Sivira system

- Experts

- Akihiro Inoue

- Version: 1.0

- Activations: 5

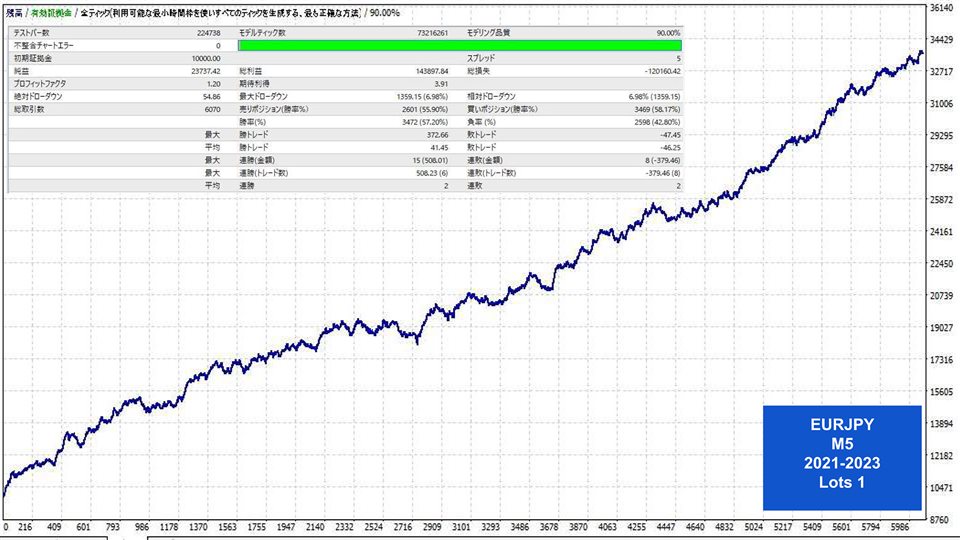

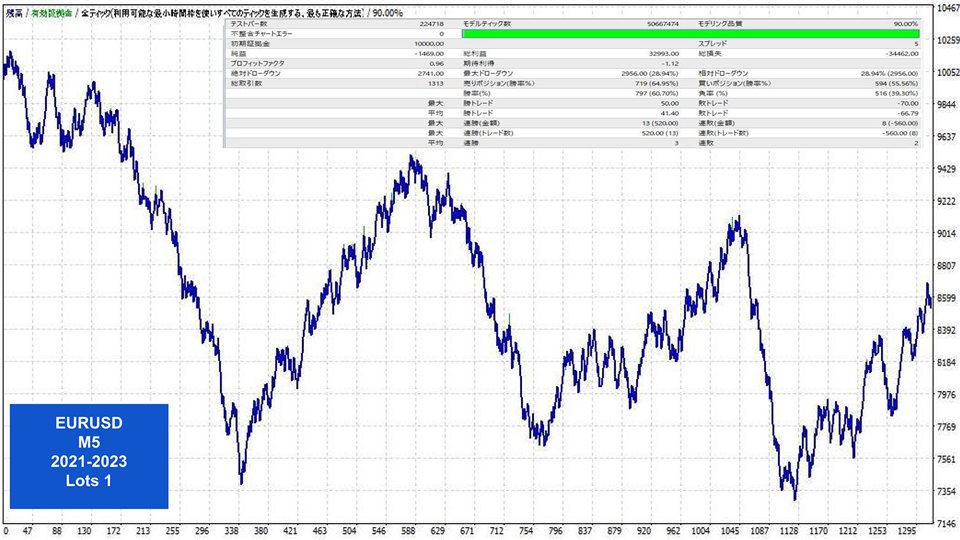

The basic trading rules focus on the divergence with Bollinger Bands and Envelopes, and the length of the candlestick wicks.

For USD/JPY and cross yen pairs, a trailing stop is incorporated, allowing for significant profits during strong rebounds, and steadily collecting a few pips of profit during weak rebounds.

It should be noted that the effectiveness of this method does not apply to currencies and timeframes other than USD/JPY and cross yen pairs on the 5-minute chart.

The stop loss is set at 7 pips. (Larger market movements may result in greater losses.)

A spread of less than 0.5 pips is desirable; performance significantly declines with larger spreads.

・Recommended Currency & Timeframe

→ USD/JPY, Cross yen pairs · 5-minute chart

・Entry Lot

→ 1

・Recommendations

→ It is advisable not to operate during markets with extremely low volume, such as during the year-end and New Year period, or when spreads are significantly diverged.