MP RiskOracle MT5

- Utilitaires

- MASTERBROK NEXUS SRL

- Version: 1.1

- Activations: 5

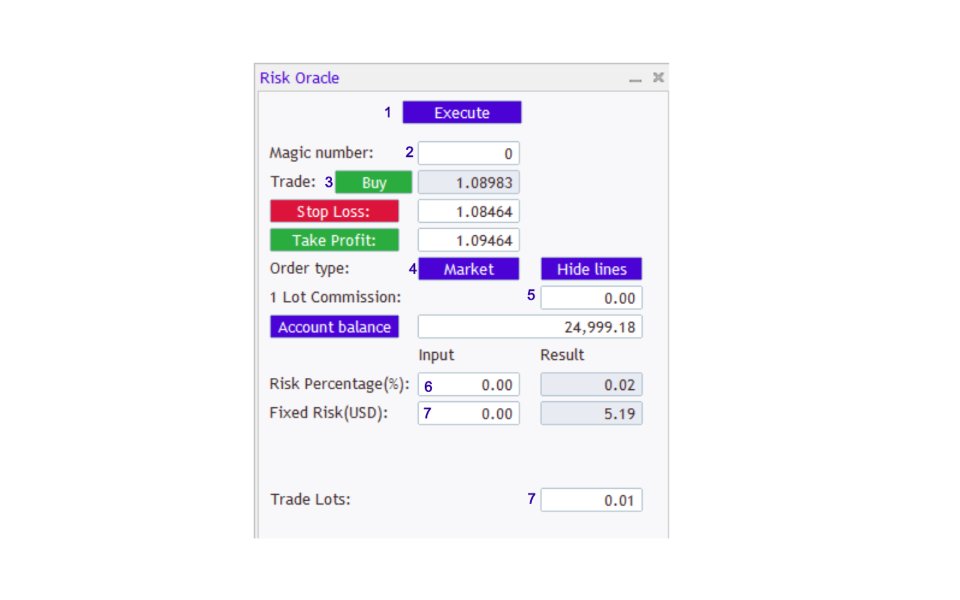

Risk Oracle - Expert Advisor Description

Risk Oracle is a sophisticated yet user-friendly Expert Advisor (EA) designed for risk management and trade execution. This utility tool is tailored to assist traders in executing orders at optimal prices while managing risk efficiently, without the need to manually calculate volumes and other parameters. By automating these critical aspects, Risk Oracle simplifies the trading process and allows traders to focus on strategy and market analysis.

Features and Functionalities

Risk Oracle comes with an intuitive interface, featuring buttons and boxes that make it easy to configure and execute trades according to specified risk parameters. Below are the key components:

-

Execute Button:

- Executes an order based on the specified risk, stop loss, and take profit parameters.

-

Magic Number:

- A unique identifier for each trade, enabling traders to manage and track batches of multiple transactions using additional tools if needed.

-

Position Type Switch:

- Allows traders to toggle between Buy (Long) and Sell (Short) positions.

-

Stop Loss and Take Profit:

- StopLoss: The price at which the stop loss will be set.

- TakeProfit: The price at which the take profit will be set.

-

Order Type Switch:

- Switches between Market (Instant) orders and Pending (Limit, Stop) orders.

-

Broker Commission for 1 Lot:

- Takes into account the broker's commission when opening a trade, ensuring that the risk is as close as possible to the desired level.

-

Risk Percentage:

- Specifies trade risk as a percentage of the account balance.

-

Fixed Risk, (in account Currency):

- Specifies trade risk in a fixed monetary amount.

-

Trade Lots:

- Specifies the number of lots for the given position.

Interchangeable Risk Parameters

Risk Oracle offers flexibility by allowing traders to switch between different risk calculation methods:

- Risk Percentage: Traders can set the risk as a percentage of their account balance, enabling proportional risk management.

- Fixed Risk Amount: Traders can specify a fixed monetary amount for risk, providing precise control over the maximum potential loss.

- Position Size: Traders can directly set the position size in lots, giving control over the volume of the trade.

This interchangeability ensures that traders can use the most suitable risk management approach for their specific trading strategy and preferences.

Benefits of Using Risk Oracle

- Simplicity and Efficiency: The tool is designed to be straightforward and efficient, reducing the time and effort required to calculate and set trade parameters.

- Accurate Risk Management: By incorporating broker commissions and allowing flexible risk settings, Risk Oracle ensures that trades are executed with the desired risk exposure.

- Enhanced Trade Execution: Automated calculations and one-click execution help traders enter the market at the best possible price without manual intervention.

Risk Oracle is an essential tool for traders looking to streamline their trading process, manage risk effectively, and execute trades with precision.