One To Three

- Experts

- Abhay Kushwaha

- Version: 1.2

- Mise à jour: 9 août 2024

- Activations: 5

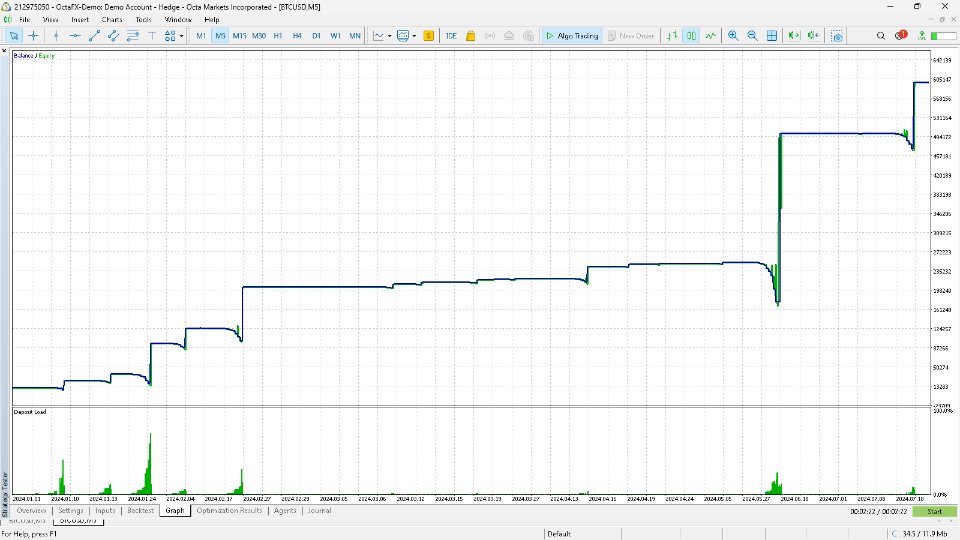

"One TO Three" Triple your money in an year.

Hey Everyone! 🌟

Love the app? Hate it? I want to hear from you! Please rate, comment, and share your feedback—it means the world and helps me improve. 🙏

Thank you! ❤️

Contact: telegram me on @abhaykushwaha1

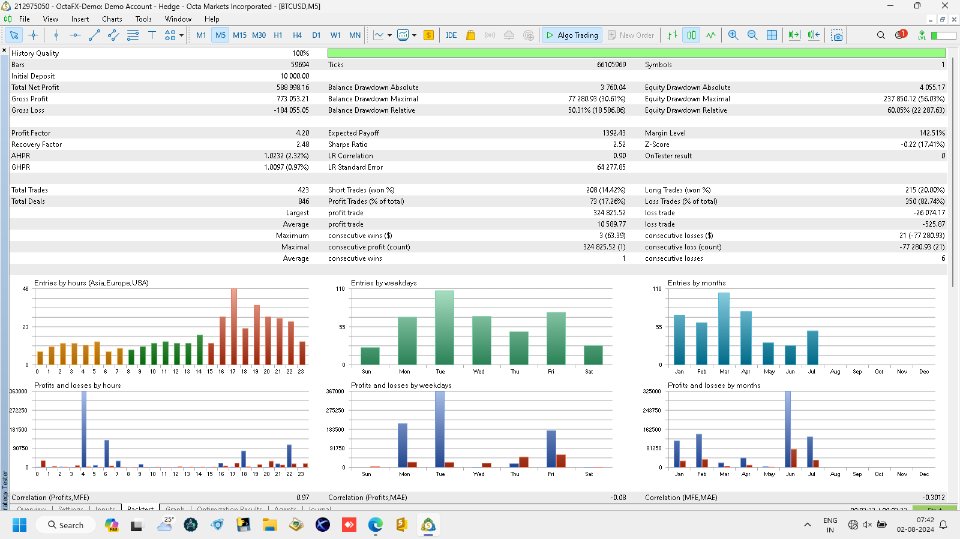

One TO Three is a sophisticated trading algorithm designed for the MetaTrader 5 (MT5) platform, developed by Abhay Kushwaha. This expert advisor (EA) leverages advanced trading strategies and customizable parameters to automate the trading process, specifically tailored for BTC/USD trading. With built-in risk management, dynamic position sizing, and the ability to sync with web-based configurations, this EA offers a powerful tool for traders seeking to optimize their trading performance.

Functionality:

- Minimum Balance Check: Ensures the account balance is at least 10000 dollars before placing first order. If the balance is below 10000 dollars, the function stops execution and prints a message.

- Web Sync: Sets web_sync to true by default, indicating that all operations are synchronized with the web.

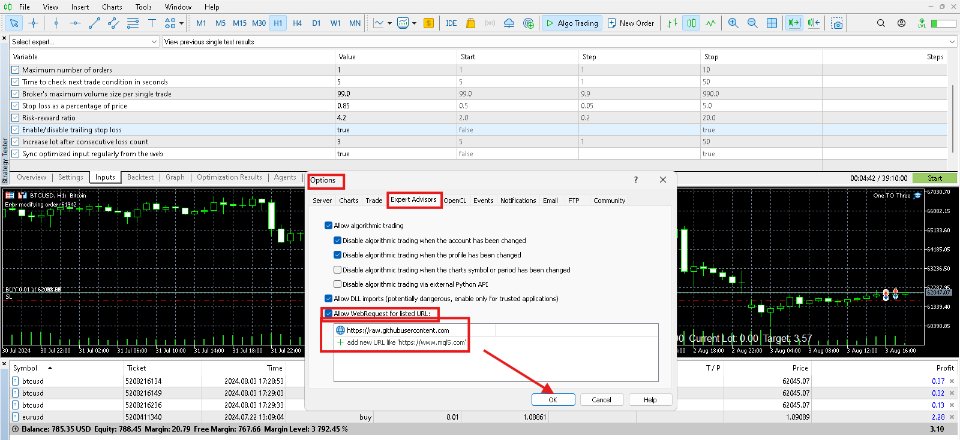

Certainly! Here are the instructions specifically for adding the URL ' https://raw.githubusercontent.com' in the options menu:

Instructions to Add URL in Options Menu

-

Open MetaTrader 5:

- Launch your MetaTrader 5 platform.

-

Access Options:

- Navigate to the Tools menu at the top of the platform.

- Select Options from the drop-down menu.

-

Web Sync Settings:

- In the Options window, go to the Web Sync tab.

-

Add URL:

- In the Web Sync settings, find the URL field.

- Enter ' https://raw.githubusercontent.com' in the URL field.

-

Enable Web Sync:

- Ensure that the Enable Web Sync checkbox is checked.

- Click OK to save the settings.

-

Apply Settings:

- Ensure that your script or expert advisor references the web sync settings appropriately.

-

- BTC Trading Only:

- The function is designed to work exclusively with BTC. If the symbol is not BTC, it stops execution and prints a message.

- Timeframe Independence: The function is designed to work on any timeframe, meaning it can be executed in different chart periods without modification.

- Order Placement Logic:

- Lot Size: Initially set to a minimum of 0.01. This size increases after 3 consecutive losing trades.

- Stop Loss and Take Profit: Calculated based on a predefined percentage of the current price.

- Target Price Percentage: Varies from 0.3% to 5%, and resets to 0.3% after 5 consecutive losses.

- Consecutive Loss Handling: Adjusts the target price percentage and lot size based on the number of consecutive losses.

Key Features

-

Advanced Risk Management:

- Stop Loss and Take Profit: The EA allows users to set a stop loss as a percentage of the price, ensuring risk is managed effectively.

- Risk-Reward Ratio: Users can define their preferred risk-reward ratio, enhancing control over trade outcomes.

- Trailing Stop Loss: An optional trailing stop loss feature helps lock in profits by adjusting the stop loss as the trade moves in a favorable direction.

-

Dynamic Position Sizing:

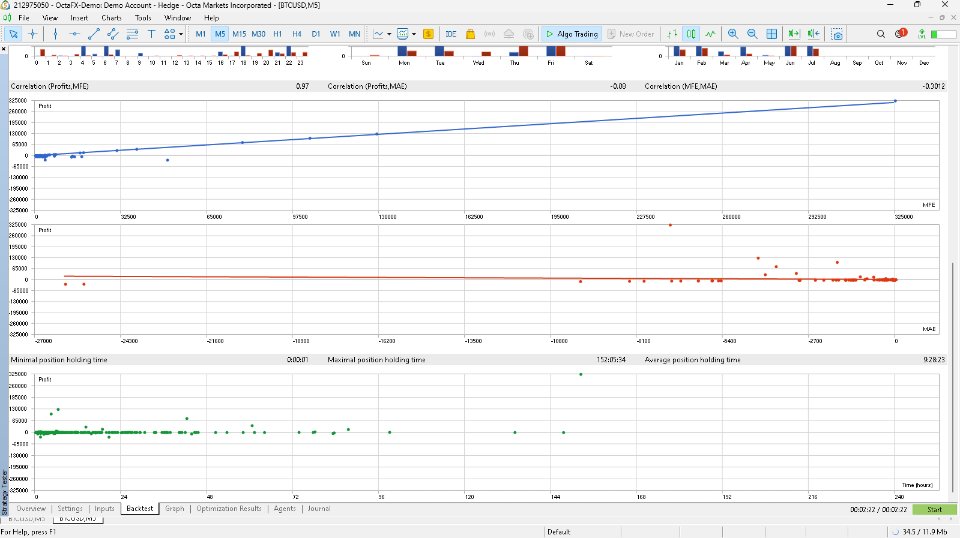

- Lot Size Calculation: The EA adjusts the lot size based on account balance and predefined percentage, ensuring optimal position sizing for each trade.

- Loss Recovery Mechanism: After consecutive losses, the EA increases the lot size to recover from previous losses while maintaining risk management protocols.

-

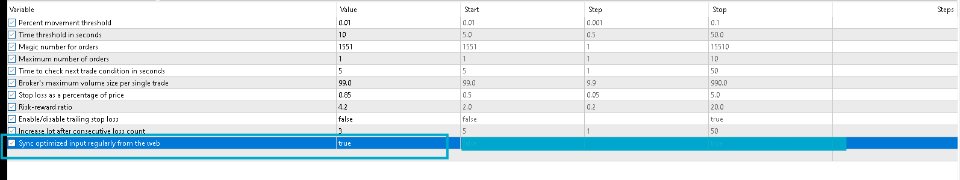

Web-Based Configuration Synchronization:

- The EA can sync optimized input parameters from a web-based configuration file, ensuring that the trading strategy remains up-to-date with the latest settings.

-

Customizable Parameters:

- Movement Threshold: Defines the percentage price movement required to trigger a trade.

- Time Threshold: Sets the time interval for checking trading conditions.

- Magic Number: A unique identifier for the EA's trades, allowing for easy management and monitoring.

- Maximum Position Limit: Limits the number of open positions to prevent overexposure.

- Sleep Interval: Controls the frequency of trade condition checks.

- Maximum Volume: Ensures compliance with broker-specific volume restrictions.

-

Comprehensive Trade Statistics:

- The EA provides detailed statistics on total trades, profit/loss for long and short positions, account balance, and other essential metrics.

-

Compatibility and Flexibility:

- Designed specifically for BTC/USD trading, the EA is adaptable to different market conditions and trading styles.

How It Works

Initialization: The EA initializes by setting a timer event and preparing the trading environment. It retrieves the initial configurations, either from user input or by downloading a JSON configuration file from a specified URL.

Trade Execution: The EA monitors price movements and time intervals. When the defined movement threshold and time threshold are met, it checks the current BTC positions. If the number of positions is below the maximum limit, the EA places a new order (buy or sell) with the calculated lot size, stop loss, and take profit levels.

Loss Management: If a trade hits the stop loss, the EA updates the consecutive loss count and adjusts the lot size for subsequent trades to recover losses. If the take profit level is reached, the EA resets the consecutive loss count and lot size.

Trailing Stop Loss: If enabled, the EA dynamically adjusts the stop loss level as the trade progresses, securing profits and minimizing losses.

Web Configuration Sync: The EA periodically checks and updates its configuration from the web, ensuring it operates with the latest optimized parameters.

Statistics Display: The EA continuously updates and displays trading statistics on the chart, providing real-time insights into trading performance.

Parameters and Their Roles

-

Input Parameters:

- Input_MovementThreshold : Percent movement threshold to trigger trades.

- Input_TimeThreshold : Time threshold in seconds to check trade conditions.

- Input_MagicNumber : Unique identifier for the EA's orders.

- Input_Maxposition : Maximum number of open positions allowed.

- Input_Sleepsecond : Interval in seconds to check the next trade condition.

- Input_Maxvol : Maximum volume size per single trade as allowed by the broker.

- Input_StopLossPercent : Stop loss percentage of the price.

- Input_RR : Risk-reward ratio.

- Input_TrailSl : Enable/disable trailing stop loss.

- Input_increaselotafter : Number of consecutive losses after which the lot size is increased.

- Input_syncwithweb : Enable/disable synchronization of optimized input from the web.

-

Global Variables:

- Variables such as MovementThreshold , TimeThreshold , MagicNumber , and others hold updated values from the configuration file.

-

Functions:

- UpdateConfigFromWeb : Downloads and parses the configuration file from the web.

- ExtractJsonValue : Extracts double values from the JSON string.

- ExtractJsonValueInt : Extracts integer values from the JSON string.

- ExtractBooleanJsonValue : Extracts boolean values from the JSON string.

- PlaceOrder : Places a new order with calculated lot size, stop loss, and take profit levels.

- CalculateLotSize : Calculates the appropriate lot size based on account balance.

- UpdateAndDisplayStatistics : Updates and displays trading statistics on the chart.

- ApplyTrailingStop : Adjusts the trailing stop loss based on current market conditions.

Conclusion

The One TO Three trading algorithm is a powerful tool for automating BTC/USD trades on the MT5 platform. With its advanced risk management features, dynamic position sizing, and web-based configuration synchronization, it offers traders a robust solution to enhance their trading strategy. Whether you're a novice or an experienced trader, this EA provides the flexibility and control needed to navigate the volatile cryptocurrency markets effectively.

Contact: telegram me on @abhaykushwaha1