Graphic Order Tool

- Utilitaires

- Volodymyr Korolevych

- Version: 1.1

- Mise à jour: 26 septembre 2024

- Activations: 10

Graphic Order Tool

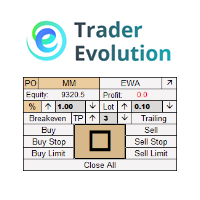

Graphic panel to help trader to make orders.

Drag TP line, SL line and/or ENTRY line with immediate calculation of the profit and loss in pips and USD.

Risk management: Set % of your balance you can risk in the order to make it safe for your money.

Automatically detect the type of possible order (BUY, SELL, BUY_STOP, SELL_LIMIT, BUY_LIMIT, SELL_STOP) depending on mode (BUY/SELL) and position of lines ENTRY, TP, SL.

Panel is semi-transparent, not to cover the main chart.

Description

- Order Data Calculations

Graphic panel calculates all the data necessary to place an order:

- determines order type: BUY, SELL, BUY_STOP, SELL_STOP, BUY_LIMIT, or SELL_LIMIT,

- calculates volume of order in lots, depending on determined level of risk,

- allows to drag entry level ENTRY and calculates current line price and deviation from current security price in pips,

- set Stop Loss level SL (by default and by dragging) - determines price, deviation from ENTRY, amount of loss in USD and pips,

- set Take Profit level TP (by ratio to SL and by dragging)- price, deviation from ENTRY, amount of earning in USD and pips.

- Risk Level

Choose the amount of money you are willing to risk in the order by setting the Risk Management information:

- initial budget:

- BALANCE (the balance of your trading account at the time of settlement), or

- EQUITY (the equity of your trading account ), or

- fixed budget as a basis of trading (BUDGET),

- % (percentage) of initial budget to apply to the order (example: 1%).

The value RISK = (BUDGET * Percentage) is used as the basis for calculating two mutually dependent values:

- the Stop Loss SL value (in USD), which should be less or equal to the RISK, and

- the volume of the order (in lots), which will be determined in assumption that the whole RISK is applied.

- Stop Loss Level

If SL level is approximately close to ENTRY level, volume can be larger, and as soon as SL line moves away from the ENTRY, volume decreases and can reach a minimal value, usually = 0.01 lot. (The minimal lot value is determined for each security).

The initial value of SL in pips is a parameter to set when the tool is activated.

Anyway, this value can easily be changed by dragging the SL line in any direction: closer to ENTRY or further from ENTRY.

Usually the trader sets the SL line looking at Support and Resistance levels.

- Take Profit Level

Take Profit level is determined by the Ratio parameter. The initial value is set to Ratio = 2.0, which means that the trader expects to earn 2 times more than to (possibly) lose. There are buttons 1 - 2 - 3 - 4 to set one of the fixed ratio levels (1.0, 2.0, 3.0 or 4.0).

Example: If ratio is equal to 3 - TP level is set to earn 3 times more than to lose.

Anyway, the trader can manually drag TP line, increasing or decreasing the expected profit of the order. After each TP line movement the current Ratio value is recalculated and displayed on the Ratio line.

- Trade Modes

Two modes of tool usage are supported: BUY and SELL.

Actual price of the security is set to "Ask" in BUY mode and to "Bid" in SELL mode.

BUY mode includes three options: BUY, BUY_STOP, and BUY_LIMIT.

Basic mode is : BUY. But if manually drag ENTER line UP or DOWN - the order turns into postponed order

- BUY_STOP : to ask a broker to open a long position at a price higher than the current price

- BUY_LIMIT : respectively to open a long position at a price lower than the current price.

The same for SELL mode:

- SELL_STOP : to open a short position at a price lower than the current price.

- SELL_LIMIT : to open a short position at a price higher than the current price.

Each time you drag the ENTER line, the Follow Price button turns red, indicating that the ENTER line is moved beyond the current price line. To return to the basic mode (just BUY, or SELL), press Follow Price button, it will turn green.

- Sandbox and Open Order Action

Sandbox is used to play with order volume.

Use buttons "+" and "-" to increase/decrease values of Risk and Lot Size:

- increasing Risk you want to earn more: lot Size is increased too.

- increasing/decreasing Lot Size you set order volume to the value you want. Risk is recalculated after every change of Lot Size.

After all the lines and risk settings are set you will see that the following data on the Graphic Tool are settled:

- trade mode;

- entry level (don't forget, after dragging ENTRY line you set the order type);

- Stop Loss level;

- Take Profit level;

- Lot Size,

you can press *Open Order* button to open order you just configured.

- UI

- Title

- security name (symbol), time-frame;

- order type;

- Order information

- risk calculation base;

- ratio for Take Profit calculation;

- Stop Loss info;

- Take Profit info;

- order volume calculation

- Sandbox

- risk percentage variation

- order volume variation

- Stop Loss info

- Take Profit info

- Open Order button

- Buttons

- Show TP Line

- Show SL Line

- Follow Price

- Lot size information

- UX

- Keyboard buttons

- "B" - keyboard button "B" activates BUY mode and displays the Graphic Tool

- "S" - keyboard button "S" activates SELL mode and displays the Graphic Tool

- "C" - keyboard button "C" removes the Tool from the screen (except the SL, TP and ENTRY lines)

- Mouse

- drag the Tool to move it (grab by the header)

- button "Close" on the right top corner of the Tool

- Tool buttons

- "Show TP Line" :

- "Show SL Line" ON/OFF

- "Follow Price" ON/OFF

- Instructions

- Download *GraphicOrderTool* to MT5 terminal (**Experts** folder).

- Activate *GraphicOrderTool* on some security graph.

- Fill parameters - set BALANCE/EQUITY or BUDGET.

- If BUDGET is chosen - populate value of budget.

- Choose Risk percentage.

- Choose initial TP level in pips.

- Press OK.

- Place mouse on the graph canvas (to allow *GraphicOrderTool* to handle graph events)

- Press "B" or "S" on the keyboard - *GraphicOrderTool* is appeared on the canvas

- Drag SL line to the preferred price level

- Choose risk ratio level or drag TP line

- Inspect calculated values of SL and TP in the USD currency

- Use Sandbox to play with values of risk and lot size

Drag ENTER line if you prefer to use deferred orders

You can manually drag the TP line, SL line and ENTRY line with immediate calculation od the profit and loss in USD.

Risk management: You can set % of your balance you can involve into the order to make it safe for your money.

Application automatically detects the type of possible order (BUY, SELL, BUY_STOP, SELL_LIMIT, BUY_LIMIT, SELL_STOP) depending on position of lines ENTRY, TP, SL.

- Development

Basic idea and initial solution is taken from William Roeder MT4 Order Tool. Graphics is fully reworked into MT5 style using graphic objects and C++ classes.