Price Action Robot

- Experts

- Harsh Tiwari

- Version: 1.0

- Activations: 5

A Price Action Trading Expert Advisor (EA) is a type of automated trading system designed to execute trades based on price action patterns and signals. Price action trading focuses on analyzing historical price movements to identify potential future price movements without relying on conventional technical indicators.

Here are key aspects and characteristics of a Price Action Trading Expert Advisor:

1. **Strategy Based on Price Action Patterns**: The EA is programmed to identify and trade based on specific price action patterns such as pin bars, inside bars, engulfing patterns, and support/resistance levels. These patterns are typically identified using rules based on candlestick formations and price movements.

2. **Rule-Based Execution**: The EA follows a set of predefined rules and criteria for entering and exiting trades. These rules are usually based on the principles of price action trading, which emphasize simplicity and clarity in trading decisions.

3. **No Dependency on Traditional Indicators**: Unlike many other EAs that rely heavily on technical indicators like moving averages, oscillators, or trend lines, a Price Action Trading EA primarily uses raw price data and chart patterns to make trading decisions. This approach is appealing to traders who prefer a cleaner, less cluttered approach to analysis.

4. **Manual Strategy Translation**: Price action trading strategies that are manually traded can be translated into automated rules for the EA. This involves converting the trader's discretionary decisions into specific algorithmic rules that the EA can execute consistently.

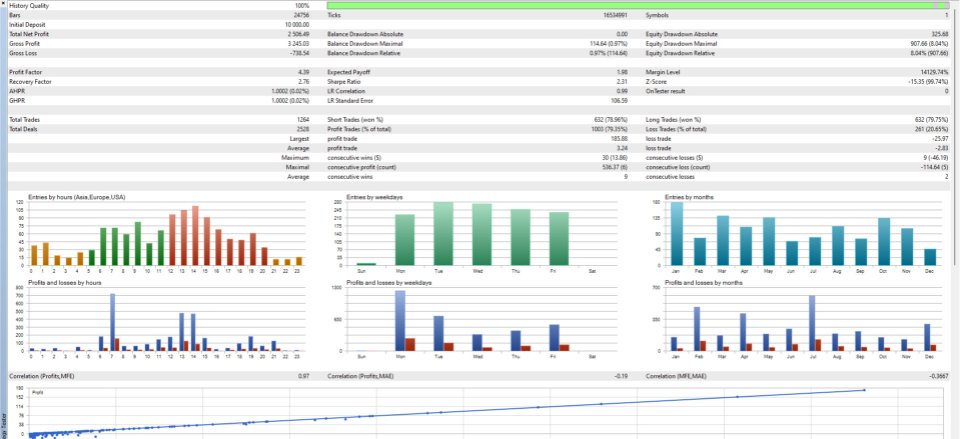

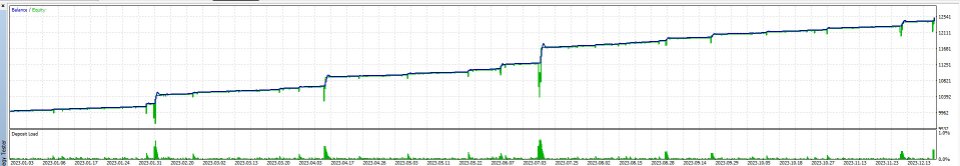

5. **Risk Management Features**: Good Price Action Trading EAs incorporate robust risk management features such as stop-loss orders, take-profit levels, and position sizing algorithms. These features are crucial for managing risk and preserving capital during trading.

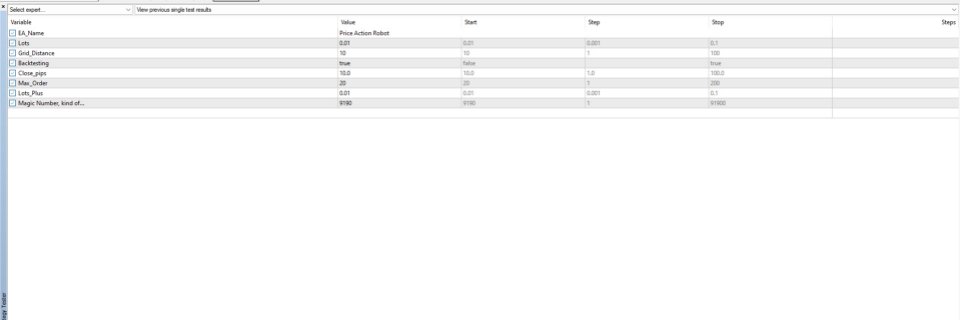

6. **Backtesting and Optimization**: Before deploying a Price Action Trading EA in live markets, it's essential to thoroughly backtest and optimize it using historical data. This process helps ensure that the EA's rules are effective across various market conditions and timeframes.

7. **Execution Speed and Reliability**: Since price action trading often involves reacting to short-term price movements and patterns, the EA needs to execute trades swiftly and reliably. This requires efficient coding and connectivity to the trading platform.

8. **Adaptability and Customization**: Some Price Action Trading EAs allow for customization and parameter adjustments to tailor the strategy to different instruments or market conditions. This flexibility can enhance the EA's performance in varying market environments.

9. **Monitoring and Maintenance**: Even though Price Action Trading EAs automate trading decisions, they still require monitoring to ensure they are functioning correctly and adapting to changing market dynamics. Regular maintenance and updates may be necessary to optimize performance over time.

Overall, a Price Action Trading Expert Advisor aims to automate the process of identifying and executing trades based on price action analysis, offering traders the potential for disciplined and systematic trading based on proven price patterns and rules.