Martin D Climber MT5

- Experts

- Ahmad Farhan Nursyafak

- Version: 1.0

- Activations: 5

Hello everyone, let me introduce Martin D Climber.

This EA (Expert Advisor) is designed to identify the best price to execute trades based on daily timeframes.

The EA also features a 50-pip stop-loss, which we recommend for this strategy.

It is highly recommended for the gold market.

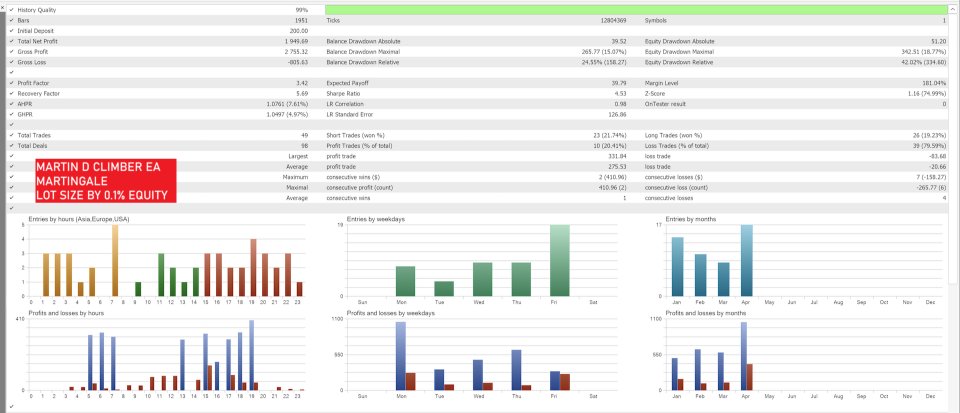

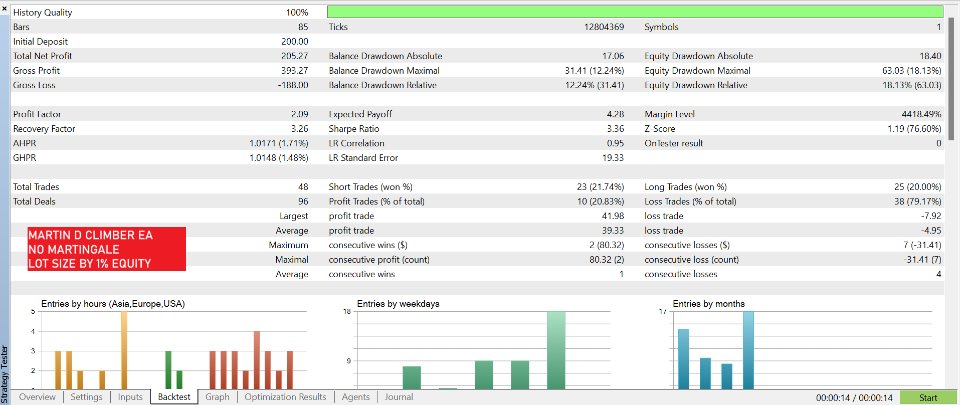

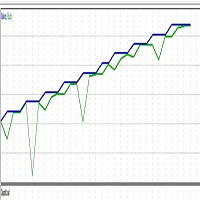

This EA has been backtested using "every tick with real tick," "random delay," and various brokers.

We have configured the available settings to be optimal in managing market risks.

Notes for traders:

- Backtest screenshots are from January 2024 to April 2024.

- We suggest that you use a VPS to operate this Expert Advisor (EA) so that you don't miss any momentum

- We look forward to discussing this with you in the future to further optimize this EA.

- SET FILE : Click here

Key features:

- Easy to use, just apply it to the chart.

- Lot size based on your equity. The default setting is 1% of your equity.

- Minimum deposit: $100-$200.

Backtesting:

- Use on XAUUSD in any timeframe.

- You can also adjust the settings to see different results.

Parameters:

- Equity Percentage: The Money Management (MM) system adjusts the lot size based on your available equity. For instance, a setting of 1% will result in a lot size based on $100 for a $10,000 account. Similarly, 20% will create a lot size based on $2,000 for a $10,000 account. If you set this to 0%, the lot size will always be within the broker's minimum and maximum lot size limits. This means that 0% could result in a 0.01 lot order if that’s the broker's minimum for that symbol.

- Number of Orders Considered: When set to 1, only the most recent order is evaluated.

- Percentage Lost: This represents the percentage of orders (based on the "Number of Orders Considered" setting) that ended in a loss. For example, if you set "Number of Orders Considered" to 1 and "Percentage Lost" to 100, the EA will start multiplying the next order after one losing trade. If you set these values to 2 and 100, the EA will multiply the next order after two consecutive losses. A setting of 2 and 50 means the EA will multiply the next order if one or both of the last two trades were losses.

- Multiplier: This determines how much the previous order volume is increased after a losing trade. For example, setting this to 2 will double the volume after a loss.

- Max Number of Steps: This limits the number of times the order's volume can be multiplied. If no new orders are opened before reaching this limit, the broker likely prevents further order increases.

- Reset Martingale After Max Steps: Enabling this will reset the lot size after reaching the maximum number of steps.

- Multiply by Raw Lot Size: If enabled, the Multiplier is applied before rounding the lot size. For instance, without this option, a lot size of 0.0003 is rounded to the minimum lot size, such as 0.01. With the Multiplier set to 2, the new lot size would be 0.02. When this option is enabled, 0.0003 would be multiplied by 2 to get 0.0006 before rounding to 0.01.

- Include Open Orders: This includes open orders in the volume calculation, not just closed ones.

- Maximum Open Orders: This sets the maximum number of orders that can be open in the same direction at the same time.

- Hedging: Enabling this allows the EA to have both buy and sell orders open simultaneously. For example, if a Buy signal opens a buy order, both Buy and Sell signals will continue to be evaluated. With Hedging off, only Buy signals are evaluated if a buy order is already open. Ensure the "Maximum Open Orders" value is more than 1 to open more than one order. With Hedging on, buy and sell orders can be opened simultaneously if their conditions are met.

- StopLoss: This is used to set your risk level.

- TakeProfit: This is used to set your reward level.

- Profit Threshold (pips): This is the number of pips an order must gain before the StopLoss is set and starts trailing. For example, if set to 30, the StopLoss will be set and start trailing when the order gains 30 pips.

- Trail Start Value (pips): This is the amount of pips where the StopLoss starts trailing, set as Open price + Trail start value (pips). For example, if set to -20, the StopLoss is set at a 20-pip loss. If set to 0, the StopLoss is set at break-even. If set to 20, the StopLoss is set at a 20-pip profit.

- Trail Step Size: This is the amount the trailing StopLoss will move when the order gains new highs. If set to 1, the trail will move 1 pip for every additional pip of profit. If set to 2, the StopLoss will move 2 pips for every additional pip of profit.

- Trail Minimum Distance (pips): This ensures the trailing StopLoss does not get closer to the current price than the set value. This is useful with a Trail Step Size larger than 1 to maintain a certain distance from the current price. If set to 0 or a negative number, the trail could overtake the current price, closing the order before a retracement. For example, with a Profit Threshold of 30 pips and a Trail Start Value of 20, and a Trail Step Size of 1, the trail will always be 10 pips behind the current price.