Turnaround Tuesday EA

- Experts

- Jimmy Peter Eriksson

- Version: 1.30

- Mise à jour: 28 octobre 2024

- Activations: 10

The Turnaround Tuesday bot is based on a time-tested, well-known concept that has consistently proven its robustness over the long term. The strategy is built on a fundamental market principle: fear often creeps into the market after a weekend, when trading has been on pause for two days. This fear, coupled with the potential for significant news events over the weekend, can lead to a sharp gap down when the market opens on Monday. Historically, the market tends to bounce back from this initial dip, creating a strong buying opportunity.

Here's how the strategy works: If Monday is a down day, the bot will automatically place a buy order on Monday night, holding the position until Tuesday night. This approach leverages the high probability of a market turnaround during this period, a pattern that has been observed across many indices and stocks.

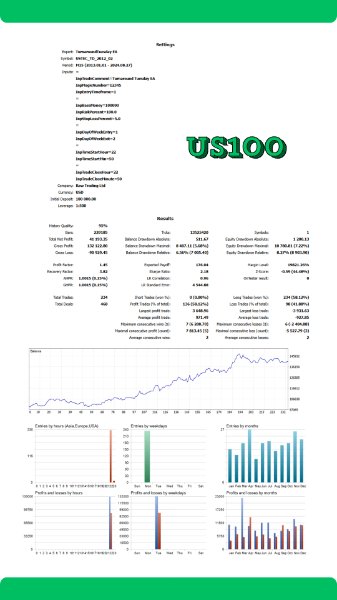

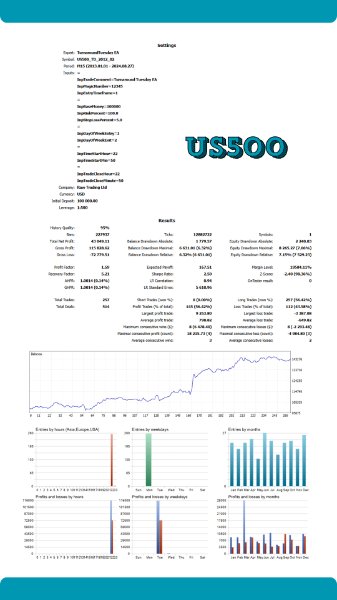

The strategy boasts a high profit factor of around 1.50 on many indices such as US500, US100 and US30, DE40, UK100, making it a reliable addition to your trading portfolio.

Optimization Guidelines

The goal of this strategy is to enter the market at the end of the New York session on Monday and close the position at the end of the New York session on Tuesday. The bot is optimized for GMT+3, meaning the entry and exit times are set according to this timezone.

However, users need to manually adjust these times based on their broker's timezone and the specific open and close times of the markets they wish to trade. Ensuring that the entry and exit align with the end of the New York session in your broker's timezone is crucial for maximizing the effectiveness of this strategy.

Got questions about setting up the bot? Feel free to reach out—I'm happy to help!

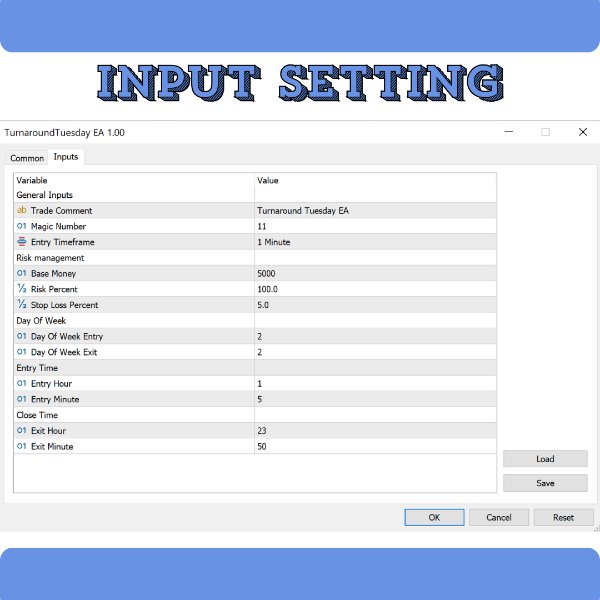

<General Inputs>

Trade Comment: A label for all trades made by the EA.

Magic Number: Unique identifier for the EA's trades.

Entry Timeframe: Timeframe used for trade entries (recommended M1).

<Risk Management>

Base Money: Reference account balance for calculating risk.

Risk Percent: Amount of risk per trade (Percentage).

Stop Loss Percent: Sets the stop loss distance as a percentage of the underlying asset's price.

<Risk Management>

Day of Week Entry: Specifies the day to open the trade. 1 = Monday, 2 = Tuesday, etc.

Day Of Week Exit: Specifies the day to close the trade. 1 = Monday, 2 = Tuesday, etc.

<Entry Time>

Entry Hour: Specifies the hour to open the trade.

Entry Minute: Specifies the minute to open the trade.

<Close Time>

Exit Hour: Specifies the hour to close the trade.

Exit Minute: Specifies the minute to close the trade.