GAMMA Trade Manager MT4

- Experts

- Patrick Murage Gichuki

- Version: 3.9

- Mise à jour: 13 octobre 2023

- Activations: 20

GAMMA is a fully featured trade manager and account monitoring assistant that offers a variety of trade and account monitoring and mechanization functionalities vital to a trader’s toolkit. This assistant takes on all the mechanical parts of trading, freeing up more time for you focus on other activities that promote your personal and financial well-being.

The trading functions GAMMA helps you to automate include:

- equity monitoring and preservation

- stop loss and take profit placement

- breakeven and trailing stops

- taking partial profits

- extending take profit distances

- early exits from unprofitable trades

- trade journaling

Link to MT5 version: https://www.mql5.com/en/market/product/106105

Main Functions

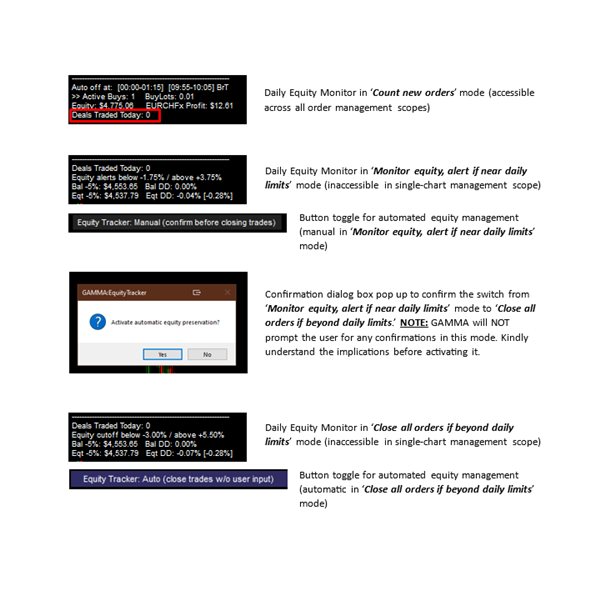

Daily Equity Monitor

The Daily Equity Monitor helps to protect your account from excessive losses and missed gains. In ‘Count new orders’ mode, it tracks and displays the number of trades taken from the start of the day based on the trade server’s time. The ‘+Monitor equity, alert if near daily limits’ mode monitors the account’s equity, sends alerts and notifications if equity falls within 1.25% of the lower limit or 1.75% of the upper limit, and prompts you to close all trades if the account’s equity breaches these limits. This mode also automates setting SL to breakeven regardless of your current auto-BE selections, but clicking the ‘BE’ button always overrides this setting if buttons are enabled. The ‘+Close all orders if beyond daily limits’ mode executes automated trade closure if the account’s equity exceeds the upper or lower limits. NOTE: This mode does not request confirmation before closing ALL active and pending trades on the account. If you copy trades locally to the GAMMA-managed account, you can list your copiers’ pause commands (e.g., Suspend-Channel for FX-Blue’s copier) to ignore new trade requests from senders past the daily equity limits and resume copying if/when the equity is back within the alert activation limits. The Daily Equity Monitor can be very useful for traders in competitive or proprietary trading environments that require strict control over the daily equity drawdown statistic as a qualifier for compensation or promotion.

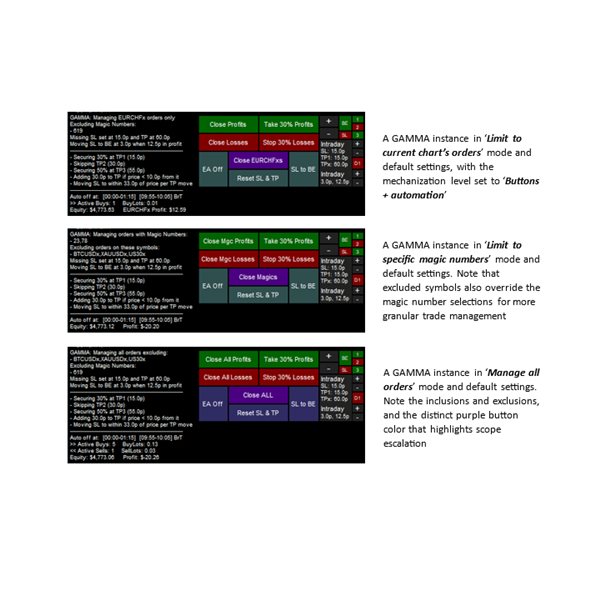

Order Management

GAMMA a multi-asset assistant for monitoring and managing all trades on your account. You can also set it to manage only one chart, specific magic numbers, and even exclude specific magic numbers (e.g., to avoid interfering with copied trades or those being managed by another EA), specific symbols or instruments, or trades executed before a specific date depending on your needs. NOTE: NEVER have more than 1 GAMMA instance in ‘Manage all orders’ mode or more than 1 GAMMA instance set to manage the same magic numbers in ‘Limit to specific magic numbers’ mode on the same account. Despite built-in safeguards to minimize conflicts, the publisher offers no assurances regarding outcomes in such environments. Here are some ideal deployments that optimize the benefits you can extract from this assistant:

1 GAMMA (set to automatic) managing all orders

1 GAMMA (set to manual and chart-limited) on each traded instrument

Or:

1 GAMMA (set to automatic) managing all orders except specific magic numbers

1 GAMMA (set to automatic) managing these magic numbers

1 GAMMA (set to manual and chart-limited) on each traded instrument

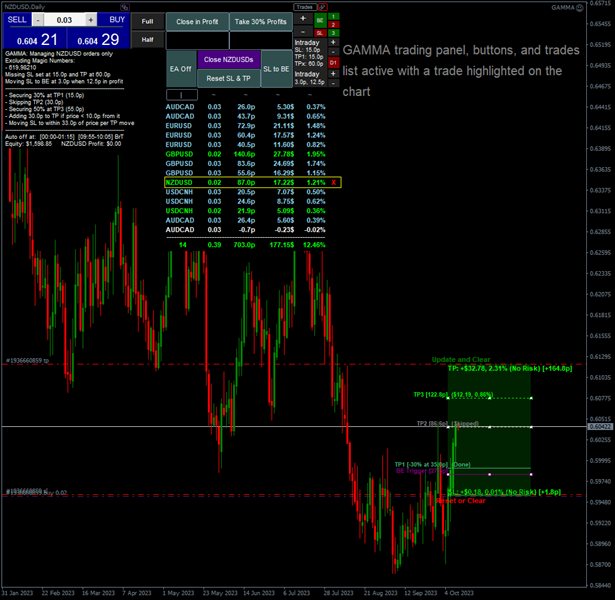

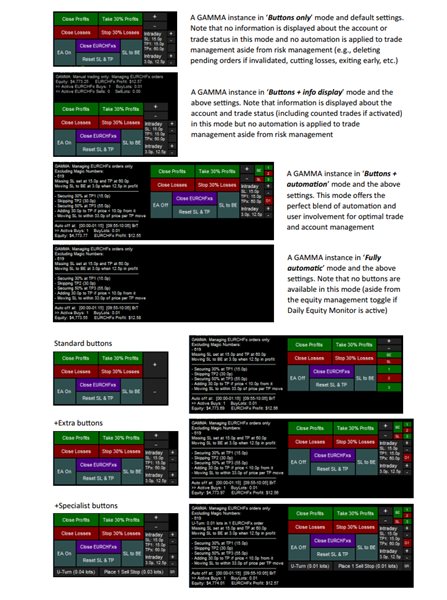

Automation and Interface

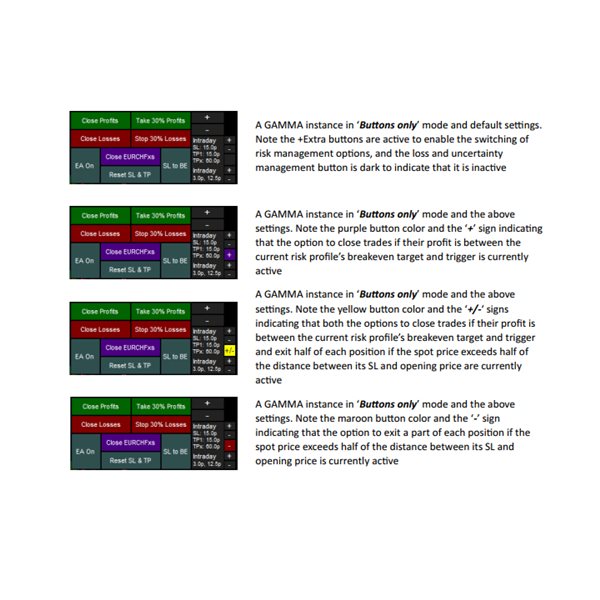

GAMMA can apply different levels of automation to the Order Management selections you set for each instance. These levels range from a manual mode with buttons only, a manual mode that includes a basic info display, an assisted mode with buttons and a comprehensive info display, and a fully automatic mode with an info display and minimized buttons. You can also enable switching trade management assistance off during periods of low liquidity or high volatility, such as during daily or inter-session crossovers. GAMMA 's preset risk profiles are designed to suit multiple trading styles, and you can change between profiles using the available ‘+’ and ‘-’ buttons to suit your risk affinity and market conditions. The profiles include ‘Scalp,’ ‘Intraday,’ ‘Swing,’ ‘Position,’ and ‘HODL’ and each profile matches the SL, TP, BE, trailing SL, partial TP, and TP extension values you set in the relevant settings sections.

Breakeven and Trailing SLs

In ‘Set SL to breakeven’ mode, GAMMA moves the stop loss to the breakeven point for an order once the gap between the spot price and the trade’s opening price exceeds the current risk profile’s trigger or the activation point set using the Trade Visualization graphic described below. This mode is also activated by default if the Daily Equity Monitor is set to monitor equity or preserve it by closing trades automatically, and is unavailable if the GAMMA instance is configured to use trailing SLs.

The ’Trail price with SL even if profit < 0’ option is useful if you want the SL to follow price as soon as the gap between spot price and the trade’s SL exceed the current risk profile’s triggers. Alternatively, the ‘Trail price with SL after profit > 0’ option delays this SL movement until the spot price crosses a trade’s opening price. You can opt to terminate the instant or jumping trailing SLs once price exceeds a defined point, such as the risk profile’s partial TP points. However, the candle high/low trailing option has no termination point and always trails indefinitely.

SLs, TPs, and Partial and Extended TPs

Assisted placement of SLs and TPs is one of the features recommended for fundamental risk management. If you choose not to set an SL or TP for pending orders, these are automatically set once the order is executed if you set the GAMMA instance to automate this process for active trades. The ability to take partial profits is also built in, allowing for up to 3 partial TP points with individual proportions. GAMMA can also secure additional profit by moving the SL to breakeven at TP1 and to the previous TP point when taking partial profits at TP2 and TP3. The partial TP points are determined by the values you sets for each risk profile. GAMMA also includes the functionality to extend a trade’s potential profitability by moving the final TP point, and optionally moving the SL nearer to the spot price to secure the growing profits.

Daily and Weekly Trade Cleanup

These features enable you to start every day or week on a new slate and assists those who hold trades for longer terms who may need to restrict their trading to these periods based on their trading styles or broker-related restrictions. You can opt to leave pending orders untouched during these events or include them during these periodic order cleanup events

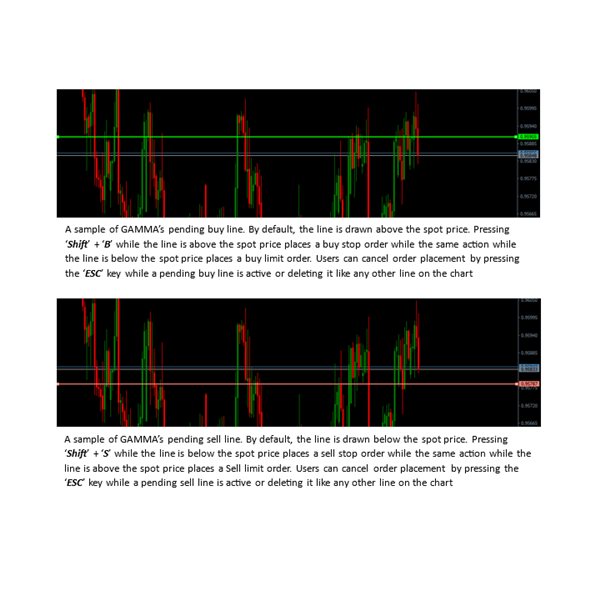

Pending Order Placement

GAMMA's ability to place pending orders easily with customized position sizing enables you to place stop and limit orders quickly with predefined parameters. The position sizes are drawn from the ‘Custom Lots’ option in the Automation and Interface settings section if the GAMMA Trading Panel is inactive or hidden, or from the Gamma Trading Panel’s position size input box if the panel is active and displayed. Pressing the ‘Shift’ + ‘B’ or ‘S’ keyboard combination creates a buy or sell pending order line, and pressing the same combination again places a pending order at the displayed line's price. Pressing the combination once and keeping it pressed counts as a single action and only creates one order line or places one pending order depending on the combination. Pressing the ‘ESC’ button while a pending order line is active deletes the line without placing a pending order.

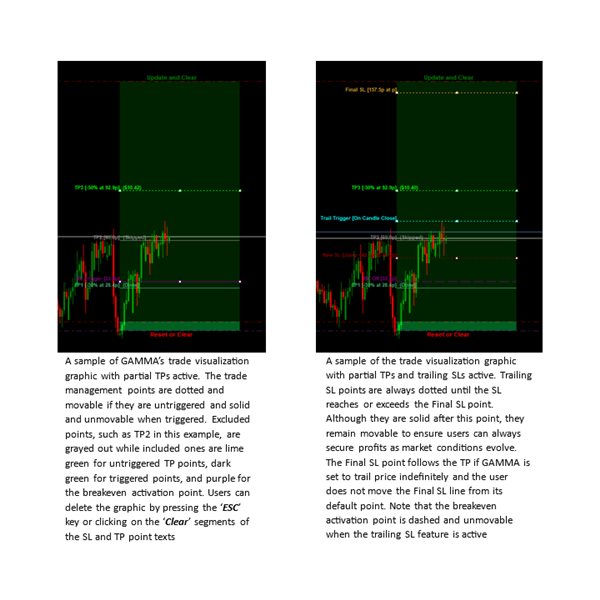

Trade Visualization

GAMMA includes a built-in module that visualizes partial TPs, BE activation, and trailing SL-related points as they apply to each trade. This feature enables you to assign unique trade management instructions to each order to reflect the difference between its needs and those of other trades. The default values are derived from any GAMMA instance that is set to ‘Manage all orders’ or ‘Limit to specific magic numbers’ mode on the same terminal or from the instance on the current chart if no instance with a higher scope is detected. you can change these values by moving the respective lines to the desired points and clicking on the ‘Update and Clear’ text located near or at the trade’s TP point. Clicking on the ‘Update’ segment of the ‘Update and Clear’ text saves the current values and keeps the trade visualization graphic on the chart while clicking on the ‘and Clear’ segment saves the values and deletes the graphic. Clicking on the ‘Reset’ segment of the ‘Reset or Clear’ text located near or at the trade’s SL or entry point reverts the trade’s management points to default or to the previously saved values if these exist and keeps the trade visualization graphic on the chart while clicking on the ‘or Clear’ segment deletes the graphic. This trade visualization module’s functionalities can be essential in optimizing GAMMA’s value as a granular trade management utility.

Loss and Uncertainty Management

This feature that can exit a portion of a position equal to the value of the Stop x% losses’ button if the spot price crosses the halfway point between the SL and opening price, or close trades entirely when their profit is between the current risk profile’s breakeven target and trigger, which can help minimize losses and free up margin for other trades whose outcomes are more certain or entries less risky. It is only available in the ‘Buttons only’ and ‘Buttons + info display’ modes, but is accessible in ‘Buttons + automation’ mode by using the ‘EA Off’ button to deactivate other automation features.

Final Notes

GAMMA’s buttons complement the assistant’s automation and provide you with granular control over your accounts and trades. Automation can be switched on and off easily without going into the settings by using the ‘EA Off’ button when in ‘Buttons + automation’ mode or the ‘EA On’ button when in the ‘Buttons only’ or ‘Buttons + info display’ modes. If a GAMMA instance is set to the ‘Limit to current chart’s orders’ or ‘Manage all orders’ modes in the Order Management Selections settings section and the current symbol is among the list of excluded symbols, automation will not be applied to the chart’s trades but the buttons can still be used for trade and loss and uncertainty management.

As previously highlighted, it is recommended to experiment with various GAMMA deployment scenarios on a demo account and fine-tune the settings to suit individual contexts and preferences before deploying this assistant on a real money account. For the sake of clarity and at the risk of redundancy, NEVER have more than 1 GAMMA instance set to ‘Manage all orders’ mode or more than 1 GAMMA instance set to manage the same magic numbers in ‘Limit to specific magic numbers’ mode on the same account. Despite built-in safeguards to minimize conflicts, issues could still occur and place an account’s profitability at risk since each instance will mechanically execute its mandate and potentially apply conflicting management decisions to active trades. Following these recommendations is vital to ensuring GAMMA optimally performs its role as a tool for maximizing the ROI of time in the market.