Hydrus Adaptive Breakout EA

- Experts

- Giordan Cogotti

- Version: 1.31

- Activations: 10

Presenting HYDRUS: The Ultimate Adaptive Trading Solution

Discover the power of intelligent, automated trading with HYDRUS - your key to unlocking consistent profits in the ever-changing financial markets.

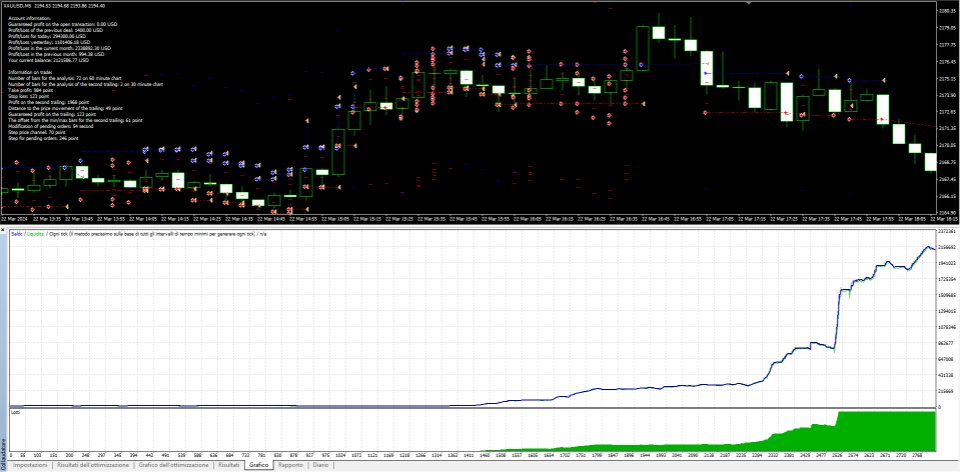

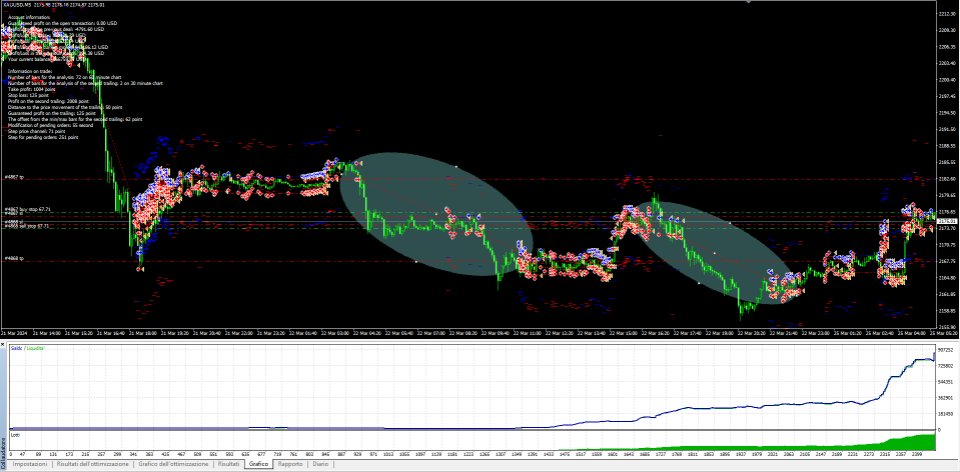

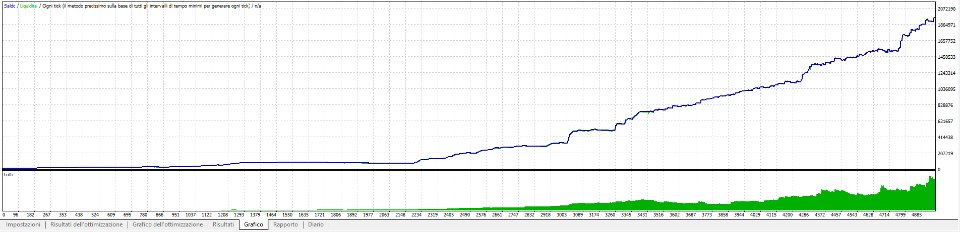

*All data, tests, screenshots, results, live trading, and anything related to Hydrus are conducted on the XAUUSD 5-minute chart. BEST SET XAUUSD

Hydrus is used on XAUUSD for our personal preferences, but it's a highly adaptive EA that, with a few small modifications, can also be applied to other instruments.This EA is highly performant and, most importantly, highly adaptive to the market, meaning it doesn't suffer from market fluctuations over time. Its initial price does not reflect its true value; it is merely an introductory price for the market and will increase over time.

Reolutionary Features:

1. Surgica Precision - Multi-timeframe analysis for informed trading decisions - Advanced algorithm that interprets real-time market conditions

2. Intelligent Risk Management - Customize your risk level per trade - Automatic lot size calculation based on available capital

3. Optimized Entries and Exits - Strategic placement of pending orders - Adaptive trailing stop system to protect profits - Automatic breakeven function

4. Unparaleled Adaptability - Continuous order updates based on market conditions - Dynamic adjustment to market volatility - Real-time recalibration of trading parameters - Proprietary market phase recognition algorithm - Seamless adaptation to trending and ranging markets - Automatic adjustment of trading frequency based on market activity

5. Intelligent Time Management - Automatic position closure before weekends - Avoids risk exposure during market closing periods

6. Comprehensive Information Dashboard - Real-time performance monitoring - Detailed statistics on profits, losses, and trading parameters

Why Choose HYDRUS:

1. Cutting-Edge Technology - Sophisticated algorithms tested on years of market data - Constant updates to maintain a competitive edge

2. Ease of Use - Quick and simple setup - Fully automated operation

3. Proven Results - Performance tested across various market conditions - Optimized to maximize risk/reward ratio

4. Expert Support - Dedicated team of customer support professionals

Limited Time Offer: Take advantage of a big discount off the regular price. This offer is valid only for the next 10 buyers! Don't let market opportunities slip away. HYDRUS is the ultimate tool to unlock your trading potential and achieve the financial freedom you've always desired.

Start Your Trading Revolution Today!

Function Description:

**MaxRisk (default: 2)**

- **Description:** Percentage of risk per trade

- **Impact:** Determines lot size based on risk

- **Adjustment:** Increase to take on more risk, decrease to take on less

- **Expected Results:** Higher values lead to larger lot sizes and potentially greater profits/losses

**Lots (default: 0.01)**

- **Description:** Fixed lot size if MaxRisk is 0

- **Impact:** Determines trade size when risk calculation is not used

- **Adjustment:** Increase for larger trades, decrease for smaller trades

- **Expected Results:** Directly influences potential profits/losses

**BarHistory (default: 72)**

- **Description:** Number of bars for analysis

- **Impact:** Affects the calculation of various parameters like take profit, stop loss, etc.

- **Adjustment:** Increase for a longer analysis period, decrease for a shorter one

- **Expected Results:** Higher values may result in more conservative settings

**PeriodBH (default: PERIOD_H1)**

- **Description:** Timeframe for historical bar analysis

- **Impact:** Affects calculations based on historical volatility

- **Adjustment:** Change according to the desired timeframe (e.g., PERIOD_M30, PERIOD_H4)

- **Expected Results:** Longer timeframes may lead to broader settings

**TimeFrame (default: PERIOD_M30)**

- **Description:** Timeframe for second trailing analysis

- **Impact:** Influences the trailing stop calculation

- **Adjustment:** Change according to the desired timeframe

- **Expected Results:** Shorter timeframes may lead to more responsive trailing stops

**BarCount (default: 2)**

- **Description:** Number of bars for second trailing analysis

- **Impact:** Affects trailing stop calculation

- **Adjustment:** Increase for more bar analysis, decrease for fewer bars

- **Expected Results:** Higher values may result in more conservative trailing stops

**AAAA(default: 8)**The offset from the min/max bars for the second trailing

- **Description:** Offset from bar high/low for second trailing

- **Impact:** Influences the position of the trailing stop

- **Adjustment:** Increase for a wider trailing stop, decrease for a closer one

- **Expected Results:** Higher values may reduce the risk of premature stops

**BBBB(default: 2)**Calculate take profit

- **Description:** Multiplier for take profit calculation

- **Impact:** Determines take profit distance

- **Adjustment:** Increase for more distant take profit, decrease for closer take profit

- **Expected Results:** Higher values can lead to potentially greater but less frequent profits

**CCCC(default: 4)**The calculation of stop loss

- **Description:** Divider for stop loss calculation

- **Impact:** Determines stop loss distance

- **Adjustment:** Increase for a closer stop loss, decrease for a more distant one

- **Expected Results:** Lower values can reduce losses but increase the risk of premature stops

**DDDD(default: 4)**Calculate take profit of the second trailing

- **Description:** Multiplier for second trailing take profit calculation

- **Impact:** Influences take profit during trailing

- **Adjustment:** Increase for more distant take profit, decrease for closer take profit

- **Expected Results:** Higher values can lead to greater profits during trailing

**EEEE(default: 6)**The distance calculation for the price movement of the trailing

- **Description:** Divider for trailing distance calculation

- **Impact:** Determines when the trailing begins

- **Adjustment:** Increase to start trailing later, decrease to start it earlier

- **Expected Results:** Lower values can lead to more aggressive trailing

**FFFF(default: 4)**The calculation of guaranteed profits by trailing

- **Description:** Divider for calculating guaranteed trailing profit

- **Impact:** Determines trailing stop distance

- **Adjustment:** Increase for a closer trailing stop, decrease for a more distant one

- **Expected Results:** Lower values can better protect profits but risk premature exits

**GGGG(default: 9)**The modification time of the price channel

- **Description:** Divider for price channel modification time calculation

- **Impact:** Influences the frequency of pending order updates

- **Adjustment:** Increase for less frequent updates, decrease for more frequent updates

- **Expected Results:** Lower values can lead to quicker adaptation to market conditions

**HHHH(default: 7)**The offset from the Ask/Bid for price channel

- **Description:** Divider for offset calculation from Ask/Bid price for price channel

- **Impact:** Determines price channel width

- **Adjustment:** Increase for a narrower channel, decrease for a wider one

- **Expected Results:** Lower values can lead to more trade signals but potentially more false signals

**IIII(default: 2)**The offset from the Ask/Bid for pending orders

- **Description:** Divider for offset calculation from Ask/Bid price for pending orders

- **Impact:** Determines pending order distance from the current price

- **Adjustment:** Increase for closer orders, decrease for more distant orders

- **Expected Results:** Lower values can lead to quicker executions but potentially more false signals

**TrailingInBar (default: true)**

- **Description:** Enable/Disable intra-bar trailing stop

- **Impact:** Influences trailing stop behavior

- **Adjustment:** Set to false to disable intra-bar trailing

- **Expected Results:** If disabled, trailing will be less responsive but potentially more stable

**TrailingBar (default: true)**

- **Description:** Enable/Disable bar-based trailing stop

- **Impact:** Influences trailing stop behavior

- **Adjustment:** Set to false to disable bar-based trailing

- **Expected Results:** If disabled, trailing will be less sensitive to price movements between bars

**BreakEvenDeals (default: true)**

- **Description:** Enable/Disable breakeven function

- **Impact:** Moves stop loss to breakeven when trade is in profit

- **Adjustment:** Set to false to disable breakeven function

- **Expected Results:** If enabled, it can protect profits but may limit potential gains

**CloseOrders (default: true)**

- **Description:** Closes all market/pending orders on Friday

- **Impact:** Influences risk management over the weekend

- **Adjustment:** Set to false to keep positions open over the weekend

- **Expected Results:** If enabled, reduces weekend gap risk but may miss opportunities

**TimeFriday (default: 2)**

- **Description:** Time to close orders on Friday

- **Impact:** Determines when orders are closed on Friday

- **Adjustment:** Change to the desired hour (0-23)

- **Expected Results:** An earlier time can further reduce risk but limit trading time

**ClosePendingOrders (default: true)**

- **Description:** Removes pending orders when there are active positions

- **Impact:** Influences risk management

- **Adjustment:** Set to false to keep pending orders

- **Expected Results:** If enabled, reduces the risk of unwanted openings but may miss opportunities

Note: Backtests can be slow due to continuous adjustment calculations. Setting the info panel to false and using non-visual mode speeds up the process.

These settings offer a wide range of customization options to tailor the EA to your trading preferences and risk tolerance. It's important to note that any changes should be thoroughly tested on historical data before being used on a live account.

Note: Trading involves risks. It is advisable to invest responsibly and always use appropriate risk management.

L'utilisateur n'a laissé aucun commentaire sur la note