Accurate Support and Resistant Zones

- Indicateurs

- Ibrahim Fathallah Abdel Halim Abdel Khaleq

- Version: 3.5

- Activations: 5

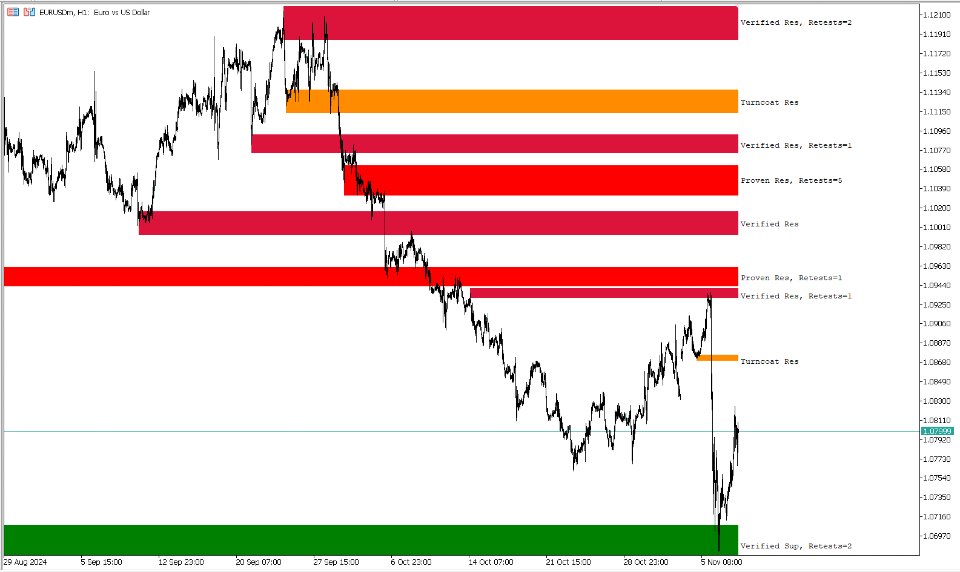

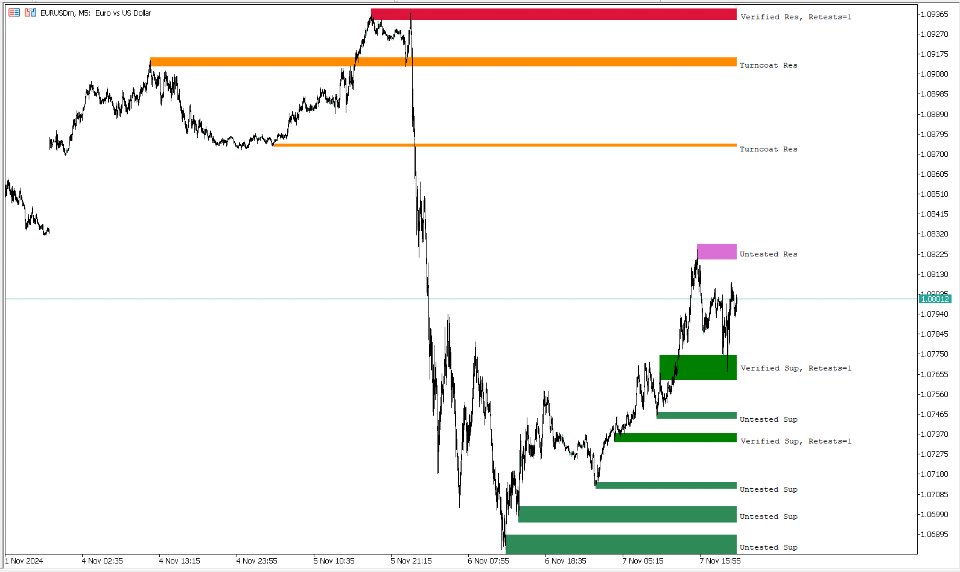

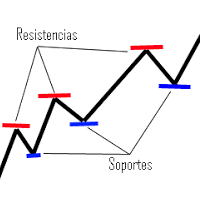

This indicator identifies and visually displays Support and Resistance zones on a financial chart, providing traders with critical insights into market structure and potential price action areas. Here's how it operates:

Key Features:

-

Zone Identification:

- Detects Support Zones (price levels where buying pressure is historically strong).

- Detects Resistance Zones (price levels where selling pressure is historically strong).

- Categorizes zones into:

- Weak Zones

- Untested Zones

- Turncoat Zones (previously broken levels acting as their opposite)

- Verified Zones

- Proven Zones

-

Customization Options:

- BackLimit: Controls the number of historical candles analyzed for zone detection.

- Zone Visibility: Toggle display of weak, untested, and broken zones.

- Zone Aesthetics: Customize zone colors, line styles, widths, and label formats.

- Merge & Extend Zones: Automatically merge overlapping zones and extend zone boundaries for better visibility.

-

Fractal-Based Zone Detection:

- Uses Fast and Slow Fractals to identify key price points for zone creation.

- ATR (Average True Range) is incorporated to refine the zone boundaries dynamically.

-

Alerts:

- Alerts when the price enters a zone, with options for popup notifications and sound alerts.

- Customizable alert delay to avoid repeated notifications.

-

Dynamic Labels:

- Displays zone strength and type as labels, such as "Verified Support" or "Proven Resistance."

- Labels include test counts for verified/proven zones.

Core Functionalities:

-

Zone Drawing:

- Automatically draws rectangles on the chart to represent support and resistance zones.

- Zones are color-coded based on their strength and type.

-

Nearest Zones:

- Identifies and highlights the nearest support and resistance zones to the current price.

-

History Mode:

- Allows users to backtrack in time and visualize historical zones by clicking on the chart.

-

Alert System:

- Alerts traders when the price enters predefined support or resistance zones.

- Configurable delay between alerts.

-

Fractal-Based Logic:

- Combines fast and slow fractals to detect price reversal points.

- Refines these points into zones using ATR to account for price volatility.

Inputs:

- Zone Customization:

- Control visibility, colors, styles, and extension of zones.

- Alert Options:

- Enable/disable sound or popup alerts.

- Fractal Settings:

- Adjust fractal sensitivity for fine-tuned zone detection.

- Global Variables:

- Optionally store zone data as global variables for cross-script access.

Use Case:

- Trend Reversals:

- Identify areas where the price is likely to reverse due to historical buying or selling pressure.

- Breakout Trading:

- Spot zones where breakouts are likely to occur.

- Zone Testing:

- Monitor test counts to assess the strength of support or resistance.

- Dynamic Adjustments:

- Automatically adapts to market volatility with ATR-based adjustments.

This indicator is designed for traders who want a detailed yet customizable visualization of support and resistance zones. It integrates seamlessly into any trading strategy, providing actionable insights for both intraday and swing trading styles.