BlueTrade EA

- Experts

- Ely Aleskry

- Version: 5.1

- Mise à jour: 19 août 2024

- Activations: 5

PLEASE CONTACT ME BEFORE PURCHASE FOR DISCOUNT UP TO 50%

Key Features:

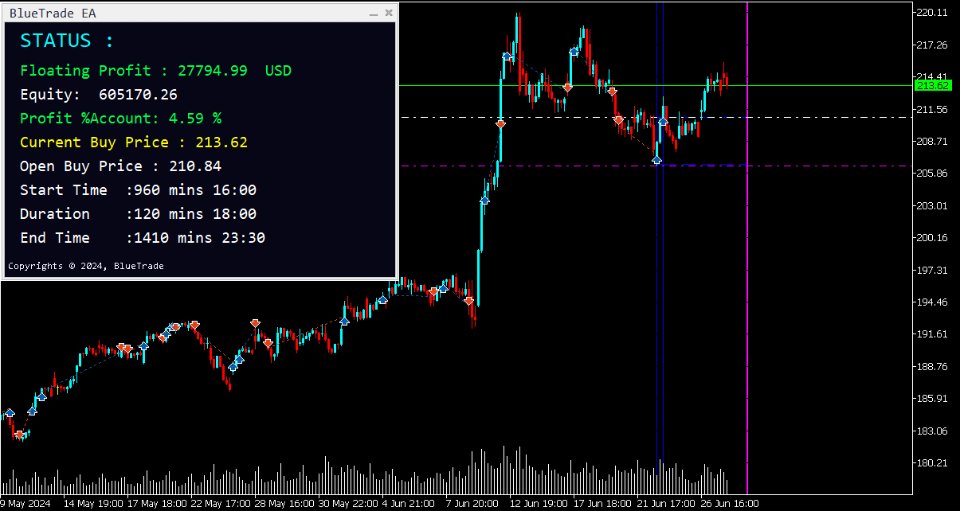

- Full Range Breakout Strategy: The EA continuously monitors price movements and identifies breakout points based on predefined high and low ranges. When the price moves beyond these levels, the EA automatically opens trades, positioning itself to take advantage of potential price trends.

- Trailing Stop Loss: To enhance risk management and protect profits, the EA includes a trailing stop loss feature. This functionality allows the stop loss level to adjust dynamically as the trade moves in favor, ensuring that profits are secured while minimizing potential loss.

BlueTrade EA

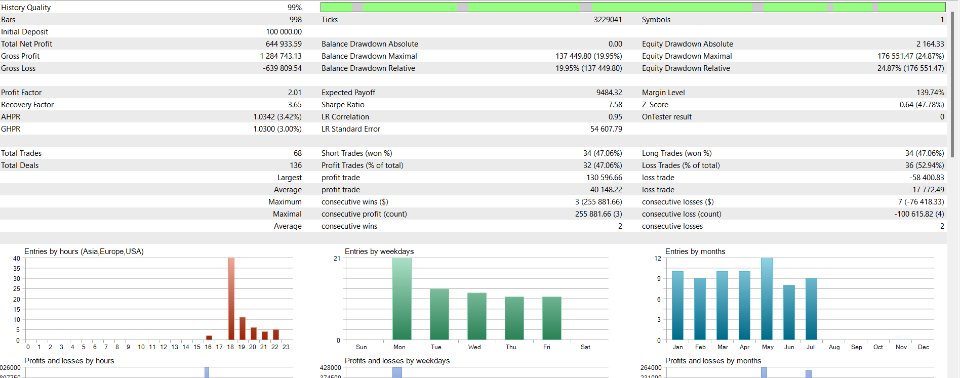

This Expert Advisor is crafted for automated trading in both Forex and stock markets. Leveraging a sophisticated range breakout strategy, this EA is designed to assist traders in capitalizing on market movements with precision and efficiency. With a comprehensive set of customizable parameters, it allows traders to tailor the EA to align with their specific trading strategies and risk management preferences.

Design Philosophy:

The core of this EA is its range breakout strategy. The trading approach is based on identifying key price levels where breakouts are likely to occur, enabling the EA to execute trades at optimal points. This strategy aims to capture significant price movements by entering trades when the price breaks out of a predefined range. This can be particularly effective in volatile markets where price swings are more pronounced.

Parameters:

- Magic Number: Assigns a unique identifier to the EA's trades, helping to differentiate and manage trades executed by different EAs or strategies. This is crucial for keeping track of performance and avoiding conflicts between multiple trading systems.

- Lot Mode: Offers flexibility in determining the lot size for trades. Traders can choose between a fixed lot size for consistent trade volumes or a dynamic lot size based on account balance, providing adaptability to varying account sizes and risk tolerance.

- Lot Size: Specifies the trade lot size used for executing orders. In fixed lot mode, this value remains constant, while in dynamic mode, it adjusts according to the account balance, allowing for proportionate trade sizes.

- Stop Loss: This parameter sets the maximum allowable loss in percentage of range calculated by EA. It is a critical risk management tool designed to limit potential losses and prevent significant drawdowns in trading capital.

- Take Profit: Defines the target profit level in percentage of range calculated by EA. By setting a take profit level, traders can lock in gains once the price reaches the desired profit threshold.

- Trailing Stop Loss:

- Trailing SL Trigger: Determines the price point at which the trailing stop loss begins to activate. This ensures that once a trade moves favorably, the trailing stop loss starts to secure profits, providing a safeguard against adverse market movements.

- Trailing SL Points: Defines the distance in pips for the trailing stop loss to follow the price. This setting allows traders to control how closely the stop loss follows the market price, optimizing the balance between locking in profits and allowing room for price fluctuations.

- Start Time: Specifies the time at which the EA should commence trading activities. This parameter allows traders to align the EA’s trading sessions with their strategy, ensuring that trades are executed during preferred market conditions.

- Duration: Sets the period during which the EA will actively trade. This parameter provides control over how long the EA remains active, allowing for targeted trading periods and adherence to specific trading strategies.

- Close Time: Defines the time at which trading activities should conclude. By setting a close time, traders can manage the EA’s trading window, ensuring that positions are closed before specific times or events.

- Breakout Mode: Allows traders to choose between trading breakouts in one direction (one side) or in both directions (two sides). This flexibility enables the EA to adapt to different market conditions and trading strategies.

- Custom Chart Template: Names the chart template that will be applied when the EA is loaded. This feature allows traders to maintain a consistent and customized charting setup, enhancing their analysis and trading experience.

- Drawing Objects: Toggles the inclusion of visual elements (e.g., lines, labels) on the chart. This parameter can be adjusted based on user preferences for visual analysis and chart clarity.

Benefits:

- Automated Trading: The EA automates the trading process, reducing the need for manual intervention and allowing for consistent execution of trading strategies. This can help eliminate emotional biases and ensure systematic trading.

- Customizability: With a wide range of customizable parameters, traders can tailor the EA to fit their unique trading styles and preferences. This flexibility enhances the EA’s adaptability to various market conditions and individual risk profiles.

- Enhanced Risk Management: Features such as trailing stop loss and predefined stop loss and take profit levels contribute to robust risk management, helping traders protect their capital and secure profits effectively.

- User-Friendly Interface: The ability to apply custom chart templates and toggle drawing objects enhances the user experience, providing a personalized and intuitive trading environment.

Example Usage:

Imagine a trader who specializes in breakout trading and wants to use this EA to automate their strategy. They set the EA to trade with a specific magic number to distinguish their trades, choose a lot size that aligns with their risk tolerance, and configure stop loss and take profit levels to manage potential losses and gains. They also set the start time to align with their preferred trading hours and define the duration to match their trading session.

By activating the trailing stop loss with a specific trigger and point distance, they ensure that their profits are secured as the market moves in their favor. With the breakout mode set to two sides, the EA is ready to capture breakouts in both directions, maximizing trading opportunities. The custom chart template and drawing objects options allow the trader to maintain their preferred charting setup and add visual aids for analysis.

Through this comprehensive setup, the trader can confidently rely on the EA to execute trades efficiently, manage risk, and adapt to changing market conditions, all while maintaining a personalized trading environment.

ATTENTION : Please contact me after purchase for more details about set file of your pair or stock.

ATTENTION : The EA is designed for USDJPY and Stocks/Shares of US Market.