

S u p p o r t | Note : It is important to note that certain comments may suggest that the wave image, which serves to illustrate the market, is overly idealistic and does not accurately reflect the complexities of reality. This observation holds true, particularly if one is still in the Basic (BASIC) stage. In fact, CYBERBOT, in its guidance, advises each client to refrain from being unduly influenced by the graphical representation as it appears. Nevertheless, it is essential to succeed in visualizing it as a neat and orderly wave. By doing so, you will become adept at determining the center line (balance) as the analytical reference line. [ Insider ] For CyberBot members, when using the "CyberBot Project" for real trading, enhance your decisions with experience and pattern recognition of major pairs. The fundamentals and trading psychology from GPT-4 and Google AI Gemini support wise actions. Tips: Increase your winnings by utilizing the trigger signals of eight currency pairs, broadcast live 24/7 on platforms like YouTube, Twitch, and Kick. Search for "CyberBot 8 Pairs" and select the 'live' option; we guarantee precise coaching. With consistency, you can become an expert in just a week. We will send the strategy with "ReviewPass". [ Neural Networks ] | S u p p o r t |

> Customize your needs and visit the links in the content that match the following products according to the table, as well as the choice of MT4 and MT5 platforms. If you are still confused about the difference between products, as well as the advantages and disadvantages of the MT4 and MT5 versions, please send a message. Recently, “CyberBot Project,” designed for professional traders in Indonesia, has expanded to serve the global trading community through MQL5.com !

| * | LITE product series is simpler+cheaper, using VR CyberBot MT5 | ||

| * | For Metatrader 4 (MT4) platform users, it is available at the link | ||

| * | Tutorials & tips available for MQL5.com members>> the channel |

Message for buyers / renters : The MQL5.com store specifically grants permission to each buyer or tenant who can become a discerning reviewer with positive ratings for this product. For our team, this is invaluable in prioritizing our ability to effectively address the personal information needs of each buyer or tenant, as well as facilitating significant strategic enhancements. Each discerning review will be uniquely able to "ReviewPass," enabling the program system to respond to the highest level of improvement in the future. We strongly recommend that you submit a positive rating promptly, as MQL5.com does not provide this feature, which complicates our ability to differentiate between messages from clients and discerning reviews of our complimentary training products. A.S.A.P.: And get a guarantee of coaching to get consistent profits with the secret of effective strategies that are specifically for CyberBot clients. Preliminary Video Guidance, choose according to product metatrader: [Setup EA CyberBot MT4] || [Setup EA CyberBot MT5]