Panoply Expert MT5

- Experts

- Ruengrit Loondecha

- Version: 24.806

---------------------------------------------------------

---------------------------------------------------------

Panoply Expert MT5

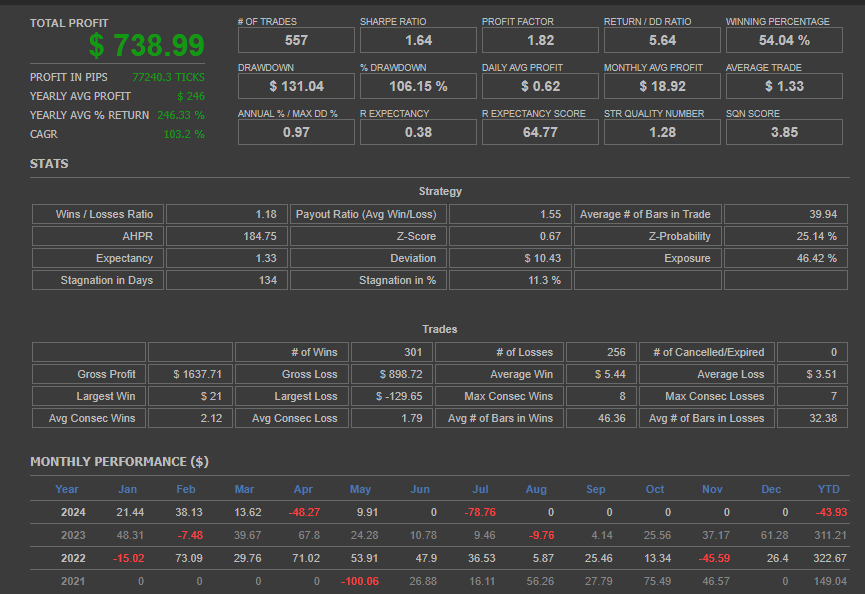

- Optimal Performance: Designed to work best with GOLD on the M30 timeframe.

- Capital Requirements: Minimum starting capital of $300-$500 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

Panoply Expert MT5

- Optimal Performance: Designed to work best with GOLD on the M30 timeframe.

- Capital Requirements: Minimum starting capital of $300-$500 for a 0.01 lot size (AutoLot feature included).

- Continuous Optimization: Monthly updates to enhance performance and adapt to market conditions.

- Stay Informed: Updates and performance reports in the comments section.

- Live Trading: Follow our live trades at https://t.me/lullfrx

---------------------------------------------------------

Indicators and Concepts

-

Momentum:

- The Momentum indicator measures the rate of change of a security's price over a specific period. It helps identify the strength of price movements, signaling potential trend continuations or reversals. High momentum indicates strong price movements, while low momentum suggests weaker trends.

-

Average Directional Index (ADX):

- ADX measures the strength of a trend, regardless of its direction. It is often used alongside the +DI and -DI lines to determine whether a market is trending and the strength of that trend. ADX values above 25 typically indicate a strong trend.

-

SR Percent Rank (SRPercentRank):

- SRPercentRank ranks the current price relative to the highest and lowest prices within a specified period. It provides a normalized score indicating whether the current price is near the high, low, or middle of its recent range, helping traders gauge relative price positioning.

-

Moving Average Convergence Divergence (MACD):

- MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. It consists of the MACD line, the signal line, and the histogram. MACD helps identify potential buy and sell signals, trend direction, and momentum strength.

-

Oscillator of Moving Average (OSMA):

- OSMA is the difference between the MACD line and the signal line. It highlights the momentum behind the MACD and is used to confirm trends and potential reversals.

Trade Style

-

Instant Entry Market Order:

- An instant entry order involves entering a trade at the current market price. This is typically done when a trading signal indicates a strong potential for a favorable price movement, necessitating immediate action.

-

Stop Loss (SL) by Percentage:

- The stop-loss level is set as a specific percentage of the entry price. This predefined percentage limits potential losses, providing a consistent risk management strategy.

-

Take Profit (TP) by ATR Coefficient:

- The take-profit level is set using a multiple of the Average True Range (ATR), which reflects market volatility. The ATR coefficient adjusts the TP target based on the market's volatility, allowing for flexible and adaptive profit-taking.

-

Move SL to Break Even (MoveSL2BE) and Add Pips with ATR:

- The strategy involves moving the stop-loss to the break-even point (the entry price) once the trade has moved favorably. Additionally, a certain number of pips, determined by the ATR, are added to the break-even level to secure some profit while minimizing risk. This method ensures that the trade is protected from losses while potentially capturing additional gains.

-

Trailing Stop by Heiken Ashi:

- A trailing stop is set based on the Heiken Ashi candlesticks, which smooth out price action to reflect the overall trend direction more clearly. The trailing stop adjusts according to the Heiken Ashi high (for long positions) or low (for short positions), allowing traders to lock in profits while staying in the trade as long as the trend continues.