Time Range Sweep EA

- Experts

- Andrii Hurin

- Version: 1.4

- Mise à jour: 27 février 2024

- Activations: 5

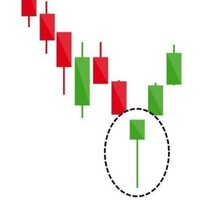

First of all, the EA marks high and low of the chosen time range and then waits for the price to sweep high or low. Now when a liquidity of a high/low is taken, EA waits for the Market Structure Shift (MSS) and enters a trade on an imbalance (FVG) formed in the displacement.

MT4 version: CLICK

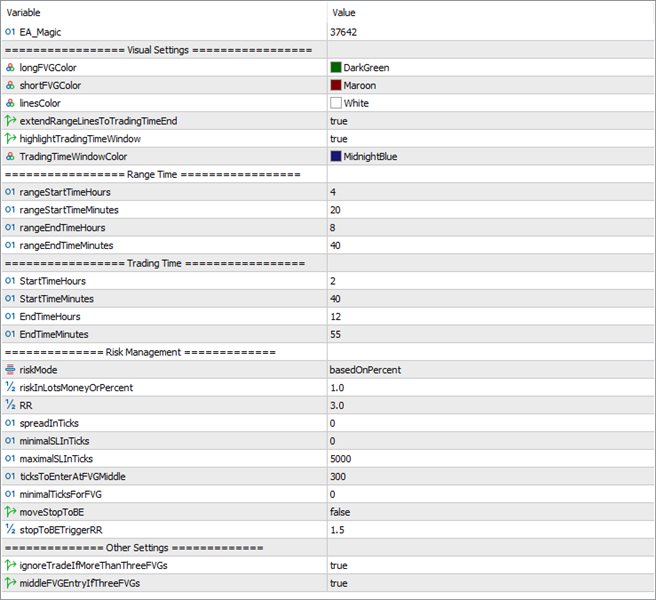

The bot includes many functions and settings of trading time and risk management. Here is a description of all the features:

- Trade on any market and instrument or on several pairs at the same time, even with different time settings.

- Select any time frame for trading, select a Time Range and a Trading Time, if an order was placed during the selected trading time but not triggered, it is canceled automatically.

- Choose the color to highlight long and short FVGs and lines.

- Choose the color to highlight trading time window.

- Full customization of risk calculation for entering a trade (percentage from account, fixed lot or risk in dollars).

- Choose a spread in ticks to be added to Entry price and Stop Loss price.

- Choose a minimal and maximal Stop Loss in ticks and minimal ticks for FVG to be valid.

- Choose a size of FVG in ticks when EA will use the middle of this FVG for entry.

- Choose the Take-Profit by RR.

- Set the transfer of the stop to breakeven after X RR.

- Choose whether to enter at the middle of the second FVG if there are 3 FVGs in a row.

- Choose whether to ignore a trade if there are more than 3 FVGs in a row.

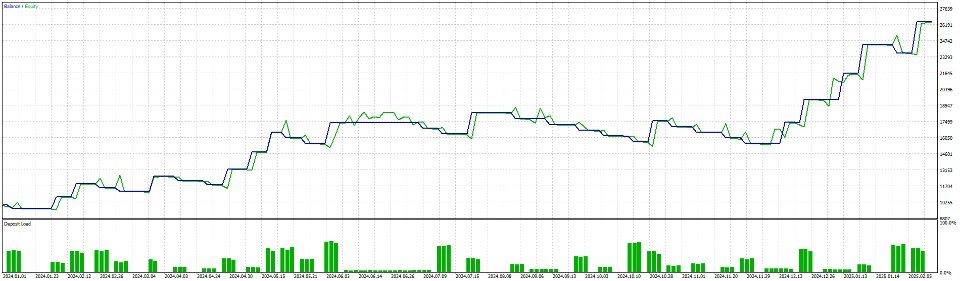

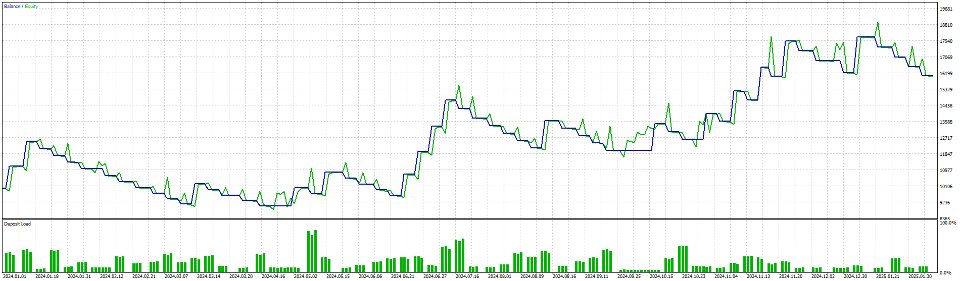

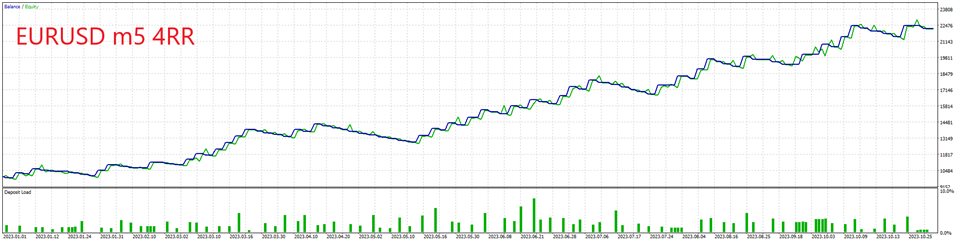

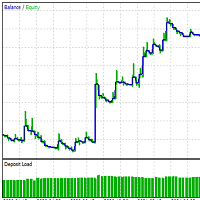

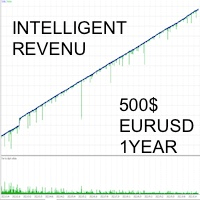

On screenshots you can see EA’s backtest statistics on different markets, timeframes, time inputs and with different risk management settings. You can customize the bot to suit your trading style: more calm or aggressive.

Simple and effective. Great support from the author. Highly recommend