Huki Hedge follow trend

- Experts

- Vu Kim Huyen

- Version: 1.43

- Mise à jour: 19 novembre 2024

- Activations: 5

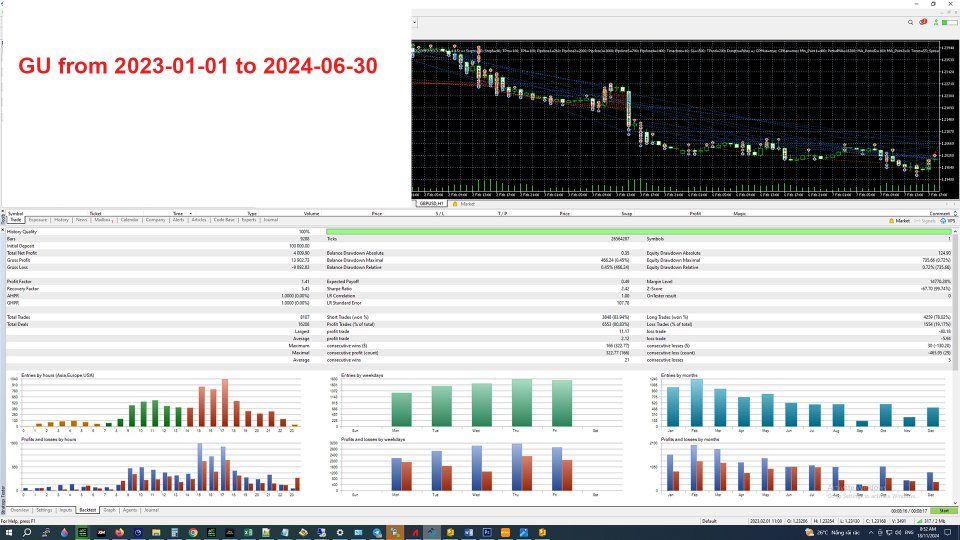

This is a Trend-Based Hedge DCA EA.

Advantages:

- Take Profit (TP) for individual orders, which is highly beneficial for minimizing slippage.

- Trims orders to reduce risks when the market moves unfavorably.

- Stop Loss (SL) for the entire sequence to preserve capital.

- Closes the entire sequence when the desired profit is achieved or when the best profit level is reached (most orders are closed individually by TP, leaving only a few orders for total closure).

- This EA performs best in trending, sideways, or moderately reversing market conditions (not excessively strong). Suitable for pairs like EUR/USD, GBP/USD, NZD/USD, AUD/USD, AUD/CAD, EUR/GBP.

- It is highly customizable for different strategies, such as short-term or long-term trading.

- This EA often performs better in real trading compared to backtesting, as most orders are closed by TP. When trading with reputable brokers, there is often an advantage in pricing during TP execution.

Disadvantages:

- In rapidly moving and highly volatile markets, it may hit Stop Loss (SL). Pairs like USD/CAD, USD/JPY, USD/CHF, XAU/USD are particularly challenging for this EA.

- Using the same setup continuously over multiple years may become ineffective. You need to adapt the setup to the market conditions of each period. For instance, the EUR/USD pair worked very well with this default setup in past years, but recent years with strong volatility have made it less suitable.

Notes When Using the EA:

- Pause News (Need to indicate news): You can download this News Indicator for free from here https://www.mql5.com/en/market/product/126831 and place it on any chart.

- The level of market volatility to enter an order: If you want orders to be placed during periods of slow market movement or small sideways trends, input a smaller value (this will result in fewer orders). The EA will avoid entering orders during periods of extreme market volatility.

- Time close (Day): This is the maximum number of days the EA will run. If the EA hasn’t closed all orders within this time, it will try to close them with the best possible result it previously achieved. Therefore, the actual number of days required to close all orders may exceed the specified number of days.

- TP USD: This is the profit target in USD at which the EA will close all orders. However, depending on market conditions, the EA may close orders earlier if the target is achieved.

- Stop trading after closing all orders: After closing all orders, the EA will stop trading. To resume trading, you need to set this option to false. If the EA has already opened orders and you want it to stop entering new cycles after closing the current ones, set this option to true.

- You should spend a lot of time setting up and backtesting specific currency pairs to develop a unique strategy for each pair and each period. It is not possible to use the default setup for all currency pairs and periods.

This EA works best in slow-moving markets. For optimal performance, during months with major news events like CPI or interest rate announcements, it is recommended to pause the EA for 1-2 days. This approach will yield significantly better results compared to backtesting.