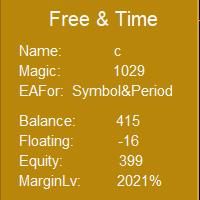

Remaining time of line K

- Indicateurs

- Zhongquan Liang

- Version: 2.0

- Mise à jour: 30 mai 2024

The purpose of the remaining time indicator on the K-line is to assist traders in gaining a deeper understanding of market dynamics and making more precise trading decisions, particularly in the realm of forex and binary short-term trading. The significance of this indicator and its application to various trading strategies will be thoroughly examined below: Enhancement of Trading Timing Accuracy - Precision: By displaying the remaining time of the current K-line cycle, traders can achieve greater accuracy in timing their entry and exit points. - Elimination of delays: Minimization of errors stemming from time estimation and prevention of delayed operations during critical moments. - Optimization of strategy execution: Empowerment for traders to timely adjust their trading strategies in response to market changes before the closure of the K-line. Elevation of Trading Experience - Auxiliary support: Serving as an auxiliary tool, the remaining time indicator enhances traders' overall experience while reducing psychological stress. - Stress reduction: Visual representation reduces psychological strain on traders during rapidly changing markets. - Efficiency improvement: Enables focus on market analysis rather than constant monitoring for timing purposes. Adaptation to Diverse Trading Cycles - Multi-period applicability: Accurate time information provided regardless if it's a one-minute, five-minute or longer cycle. - Flexibility in adjustment: Traders have leeway to tailor their sensitivity towards timing based on different strategies and market conditions. - Support for complex strategies: Crucial information provided for executing cross-cycle trading strategies by those who implement multi-time frame analysis. Advancement in Technical Analysis Accuracy - Integration with other indicators: Utilization alongside other technical analysis tools results in more accurate predictions regarding market movements. - Real-time data support: Provisioning real-time data aids decision-making based on up-to-date market information. - Confidence enhancement in decision-making process through clear timing information empowering trader confidence.