Liquidity Hunter

- Experts

- Philani Mthembu

- Version: 1.7

- Mise à jour: 9 août 2024

- Activations: 10

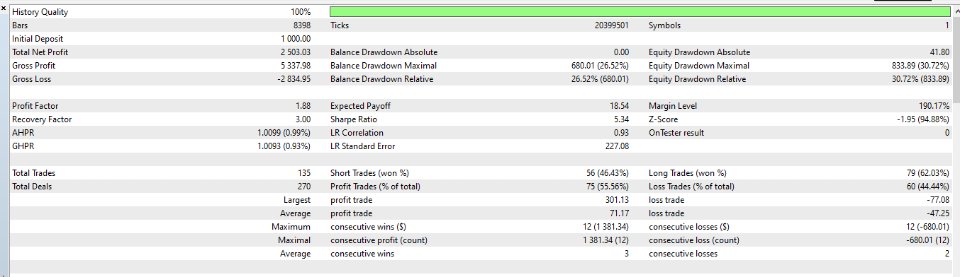

The Liquidity Hunter EA for MetaTrader 5 leverages advanced liquidity concepts inspired by Smart Money Concepts (SMC). Using sophisticated algorithms, the EA identifies key areas of liquidity at extreme and internal swing highs and lows in the market. It strategically plots rectangle clusters around these levels, indicating potential stop areas and liquidity pools.

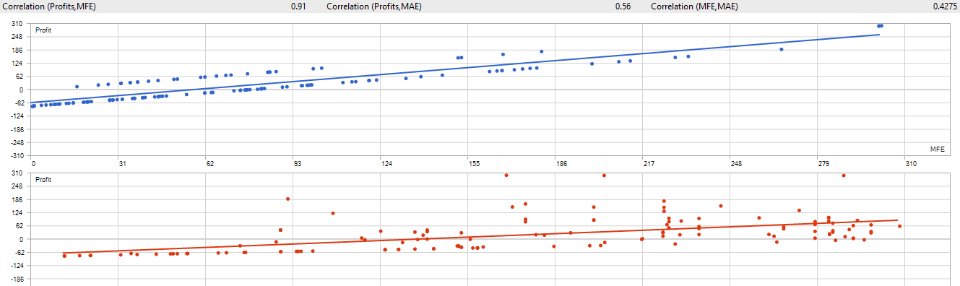

The EA then executes pending limit orders precisely at these identified liquidity zones, optimizing entry points for trades. It features comprehensive risk management tools, including trailing stop-loss (SL), break-even (BE), and multiple take-profit (TP) levels (TP1, TP2, TP3).

Moreover, the Liquidity Hunter EA incorporates Fibonacci deviation levels to dynamically adjust SL and TP levels, enhancing flexibility. Key SMC concepts such as Change of Character (ChoCH), Break of Structure (BOS), Order Blocks, and Fair Value Gaps (FVG) are integral to its strategy, allowing it to capitalize on market inefficiencies and mitigate risks effectively.

The EA also includes a Daily Drawdown Tracker, which adheres to most prop firm rules. You can set a daily drawdown limit and a maximum account drawdown. If the daily drawdown limit is reached, the EA will stop trading and close all open and pending orders until the next day when it resets. This feature makes the Liquidity Hunter EA ideal for use with prop firms, ensuring adherence to strict drawdown requirements.

This automated trading solution is designed to offer traders a strategic advantage in the forex and financial markets, making it a powerful tool for those seeking to trade in alignment with Smart Money Concepts while adhering to prop firm rules.

Added Features:

- We have added alerts for Swing Highs and Swing Lows.

- Feature to disable the EA and trade manually by using the EA market analysis.

- Volume profile at swing highs and swing lows. This helps traders see how many orders were at the swing highs and lows, and potentially can act as support and resistance levels in the future.

- Trend filter based on SMA.

Example of Input Settings:

Here are the Expert Advisor (EA) input parameters in table form along with an explanation for each input.

| Inputs | Description | Default Value |

|---|---|---|

| 1. Analysis Parameters | ||

| The number of historical bars used to identify price swings. | 24 |

| The minimum number of points required for a Fair Value Gap (FVG) to be considered. | 100 |

| The number of bars for extending the FVG rectangle. | 10 |

| The maximum number of FVGs to draw on the chart. | 5 |

| A boolean to show or hide Fair Value Gaps on the chart. | true (show FVGs) || false (hide FVGs) |

| The time frame used for Fibonacci analysis. | PERIOD_W1 (Weekly Timeframe) |

| The time frame shift, which could be used to analyze different time frames. | 1 |

| 2. Trade Parameters | ||

| The trailing stop-loss in pips. (A set file is provided)* | 30 |

| The number of points at which the stop-loss is moved to the breakeven level. | 20 |

| The number of days after which a pending order expires. | 2 |

| 3. Lot Size Settings | ||

| The mode used to determine the lot size (e.g., fixed or percentage). | FIXED |

| The fixed lot size to be used for trades. | 0.1 |

| The lot size as a percentage of the account balance | 1 |

| A boolean to indicate whether to use the first Take-Profit level (Swing High/Low). | true |

| A boolean to indicate whether to use the second Take-Profit level (1.236 Fibonacci extension). | true |

| A boolean to indicate whether to use the third Take-Profit level (1.5 Fibonacci extension). | true |

| 4. Risk Management | ||

| The daily drawdown limit in percentage. | -5.0% |

| The overall account drawdown limit in percentage. | -12.0% |

* Set file for GBPUS,NASDAQ,GOLD,US30,Volatility Indices (Deriv) Symbols is provided upon request. Just Send Me a Message.

Risk Warming: